Bitcoin Struggles Below $110K as Analysts Warn of Major Market Moves Ahead

The world’s largest cryptocurrency is trading at $109,901, down nearly 2% on the week, bringing its market capitalization to $2.18 trillion.

Despite multiple attempts, Bitcoin has been unable to break above its resistance levels, raising the possibility of another leg lower in the near term. Analysts argue that this could set up a major buying opportunity, particularly for altcoins.

Resistance Holding Strong

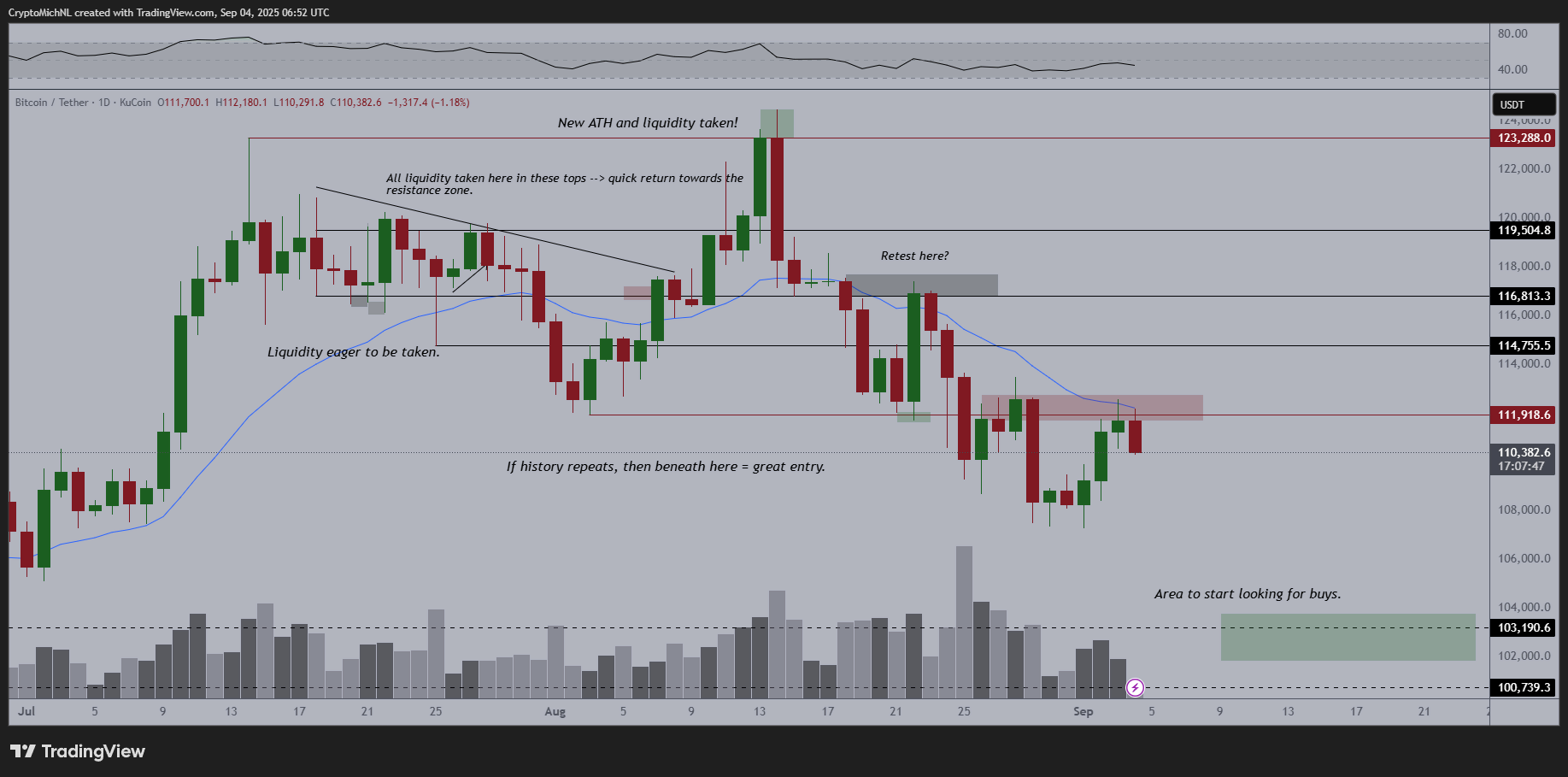

Michaël van de Poppe, founder of MN Trading, highlighted that Bitcoin has failed to overcome its resistance and the 20-week EMA. “Resistance remains resistance, couldn’t break through it,” he said, warning that if the level continues to hold, a new local low is likely.

Charts shared by van de Poppe show a retest attempt around $111,900 being rejected, with lower levels near $103,000 identified as a key demand zone where buyers may step in. “If this isn’t breaking through, I would project we’re making a new low and that’s where you need to go max long altcoins,” he explained.

