Solana Price Prediction — $250 Target in Play as Whales Accumulate and ETF Buzz Builds

Analysts are keeping a close eye on Solana (SOL) to see if the token will hit the $250 mark. A potential ETF decision is one of the biggest drivers fueling speculation. At the same time, whales are continually stacking up, supporting market confidence. As focus on SOL increases, many investors are also diversifying their investments into some of the high upside coins, such as MAGACOIN FINANCE, which is in high demand as a breakout opportunity.

Price Analysis for Solana

Solana is trading at around $203 after compressing inside a symmetrical triangle on the two-hour chart. Buyers defend higher lows near $194 and $189. However, sellers are still active near $212 and $217. The 50-period SMA at $205.02 is immediate resistance. On the other hand, the 200-period SMA at $194.37 supports the lower boundary.

The upper trendline tops rallies around $208, while demand rises from $189. Key resistance levels are still $212 and $217. More so, support zones are firm at $199, $194, and $189. The Relative Strength Index is at 52, indicating neutral momentum. A breakout above $208 could open the path towards $212 and eventually $250. Conversely, failure may drive the price back to $199 and $194.

Solana Hits New Milestones

Solana generated $148 million in application revenue in August (92% year-over-year increase). Consequently, this overtook all other blockchains. Additionally, trading volume also surged. Perpetual futures have $43.8 billion and decentralized exchanges processed $144 billion year-over-year.

Meanwhile, on-chain growth also accelerated. Solana accommodated 2.9 billion transactions, which is over 4 times the sum of the output competitors. Active addresses doubled to 83 million addresses, and the creation of tokens spread quickly. August saw 843,000 new tokens launched, with 357 reaching valuations above $1 million. These figures are an important point in the growing strength of Solana’s ecosystem.

ETF Speculation Builds

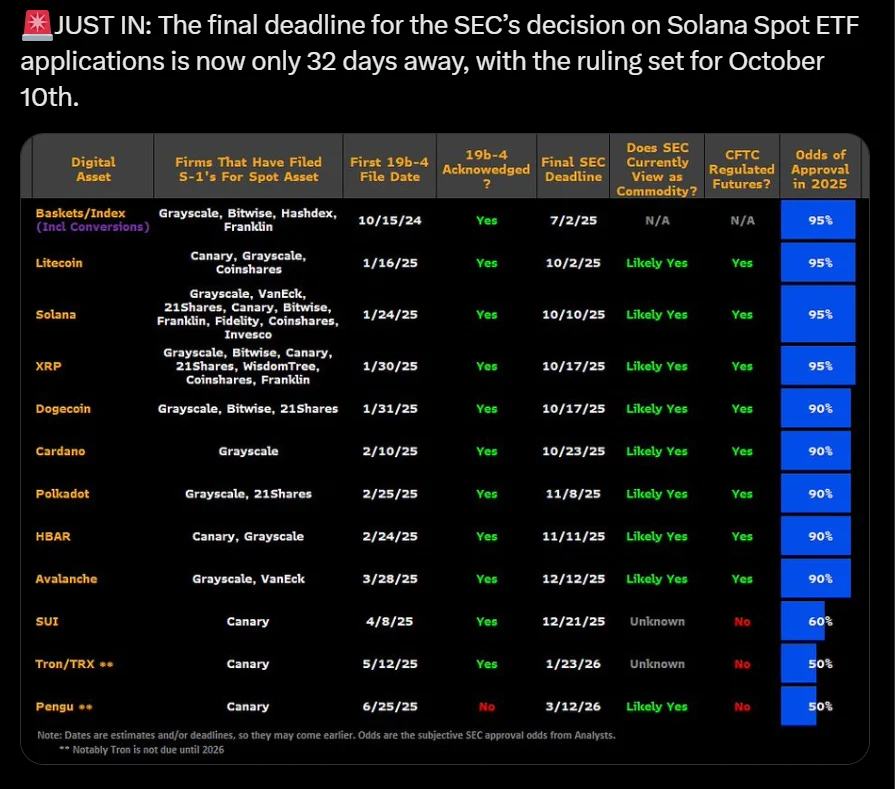

More so, the SEC’s spot ETF applications for Solana are set for a decision by October 10. This deadline has added to market interest. Analysts suggest the long SEC review period could be a sign that it’s moving forward. Approval may take place by mid-October if filings meet requirements.

Thirteen public companies already hold 8.9 million SOL, which are worth roughly $1.8 billion. This is equal to 1.55% of the circulating supply. This institutional backing gives Solana an even stronger hold on its position in the market.

MAGACOIN FINANCE: Altcoin Opportunity Rising

As Solana attempts to break higher, savvy investors are increasing the range of their search for the next big altcoin with big upside. MAGACOIN FINANCE is attracting a lot of attention and analysts expect potential returns of up to 40x. This forecast has led to an increasing FOMO as traders scramble for uncharted opportunities outside of the major trends. Early buyers are inciting fast to take positions.

As a result, there is clearly a shift in investor attention. MAGACOIN FINANCE is unique for its transparency, active community, and stable demand. These traits set it apart from weaker speculative plays. As accumulation is building, MAGACOIN FINANCE is holding itself as a strong contender in today’s altcoin rotation. For risk-tolerant investors, the project is one of the best opportunities to invest in along with Solana’s rise.

Conclusion

Solana’s growing revenue and increasing transactions and whales highlight its potential as a leading blockchain. ETF speculation provides another driving force, with analysts now looking at $250 as a realistic goal. Meanwhile, MAGACOIN FINANCE is further gaining pace as a surging altcoin opportunity. Together, these projects show how diversification can capture both security and explosive upside in today’s market.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Hoskinson to Attend Senate Roundtable on Crypto Regulation

Pepenode Community Members Evaluate XRP Tundra Presale Metrics for Potential Rapid Return Opportunity