WLFI price prediction: Can $0.18 hold after a 60% collapse?

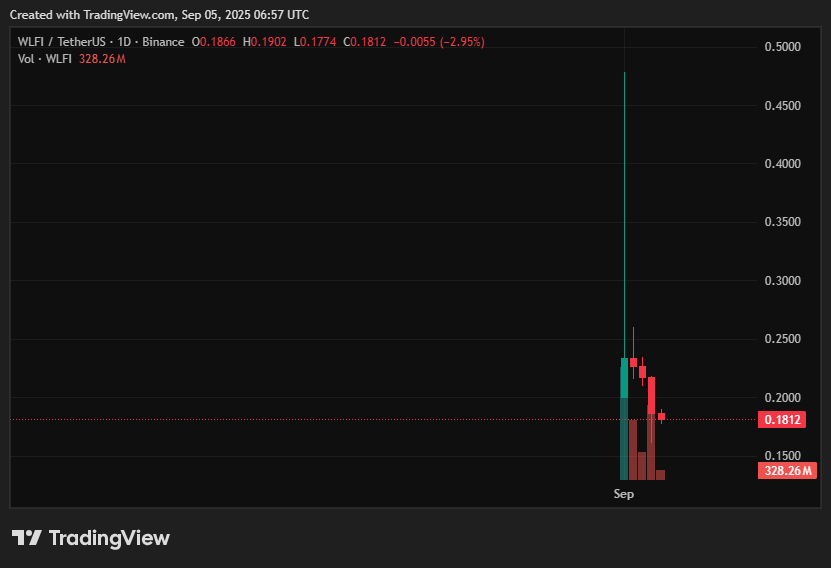

- WLFI price prediction indicates that the token is currently trading at around $0.18, representing a decline of more than 60% from its peak of $0.46.

- $23 million worth of coins are flooding exchanges, according to on-chain flows, indicating waning trust.

- The crucial support is $0.18; a bounce might push the price up to $0.20–$0.22, but there is a chance of a fall to $0.16–$0.15.

- The WLFI outlook remains very negative and speculative, with regulatory and whale control issues driving volatility.

The Trump-backed coin, World Liberty Financial, is still declining; it is currently trading at about $0.18, down over 60% from its peak of $0.46. Extreme volatility has been driven in recent sessions by heavy selling, huge token transfers to exchanges, and speculative euphoria based on the latest WLFI price prediction analysis.

The $0.18 level is currently being challenged as a crucial floor, and markets are intently monitoring whether it stabilizes or breaks lower, despite a 47 million token burn intended to boost sentiment.

Table of Contents

- WLFI price prediction market info

- Upside Outlook

- Downside Risks

- WLFI Price Prediction Based on Current Levels

WLFI price prediction market info

As of September 5, 2025, World Liberty Financial’s price forecast shows WLFI trading close to $0.18, representing a roughly 20% decline in only the last day. The coin is currently following a descending channel pattern, indicating bearish dominance after plummeting precipitously from its launch highs.

More than $23 million worth of World Liberty Financial (WLFI) has been moved to exchanges, according to on-chain data, indicating a decline in holders’ confidence and mounting downward pressure.

Upside Outlook

WLFI might try a slight recovery toward the $0.20–$0.22 range if $0.18 holds, propelled by speculative buying and short-covering patterns. Although the token burn event can progressively strengthen the sense of scarcity, the overall bearish trend is unlikely to be reversed due to its small magnitude in relation to the entire supply.

Any unexpectedly positive news stories, including institutional involvement or momentum with political connections, could serve as temporary stimulants for a recovery.

Downside Risks

If $0.18 is not protected, there is a chance that the price may drop precipitously again, possibly reaching $0.16 or even $0.15. Because most of the supply is still in a small number of hands, centralized whale management erodes market trust and increases the possibility of manipulation.

Furthermore, mood is being affected by news of wallet security problems and heightened regulatory scrutiny, making WLFI extremely susceptible to additional selloffs. Given these risks, the expectation remains skewed heavily toward downside pressure.

WLFI Price Prediction Based on Current Levels

For WLFI, the immediate key range is still $0.16–$0.22. Support at $0.18 would hold in a bounce scenario, allowing a move toward $0.20–$0.22. On the other hand, a fall below $0.18 would swiftly set off a downward trend toward $0.16–$0.15.

All things considered, the WLFI price prediction remains speculative and leaning negative, with high volatility anticipated as traders determine if $0.18 is a stable floor or simply another decline.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Digitap Raises Over $4M: A Comparison with DeepSnitch AI

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise