Here’s XRP Price If It Becomes the First Coin Held by Top 10 Central Banks

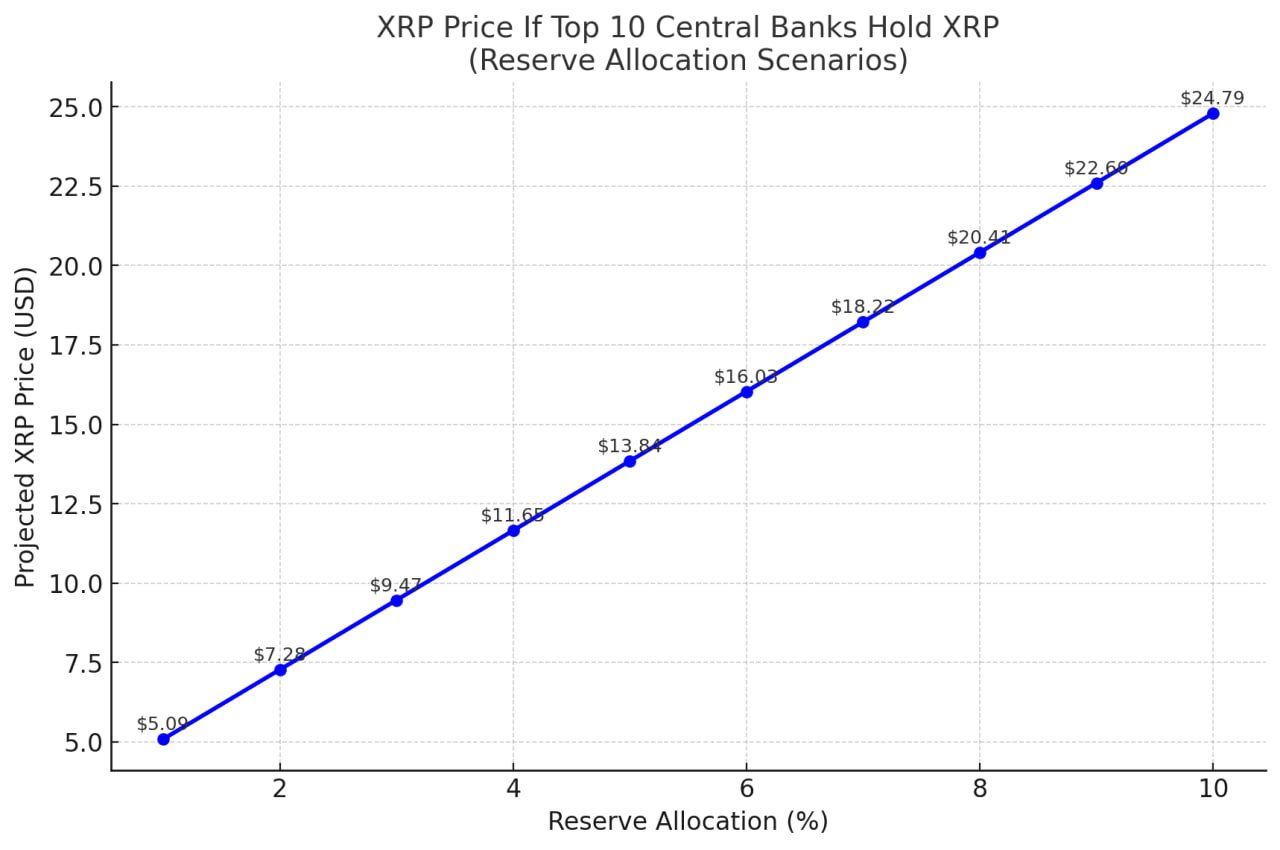

A new analysis explores the potential XRP price if the world’s top 10 central banks allocate a portion of their combined $13 trillion in reserves to the coin. The results show that even a modest level of adoption at this scale could propel XRP to new heights. XRP's Current Market Position Notably, XRP is currently trading at around $2.81, with a circulating supply of approximately 59.4 billion tokens. This gives it a market cap of about $172.3 billion, making it one of the largest digital assets in circulation. Despite this substantial valuation, the entry of central banks could completely reshape XRP’s trajectory. Allocation Scenarios from $130B to $822B in XRP If the top 10 central banks—including those in China, Japan, Switzerland, India, Russia, the United States, and others—were to allocate just 1% of their reserves (around $130 billion) to XRP, its market cap would rise to over $302 billion. This would push the token’s price to approximately $5.09. A 3% allocation, representing $390 billion, would drive XRP’s value to about $9.47. At the upper end, a 5% allocation equal to $650 billion would result in a market cap of more than $822 billion, translating to a token price near $13.84. Extended Outlook at 10% Looking beyond modest allocations, a 10% commitment from central bank reserves, roughly $1.3 trillion, could raise XRP’s market cap to $1.47 trillion. In this scenario, XRP price could climb to around $22.58 per coin, nearly eight times its current value.  Speculative prices for XRP on goverment allocationSpeculative prices for XRP on government allocation However, it is important to note that these figures are based on basic market cap arithmetic, assuming that central bank inflows would translate directly into increased valuation. In reality, such massive buying pressure from institutions of this size would likely create a