Cardano News And XRP Updates Take A Back Seat As Rollblock Dominates Speculator Watchlists

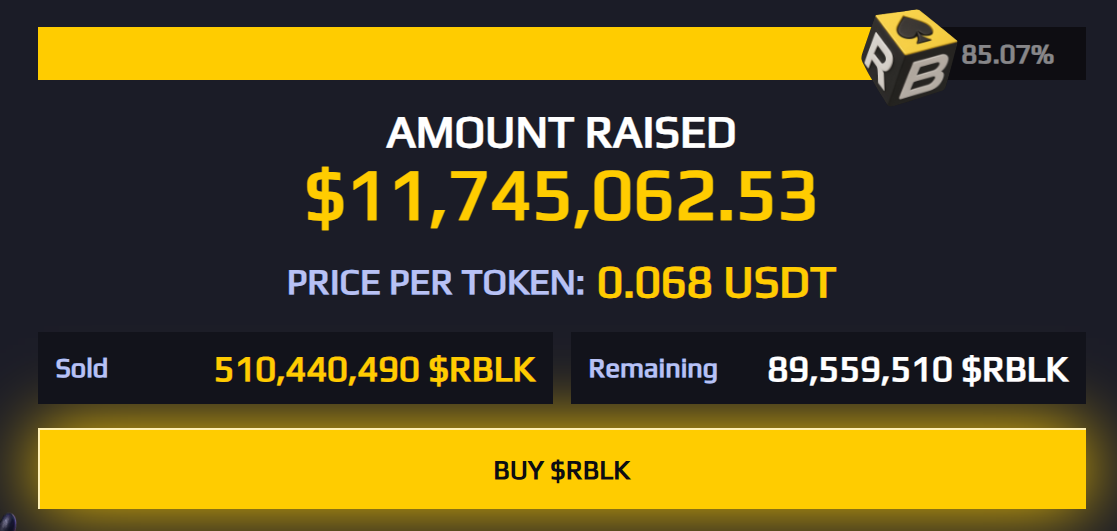

Recent Cardano news on network progress and XRP updates around regulatory battles have kept both tokens in the spotlight, but speculators are turning elsewhere. Rollblock (RBLK) has already raised $11.7 million in presale funding and processed millions in wagers through its live iGaming hub. With deflationary tokenomics and fast-growing adoption, traders see RBLK as the sharper play heading into the next cycle.

Cardano News: ADA Struggles Despite Development Advances

At $0.8958, Cardano (ADA) shows a slight 1.98% gain, yet price action reflects hesitation. After briefly topping $1.0193, ADA has failed to hold above $0.90, signaling weak momentum. Whale sell-offs have amplified this struggle, keeping the market cautious.

Nonetheless, Cardano news on the development side remains positive. Hydra, aimed at scaling transaction throughput, and a new treasury voting framework highlight steady innovation.

However, these advances have not translated into immediate price strength.

The latest Cardano news suggests a network quietly preparing for growth while price stalls. A decisive push above $1.00 likely depends on stronger buying pressure aligning with these upgrades.

XRP Struggling Around $3 Amid Uncertainty

Currently priced at $3.02, XRP has managed only a 0.89% daily increase, and its chart shows difficulty building a solid base above the $3 threshold. Over the past month, the token has fallen 7.54%, eroding some of its momentum, even though the yearly gain of 438% underscores how far it has rebounded.

Developments beyond the chart offer mixed signals. Ripple’s new partnership with BBVA in Europe expands banking integrations under MiCA rules, supporting adoption. Yet, the SEC’s delay of the Franklin XRP ETF decision until November 14 has slowed enthusiasm.

With XRP struggling to stabilize, a breakout above $4 remains the next critical test.

