4 Cryptos Deepseek Says to Watch Before the FOMC Meeting

After September, the central bank is projected to deliver three more 25 bps reductions at subsequent meetings before pausing indefinitely. For risk assets, that path signals a steady drip of liquidity into markets. And in crypto, that usually translates into capital rotating fastest into the most speculative corners of the market.

Each offers something different. Whether it’s scaling Bitcoin, building cultural IP, gamifying meme mining, or leaning into nothing but pure irony. However, all reflect where the risk-on narrative is heading if markets get the green light from the Fed.

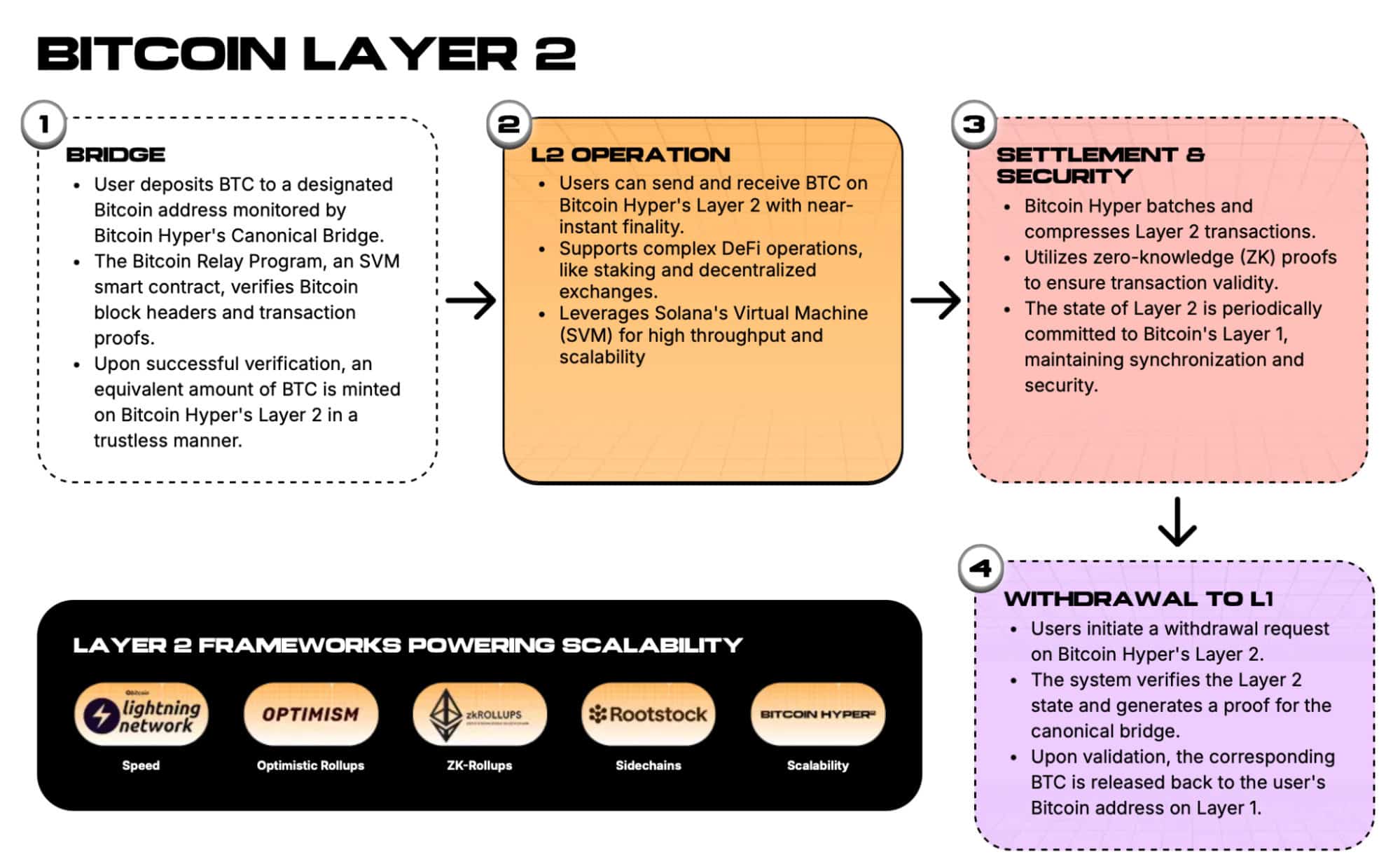

1. Bitcoin Hyper ($HYPER) – Bitcoin’s First True Layer 2

Bitcoin Hyper positions itself as the first true Layer 2 for Bitcoin, designed to turn the world’s largest crypto asset from a passive store of value into an active execution layer. Integrated with the Solana Virtual Machine (SVM), it enables sub-second transactions, near-zero fees, and full cross-chain interoperability from day one.

That means you can bridge $BTC in, trade, stake, launch dApps, and even create meme coins, all while settling back to Bitcoin’s secure base layer with zero-knowledge proofs.

The project’s presale has already gained serious traction. Investors have committed over $16M, with tokens priced at $0.012925 and staking rewards offering 71% APY.

If the FOMC sparks a broader rally in $BTC, Bitcoin Hyper stands to benefit directly. It’s essentially pitching itself as the Ethereum of Bitcoin – where builders, degens, and communities can finally do more than just hold. In a market environment that rewards speed and culture, $HYPER brings both.

Discover how to buy Bitcoin Hyper ($HYPER) in our step-by-step guide.

2. Pudgy Penguins ($PENGU) – Meme IP Meets Institutional Interest

Pudgy Penguins has cemented itself as one of the most recognizable brands in Web3, often called the ‘Mickey Mouse of crypto.’ The community-driven IP has racked up more than 220B views online, and its reach stretches well beyond NFTs. $PENGU, the official token, underpins a brand that has entered mainstream retail, entertainment, and gaming.

Partnerships tell the story. Walmart and Target stock Pudgy Penguin toys, ICEE rolled out themed promotions, and Lufthansa integrated Pudgy Penguins into its Miles program. NASCAR brought the penguins to race fans, while Suplay distributed collectibles across 8,000 Asian retail outlets.

Institutions are also circling. Pudgy Penguins recently teamed up with Sharps Technology, a NASDAQ-listed Solana treasury, and Canary has filed for a $PENGU ETF that would hold both the token and Pudgy NFTs.

The token currently trades at $2.07B, with $353M daily volume. If the Fed’s upcoming rate cuts spark another risk-on wave, tokens tied to cultural IP could benefit massively. Pudgy Penguins is one of the few meme assets with mainstream crossover and institutional recognition.

3. PepeNode ($PEPENODE) – Gamified Mine-to-Earn Meme Coin

PepeNode introduces the first mine-to-earn meme token, fusing DeFi mechanics with gamified mining. Instead of passively holding, you build and optimize a virtual server room. Adding nodes, upgrading rigs, and fine-tuning combinations increases your yield of $PEPENODE. The system creates an active experience closer to strategy gaming than traditional staking.

Leaderboards add a competitive twist. Top miners don’t just earn more $PEPENODE, they also receive bonus rewards in trending meme tokens like $PEPE and $FARTCOIN. This mechanic turns participation into an ongoing contest, keeping the community engaged and the token in constant circulation.

The project’s presale has already raised over $1.15M, with tokens priced at $0.0010575. Staking rewards are eye-catching, with yields currently sitting at 1175% APY. That makes early entry especially appealing for investors looking to compound exposure before launch.

Presales typically thrive when markets flip risk-on. $PEPENODE offers an interactive utility that could resonate with traders looking for yield and entertainment.

4. Useless Coin ($USELESS) – The Irony Play on Solana

Useless Coin ($USELESS) takes meme culture to its logical extreme by branding itself as intentionally pointless. Launched in May 2025 on the LetsBONK.fun platform, it gained traction precisely because it rejects the usual trappings of utility.

No staking, no governance, no roadmap: just pure speculation wrapped in irony. That self-awareness has resonated with Solana’s meme-native community, including early support from OG figures like @theunipics.

The token trades at $0.2262, giving it a $225M market cap and generating $62M in daily volume over the past 24 hours. Unlike most meme projects, Useless doesn’t pretend to offer yield or long-term mechanics. Its entire pitch is that there is no pitch.

Ironically, that clarity works in its favor during risk-on periods. When markets chase memes, the loudest, weirdest, and most cultural plays often outperform. If the Fed’s expected cut sparks a surge, $USELESS has the potential to rally simply because it embodies the absurdist humor that drives much of Solana’s ecosystem.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Kalshi debuts ecosystem hub with Solana and Base