multiplier effect, potentially driving XRP’s price well beyond these projections. Even a $1 billion government allocation could trigger significant market reactions, making inflows of $130 billion to $1.3 trillion far more impactful than the raw numbers might suggest. Consider the market frenzy that would likely follow an announcement that the U.S. government is purchasing $1 billion worth of XRP. But Is There Any Chance These Governments Will Hold XRP? The idea of governments holding XRP is compelling, especially amid a global push for crypto innovation and adoption at the governmental level, which has reached unprecedented momentum this year. The U.S. government has signed into law a bill on stablecoins, marking a historic milestone for crypto legitimacy. Furthermore, the government is working toward establishing a national crypto reserve that could hold up to 1 million BTC, along with a diversified crypto stockpile including XRP, Ethereum, Cardano, and Solana. However, the U.S. has not expressed readiness to purchase any cryptocurrency beyond Bitcoin. In countries like Russia and China, most discussions around crypto have focused on Bitcoin and stablecoins, often viewed as tools to promote their local currencies. Regarding Bitcoin, institutional FOMO remains high. Governments that currently hold BTC show no signs of selling. Notably, countries such as the U.S., China, the U.K., Ukraine, Bhutan, El Salvador, and four others collectively hold 517,298 BTC—worth over $56.76 billion. In essence, the current institutional focus is overwhelmingly on Bitcoin, while altcoins like XRP remain in the background. Takeaway This analysis highlights the potentially outsized impact of institutional adoption on XRP, particularly at the highest level. However, the scenario of governments allocating between $130 billion and $1.3 trillion into XRP remains highly speculative. As it stands, Bitcoin is the more likely candidate for such large-scale government adoption.

