Cardano and Tron Look Strong for 2025—But Investors Eye One Rising Utility Token Could Steal the Spotlight

Which Crypto Could Multiply 40× by Early 2026?

Cardano’s a solid choice for the long haul, with its research-backed security and appeal to big players. Tron, on the other hand, is all about speed and low costs, making it a hit for apps like games and social media.

MAGAX is looking to bring the best of both worlds – think culture, lightning-fast transactions, and serious growth potential. It’s shaping up to be an exciting new option in the crypto space.

Cardano: The Foundation of Certainty

Cardano (ADA) is trading around $0.89 USD right now. It wins praise for its research-led development, proof-of-stake efficiency (99%+ less energy than proof-of-work chains), and its layered architecture allowing smart contracts and DeFi growth. It currently has over $400 million USD locked in DeFi.

But while that stability matters, it also means potential gains in the immediate horizon tend to be moderate. For folks who want massive upside in a short timeframe, the slow grind of traditional blockchain improvements can feel like watching paint dry.

Tron: Transactions Over Hype

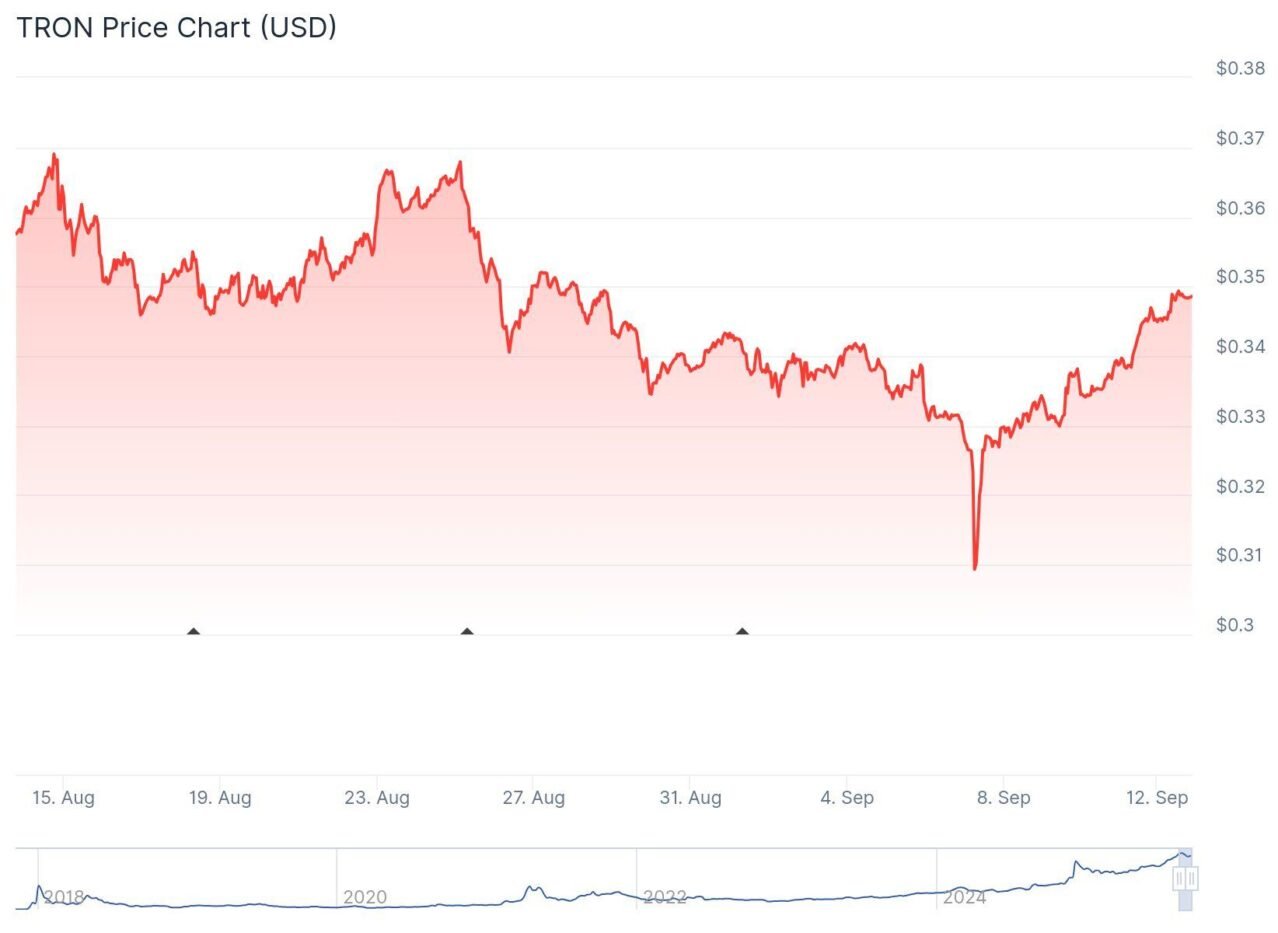

Then there’s Tron (TRX), which is doing a lot of things right. It’s super efficient for fast, cheap transfers. Its vast usage comes largely via stablecoin flows—especially USDT—which gives it utility and volume. TRX is currently priced around $0.34–$0.35 USD, with a market cap in the tens of billions.

The weakness? Much of its activity is derivative of stablecoin movement, rather than building culture, virality, or identity. That means growth is often tied to macro trends rather than community momentum.

Source: Coingecko – Tron – Price Chart

MAGAX: Where Meme, AI & Scarcity Collide

Enter MAGAX. This isn’t just another presale token. It leans into culture. It uses memes, content creation, community engagement—and turns all that into reward via a Meme-to-Earn model. Its code is Certik-audited, which adds a trust layer many meme projects lack.

Here are the features that give MAGAX the edge:

- Deflationary Design: Each presale stage raises the price and reduces token availability, so early participants benefit most.

- AI-Powered Ecosystem: Using Loomint’s AI tech, MAGAX weeds out bots and rewards real, engaging content. No more “spam or hype farms.”

- Cultural Virality: Memes spread, people share, culture builds. MAGAX is tapping into human behavior, which can accelerate everything from awareness to adoption.

These are not theoretical. In other presales with similar combinations (scarcity + community + trust), early investors have seen returns multiplied many times over.

Presale Stage: Timing Is Everything

The presale for MAGAX is currently in Stage 2, with the price set at $0.000293 per token. Every stage after this will be more expensive and the available supply tighter. That means there’s a window of opportunity—and that window is narrowing.

If MAGAX follows patterns of fast-moving presales, participating now could put you well ahead of those who jump in later.

More Than Money: The Social Impact of MAGAX

One thing too many crypto articles overlook: the people. Many young creators around the world already spend hours making memes, content, jokes, community material—for no or little financial return. In regions with few job opportunities, especially where creative infrastructure is limited, those contributions often go invisible.

MAGAX changes that. It gives people who create culture—memes, social content, challenges—a way to be rewarded. It’s not just about profit. It’s about recognition, about transforming fun into income, and about giving economic dignity to cultural work.

Putting It All Together: Which One Sets You Up Best?

| Name | Price (Approx.) | What You Get | What Might Hold You Back |

| Cardano (ADA) | ~$0.89 USD | Stability; strong long-term roadmap; energy efficient | Much slower growth; less short-term upside |

| Tron (TRX) | ~$0.34–$0.35 USD | High transaction volume; utility; low fees | Heavy dependence on stablecoin flows; less cultural or viral momentum |

| MAGAX (ongoing presale) | $0.000293 (Stage 2) | Meme-to-Earn fun; AI-verified rewards; early scarcity advantage; cultural virality | Higher risk; still early; depends on community traction |

Don’t Just Watch—Act

If you believe in balancing safety and upside, you don’t have to pick one. Cardano gives you foundation. Tron gives you utility. MAGAX offers the chance of outsized gains and cultural impact.

Stage 2 presale is live now. The price will go up, and access will get harder with each stage. If you want a shot at 40× returns by March 2026, while supporting a model that rewards creators, this is your moment: Secure your MAGAX tokens at $0.000293 before it’s too late.

The post Cardano and Tron Look Strong for 2025—But Investors Eye One Rising Utility Token Could Steal the Spotlight appeared first on Blockonomi.

You May Also Like

Pump Fun Fund Launches $3M Hackathon: Market-Driven Startups

WhatsApp Web to get group voice and video calls soon