Ethereum Eyes Correction Levels

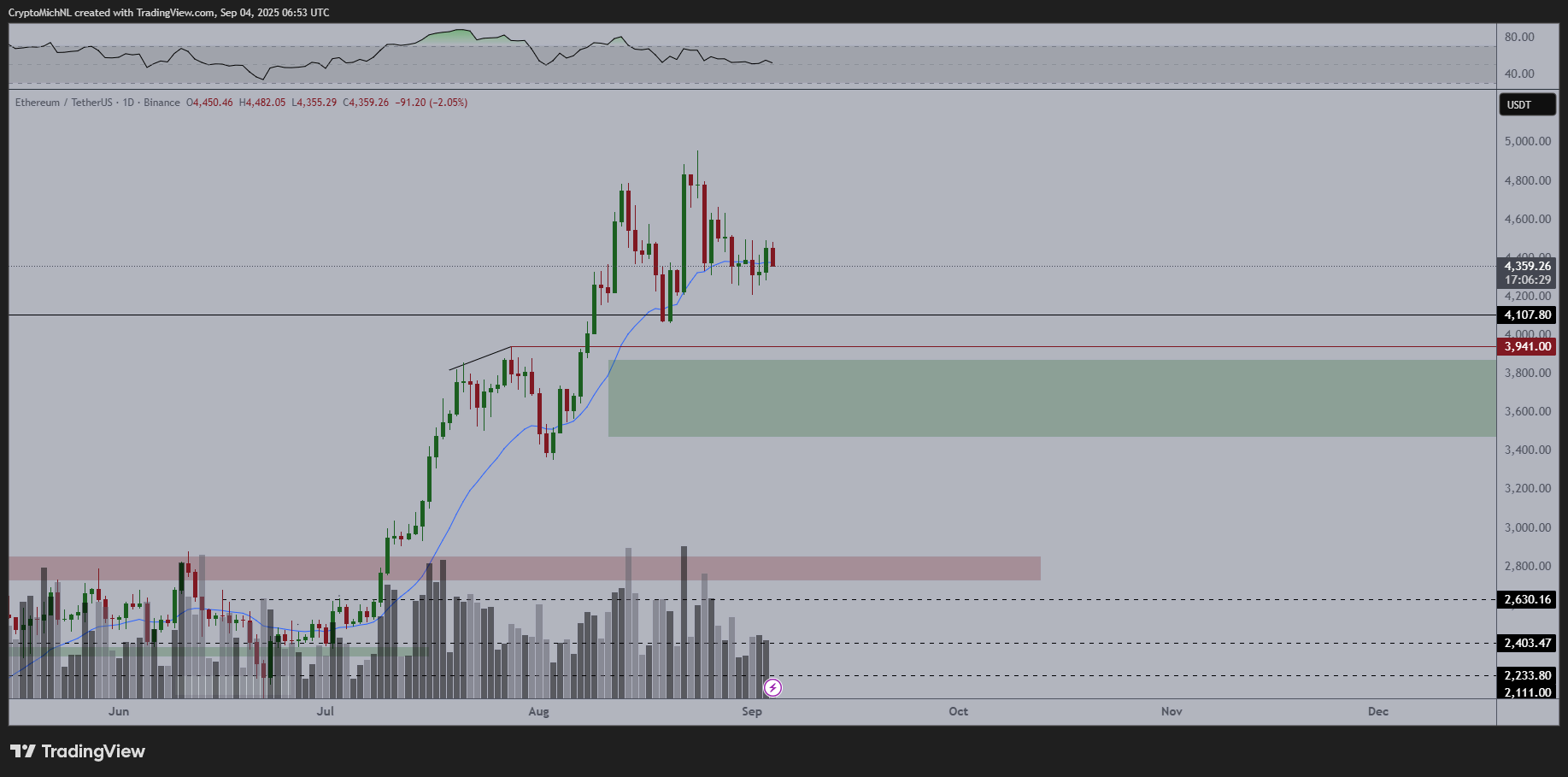

Ethereum has mirrored Bitcoin’s weakness, trading near $4,275 after a rejection at higher levels. Van de Poppe suggested that Ethereum could correct further, with $3,600–$3,900 acting as the green accumulation zone.

“As Bitcoin rejected the crucial resistance zone, I wouldn’t be surprised if we’ll be seeing a correction towards the green zone on the markets for Ethereum,” he noted. Despite the bearish short-term view, he framed the potential drop as a “massive opportunity” for long-term investors.

Volatility Near Multi-Year Lows

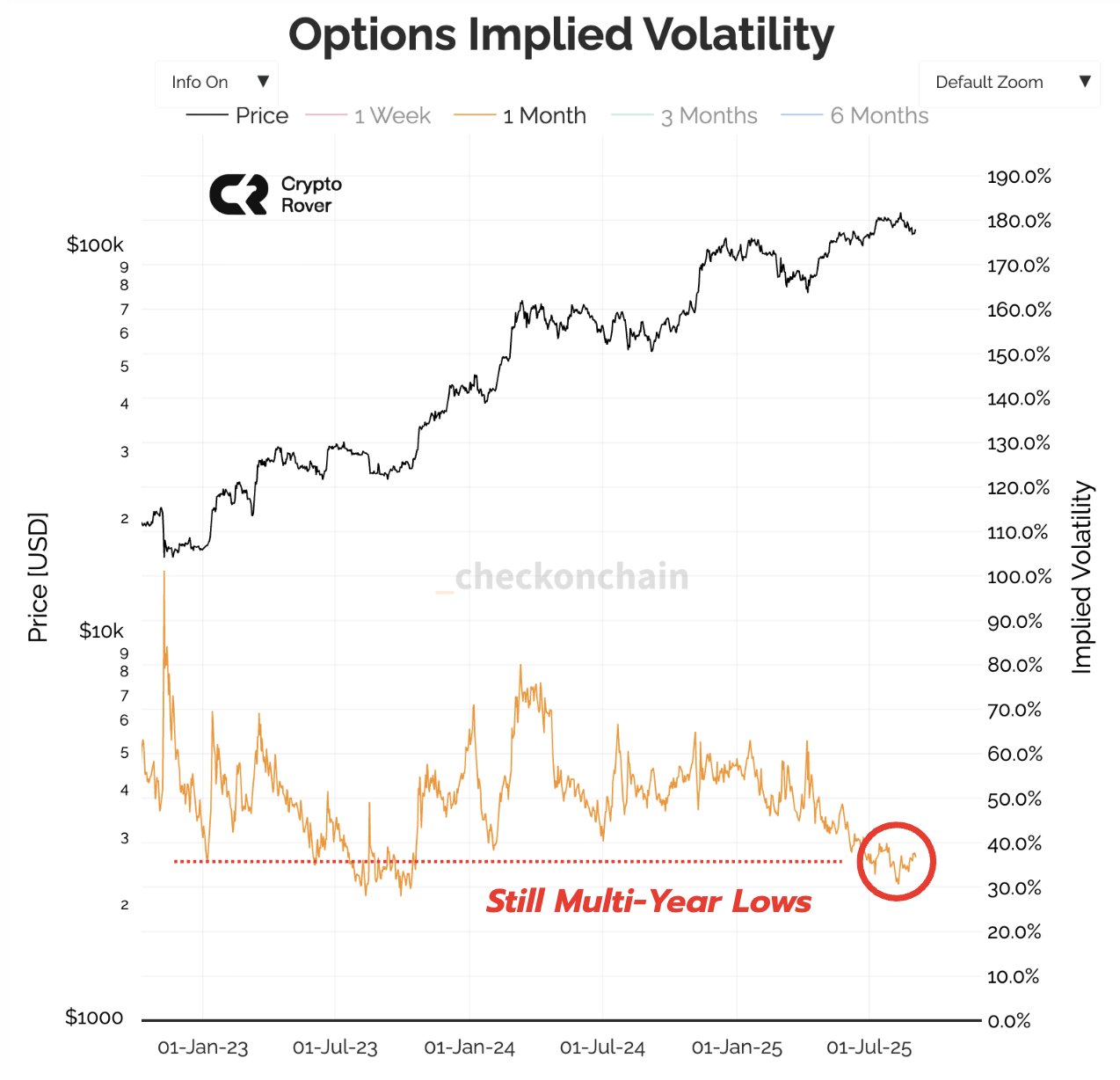

Adding to the intrigue, Bitcoin options markets are signaling historically low implied volatility. Data shared by Crypto Rover shows that one-month implied volatility remains near multi-year lows around 30%–35%, levels often associated with sharp breakouts.

“Bitcoin implied volatility remains insanely low. Huge moves are ahead. A ticking time bomb…” Rover warned in a post to his 62,000 followers.

Periods of compressed volatility rarely last long, and traders are bracing for a significant move in either direction as the market coils tighter.

The Key Levels to Watch

On the downside, traders are monitoring the $103,000 level, flagged as a strong area to look for buys if Bitcoin extends its decline. Below that, the $100,700 zone marks the next major support.

On the upside, bulls would need to reclaim $114,700 and ultimately $116,800 to invalidate the bearish outlook and signal a continuation of the uptrend toward $119,500 and $123,000.

Ethereum’s crucial support sits between $3,600 and $3,900, while resistance remains near $4,500.

What Comes Next

With September historically one of the most volatile months for markets, Bitcoin’s muted options pricing suggests traders are underestimating the scale of the coming move. Both Bitcoin and Ethereum face immediate resistance zones, and failure to break through could trigger a deeper retracement.

For now, market sentiment is cautious but opportunistic. Analysts believe that deeper pullbacks could pave the way for strong entries, particularly into altcoins, which often outperform Bitcoin in the aftermath of volatility spikes.

The combination of technical rejection, low implied volatility, and looming support zones sets the stage for a decisive move in the weeks ahead. Whether Bitcoin breaks down toward $103,000 or flips resistance into support above $114,000 may determine the broader crypto market’s trajectory into year-end.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin Struggles Below $110K as Analysts Warn of Major Market Moves Ahead appeared first on Coindoo.

You May Also Like

Republicans dogged by 'very bad news' as midterms draw closer

The Manchester City Donnarumma Doubters Have Missed Something Huge