Massachusetts Sues Kalshi Over Alleged Unlicensed Sports Betting, Platform Vows to Fight

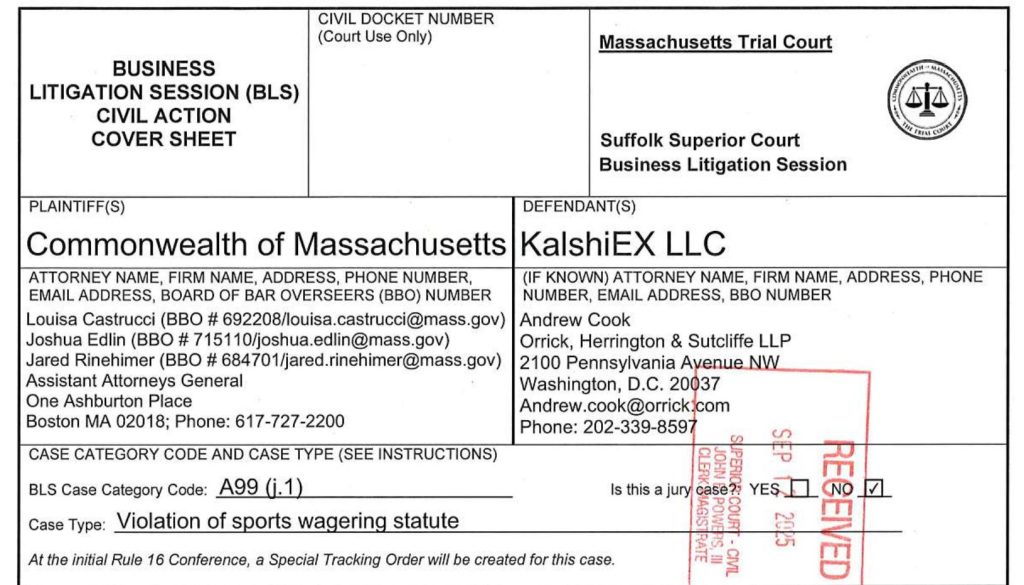

Massachusetts Attorney General Andrea Joy Campbell filed a civil lawsuit against prediction market platform Kalshi, alleging the company operates unlicensed sports betting disguised as “event contracts” in violation of state gambling laws.

The Commonwealth seeks damages, civil penalties, and a permanent injunction to stop Kalshi from accepting sports wagers without proper licensing from the Massachusetts Gaming Commission.

The lawsuit filed in Suffolk Superior Court claims Kalshi processed over $1 billion in sports wagers from 3.4 million bets between January and June 2025.

Sports contracts comprised 70-75% of Kalshi’s trading volume, surpassing percentages recorded by licensed operators DraftKings and FanDuel during the same period.

Source: MASS[.]GOV

Source: MASS[.]GOV

Kalshi Accused of Bypassing Consumer Protections Through “Event Contract” Model

Massachusetts regulators allege Kalshi’s binary “yes or no” event contracts function identically to traditional sports betting while circumventing state oversight.

The platform offers moneyline contracts, point spreads, over-under bets, and proposition wagers that mirror licensed operators’ offerings.

The company allows users aged 18-21 to place bets despite Massachusetts requiring age 21 for sports wagering.

Kalshi provides minimal responsible gambling safeguards compared to licensed operators, offering no deposit limits or cooling-off periods until March 2025.

State officials note Kalshi markets extensively through television, social media, and partnerships with Robinhood.

The platform previously advertised itself as “The First Nationwide Legal Sports Betting Platform” before shifting language to describe activities as “trading” after receiving cease-and-desist orders from multiple states.

The Massachusetts Gaming Commission specifically requested Attorney General Campbell pursue enforcement action.

Licensed operators pay $5 million for five-year licenses, plus annual fees of $1 million, while Kalshi operates without state authorization, despite processing comparable wagering volumes.

Attorney General Campbell emphasized in a press release that sports wagering “comes with significant risk of addiction and financial loss and must be strictly regulated to mitigate public health consequences.”

The filing requests a court order for Kalshi to cease Massachusetts operations during litigation.

Federal vs State Jurisdiction Battle Intensifies Across Multiple States

Kalshi argues its operations fall under Commodity Futures Trading Commission oversight rather than state gambling regulation.

The company previously sued Nevada and New Jersey gaming regulators, claiming federal authority preempts state enforcement actions.

Federal courts sided with Kalshi in those cases, barring state regulators from intervening while litigation continues.

However, at least seven states, including Arizona, Montana, Ohio, and Illinois, have issued cease-and-desist orders targeting the platform’s sports offerings.

Robinhood Derivatives filed similar lawsuits against Nevada and New Jersey in August, claiming unfair treatment compared to Kalshi’s protected status.

The trading platform facilitates event contracts that settle on Kalshi’s system while seeking identical federal preemption protections.

Kalshi co-founder Tarek Mansour stated the company stands “ready to defend” its technology “once again in a court of law.”

The platform maintains that prediction markets represent “critical innovation” that all Americans should have access to.

Meanwhile, rival prediction market Polymarket prepares U.S. re-entry after CEO Shayne Coplan claimed CFTC approval.

Business Insider reports that Polymarket is seeking funding that could potentially triple its $1 billion valuation to $10 billion.

Notably, for Kalshi, its rapid growth trajectory adds complexity to the regulatory challenges it faces.

The platform processed $441 million in trading volume during the first four days of the 2025 NFL season, with nearly $200 million on September 7 alone, which was one of its busiest periods since the 2024 presidential election.

The company achieved $875 million in monthly volume during August 2025, while reports suggest Kalshi is approaching a new funding round, potentially valuing it at $5 billion.

This would more than double its $2 billion valuation from a June funding round led by Paradigm with participation from Sequoia and Multicoin Capital.

As it stands now, Massachusetts joins growing state-level enforcement efforts targeting platforms that process billions in wagering volume without traditional sports betting licenses.

CFTC acting Commissioner Caroline Pham announced in February a shift away from “regulation by enforcement” toward fraud protection.

However, the agency previously probed Super Bowl contracts offered by both Kalshi and Crypto.com before concluding investigations without enforcement actions.

You May Also Like

Robinhood’s New Move: MNT Coin Joins the Roster

Microsoft Corp. $MSFT blue box area offers a buying opportunity