Dirty Pirate Metrics: How to Measure the Success of Your Open-Source Dev Tool

Tech founders who are venture-backed always have a dashboard with numbers they show to investors: sign-ups, MRR projections, growth charts that slope neatly upwards. These are useful, but deep down, they know those dashboards don’t actually tell them whether the tool and the company are headed in the right direction.

\ The truth is, most founders don’t know how to measure the real success of their product. That’s where Pirate Metrics, and more importantly, Dirty Pirate Metrics, come in.

Pirate Metrics: The Starting Point

The Pirate Metrics framework (AARRR: Acquisition, Activation, Retention, Revenue, Referral) was created by Dave McClure to help SaaS startups stop obsessing over vanity metrics (like impressions and likes) and focus on what actually drives growth.

\ It worked because it gave early-stage companies a new way to measure progress when the traditional marketing funnel didn’t fit. But if you’re building a developer tool that depends on GitHub stars, you’ll quickly see AARRR doesn’t go deep enough.

Enter Dirty Pirate Metrics

My former mentor, Stefan Verkerk (WeTransfer founding shareholder, angel investor), extended Pirate Metrics into something that founders can actually run their companies on. He broke down the funnel further so you could measure not just “users coming in and paying,” but also the stages where your product, your community, and your team determine whether you live or die.

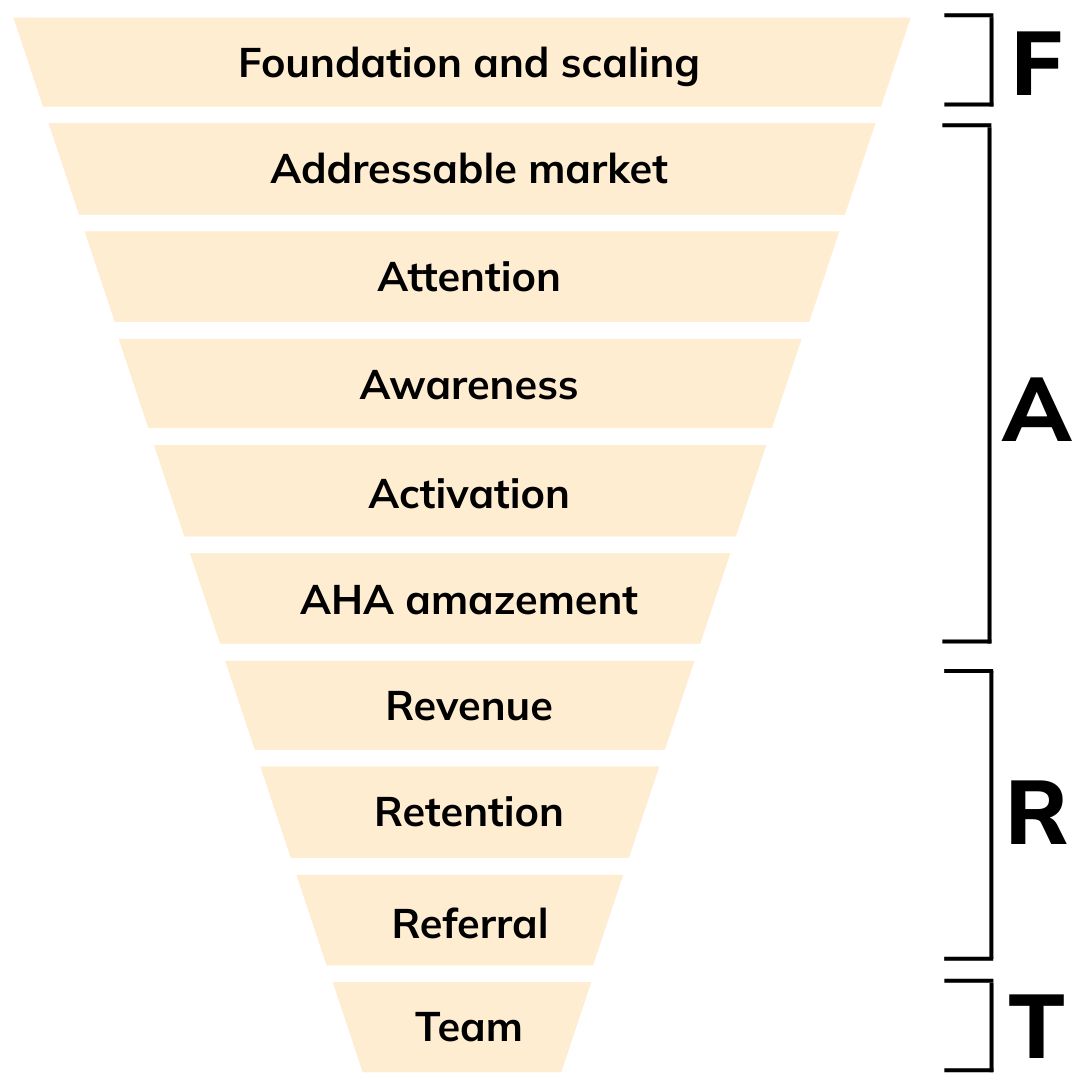

\ That framework is called Dirty Pirate Metrics (because the acronym is FAAAAARRRT).

\ The steps are:

-

Foundation & Scaling

-

Addressable Market

-

Attention

-

Awareness

-

Activation

-

AHA Amazement

-

Revenue

-

Retention

-

Referral

-

Team

\ It looks like a lot, but in reality, it gives you a much clearer picture of whether your product is actually healthy, or whether you’re just dressing up your numbers for pitch decks.

Why This Matters for Founders

Let’s be honest: investors love growth curves, but users don’t care about your MRR chart. Developers care about whether your tool works, solves their problem, and fits into their workflow. If you can’t measure those things, you’re essentially flying blind.

\

- Foundation & Scaling forces you to ask: What are the limitations of my tool, how fast and how far it scales for users?

- Addressable Market: Am I building in a space that’s actually worth it?

- Attention & Awareness: Do devs even know I exist, and do they understand what I do?

- Activation & AHA: Are they trying it, and do they actually love it?

- Retention: Do they keep coming back, or do I churn users after one test run?

- Revenue: What’s my actual sustainability path: sponsorships, enterprise licenses, grants?

- Referral: Are my users doing my marketing for me?

- Team: Do people want to build with me, or am I alone?

The Reality Check

If your current “metrics deck” is mostly GitHub stars, Discord sign-ups, and a hockey stick drawn in Excel, you’re not measuring success; you’re performing for investors.

\ Dirty Pirate Metrics forces you to get honest:

- Where exactly are devs falling off?

- Which part of the funnel is healthy, and which one is broken?

- Is your company built on substance, or just good optics?

Where to Start?

Don’t overcomplicate it. Focus on what matters for your stage:

- 0-1,000 users: Attention & Activation, getting devs to try your tool.

- 1,000-10,000 users: Retention, making sure they stick around.

- 10,000+ users: Revenue & Team, building sustainability and scaling your company.

\ The bottom line: Dirty Pirate Metrics gives you a way to measure the true health of your tool and your company. Investors might still get their pretty charts, but you’ll finally know whether what you’re building is real or just theater.

You May Also Like

WhiteWhale Meme Coin Crashes 60% in Minutes After Major Token Dump

Will Elon Musk buy this company next?