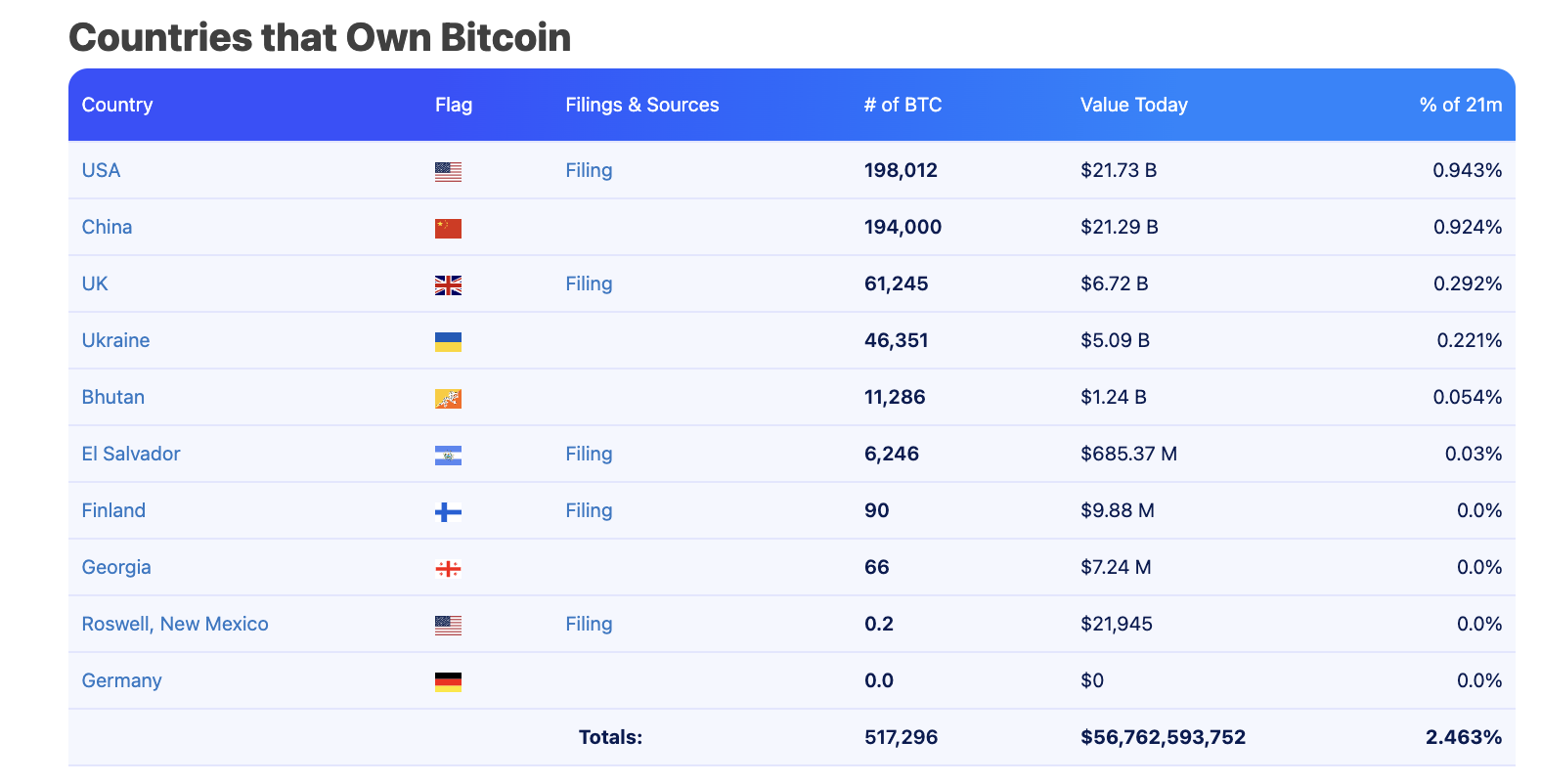

Speculative prices for XRP on goverment allocationSpeculative prices for XRP on government allocation However, it is important to note that these figures are based on basic market cap arithmetic, assuming that central bank inflows would translate directly into increased valuation. In reality, such massive buying pressure from institutions of this size would likely create a multiplier effect, potentially driving XRP’s price well beyond these projections. Even a $1 billion government allocation could trigger significant market reactions, making inflows of $130 billion to $1.3 trillion far more impactful than the raw numbers might suggest. Consider the market frenzy that would likely follow an announcement that the U.S. government is purchasing $1 billion worth of XRP. But Is There Any Chance These Governments Will Hold XRP? The idea of governments holding XRP is compelling, especially amid a global push for crypto innovation and adoption at the governmental level, which has reached unprecedented momentum this year. The U.S. government has signed into law a bill on stablecoins, marking a historic milestone for crypto legitimacy. Furthermore, the government is working toward establishing a national crypto reserve that could hold up to 1 million BTC, along with a diversified crypto stockpile including XRP, Ethereum, Cardano, and Solana. However, the U.S. has not expressed readiness to purchase any cryptocurrency beyond Bitcoin. In countries like Russia and China, most discussions around crypto have focused on Bitcoin and stablecoins, often viewed as tools to promote their local currencies. Regarding Bitcoin, institutional FOMO remains high. Governments that currently hold BTC show no signs of selling. Notably, countries such as the U.S., China, the U.K., Ukraine, Bhutan, El Salvador, and four others collectively hold 517,298 BTC—worth over $56.76 billion. In essence, the current institutional focus is overwhelmingly on Bitcoin, while altcoins like XRP remain in the background. Takeaway This analysis highlights the potentially outsized impact of institutional adoption on XRP, particularly at the highest level. However, the scenario of governments allocating between $130 billion and $1.3 trillion into XRP remains highly speculative. As it stands, Bitcoin is the more likely candidate for such large-scale government adoption.  Countries holding Bitcoin | https://bitbo.io/treasuries/countries/

Countries holding Bitcoin | https://bitbo.io/treasuries/countries/

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Will XRP Price Increase In September 2025?