Rollblock Dominates Speculator Watchlists in 2025

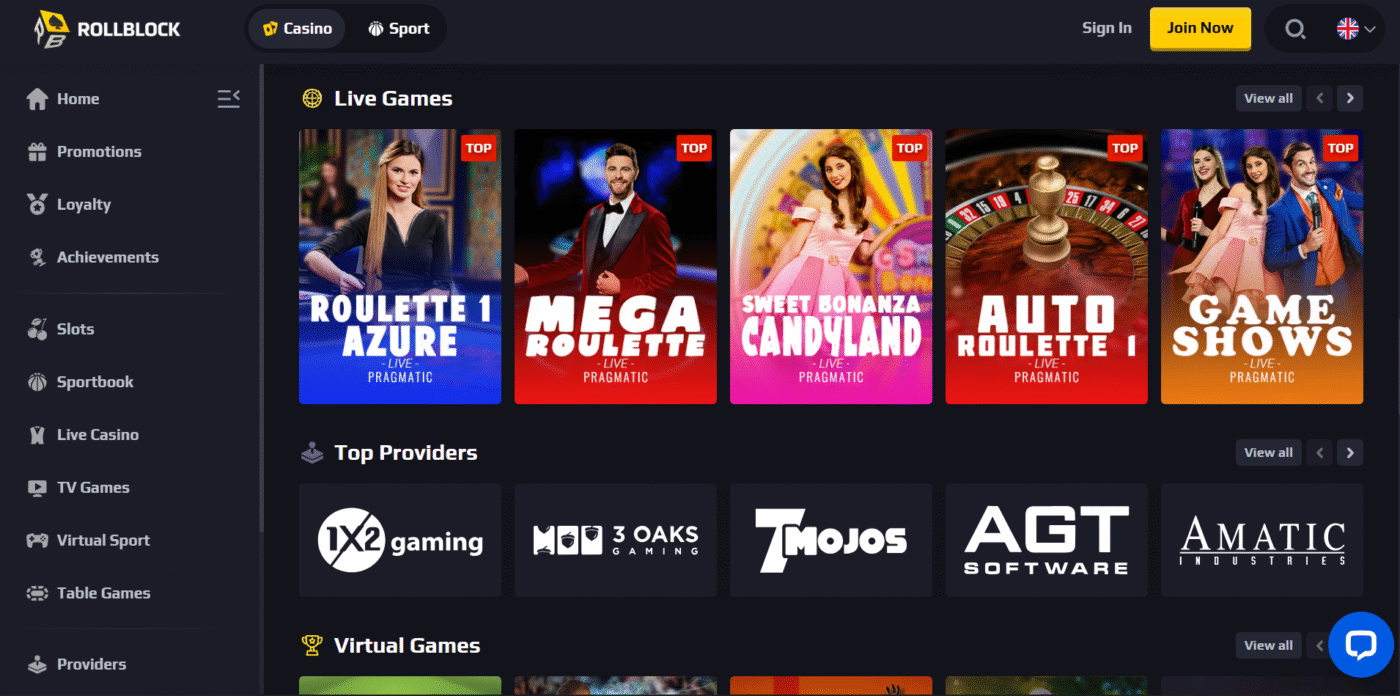

Speculators searching for the next breakout token are shifting their attention to Rollblock (RBLK). Unlike many GameFi launches that rely on hype alone, Rollblock has already demonstrated traction, processing $15 million in wagers across 55,000 users well before its exchange debut. This performance gives the project credibility that most early-stage tokens lack.

The ecosystem blends entertainment with investment appeal. Players have access to 12,000 various games and receive regular rakeback incentives on a daily, weekly, and monthly basis. Investors, however, are attracted to the staking opportunities that have up to 30% APY and monthly prize pools exceeding 2 million dollars. This dual reward model strengthens both engagement and token demand.

Adding another layer of sustainability, Rollblock employs a weekly buyback-and-burn program that gradually shrinks supply while providing consistent returns to committed holders. Analysts view this as a key factor that could separate RBLK from short-lived projects in the space.

Here are some Rollblock features drawing investors’ appeal:

- 12,000+ games available, keeping gameplay fresh and engagement high.

- Daily, weekly, and monthly rakebacks reward active players consistently.

- Monthly prize pools exceeding $2 million, boosting platform competitiveness.

- Staking rewards up to 30% APY, appealing to both gamers and investors.

With $11.7 million raised in its presale and the token priced at just $0.068, Rollblock is being positioned as a serious contender for viral growth in 2025. For speculators, it represents more than hype; it’s proof of adoption combined with scalable long-term value.

Rollblock Outpaces Cardano and XRP With Stronger Momentum

Rollblock is increasingly viewed as a stronger upside play compared to established tokens like Cardano and XRP. While Cardano news highlights ongoing struggles with price stagnation and XRP wrestles with holding the $3 mark, Rollblock has already processed $15 million in wagers and raised $11.7 million, giving it clear momentum that speculators can’t ignore.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Cardano News And XRP Updates Take A Back Seat As Rollblock Dominates Speculator Watchlists appeared first on Blockonomi.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse