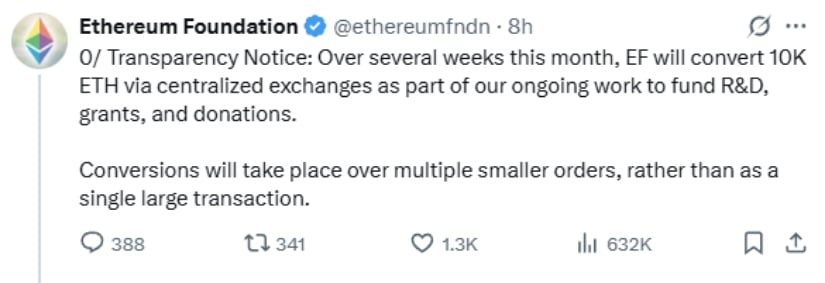

Ethereum Foundation Plans $43 Million ETH Sale to Fund Development and Grants

The sale will happen over several weeks through smaller transactions on centralized exchanges rather than one large sale.

This marks the second major ETH sale by the foundation in 2025. In July, the organization sold 10,000 ETH to SharpLink Gaming for $25 million, making it the first direct sale to a publicly traded company.

Strategic Treasury Management Under New Policy

The sale follows the foundation’s comprehensive treasury policy launched in June 2025. This policy caps annual spending at 15% of the total treasury value and maintains a 2.5-year operating buffer. The foundation plans to gradually reduce this spending to 5% over the next five years.

According to the official policy document, the foundation believes 2025-26 are “pivotal years” for Ethereum that require enhanced focus on critical projects. The structured approach aims to balance operational needs while supporting long-term ecosystem growth.

Source:@ethereumfndn

The foundation will split the 10,000 ETH sale into multiple smaller orders to reduce market impact. This method aligns with their treasury policy guidance for managing currency fluctuations and ensuring steady funding for operations.

Supporting Ethereum’s Development Ecosystem

The funds will support three main areas: research and development, ecosystem grants, and donations to related projects. In the first quarter of 2025 alone, the foundation distributed $32.6 million in grants to various projects focusing on developer tools, research, and education.

Recent data shows the foundation and its partners have allocated nearly $500 million to ecosystem projects between 2022 and 2023. The Ethereum Foundation contributed $240.3 million of this total, with other organizations like MakerDAO, Optimism, and Gitcoin providing the remaining support.

The foundation recently paused its open grant applications to restructure its funding approach. This shift moves from responding to applications to actively identifying and supporting strategic initiatives that align with Ethereum’s long-term goals.

Market Impact and Historical Context

Research from CoinGecko shows that Ethereum Foundation sales typically have less market impact than many people believe. The average price change seven days after a foundation sale is actually positive at 1.3%. Less than half of all foundation sales result in immediate price declines.

The current sale comes during a strong period for ETH, which reached an all-time high of $4,866 in late August 2025. On-chain data shows that while the foundation moved funds to exchanges, large investors accumulated over $358 million worth of ETH in the past 24 hours.

Historical data supports this pattern. The foundation’s sale of 100,000 ETH in December 2020 coincided with an 84% price increase, showing that institutional moves don’t always predict market direction.

Broader Ethereum Ecosystem Funding

The foundation’s treasury represents just part of Ethereum’s broader funding ecosystem. Combined treasury assets across various Ethereum-related organizations and DAOs exceed $22 billion. These treasuries primarily hold native tokens from projects like Aave, Polygon, Optimism, Uniswap, and others.

This distributed funding model reflects Ethereum’s decentralized approach to development. Rather than relying on a single entity, the ecosystem benefits from multiple funding sources that can support different types of projects and initiatives.

The foundation currently holds about $970.2 million in total treasury assets as of October 2024, with $788.7 million in crypto assets and $181.5 million in traditional investments. This represents approximately 0.26% of Ethereum’s total token supply.

Looking Forward

The foundation’s new treasury policy introduces a “Defipunk” framework that prioritizes security, open-source development, financial independence, and privacy. This approach guides which projects receive support and how the foundation deploys its resources.

The organization plans to increase its involvement in decentralized finance protocols while maintaining its core mission of supporting Ethereum development. Current strategies include solo staking and supplying wrapped ETH to established lending protocols.

The foundation will publish quarterly reports to increase transparency about its treasury management and spending decisions. These reports will include performance metrics and details about major allocations across different asset types.

The Road Ahead

The Ethereum Foundation’s planned ETH sale represents careful financial planning rather than lack of confidence in the network’s future. The structured approach over several weeks, combined with strong institutional demand, suggests this move supports long-term ecosystem health.

With institutional interest growing and the foundation implementing more transparent policies, the sale funds critical development work during what leaders consider a pivotal period for Ethereum’s evolution.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis