Bitcoin Spot ETFs Rake in $260M Inflow Overnight – 6 Day Streak as Ethereum ETFs Heat Up

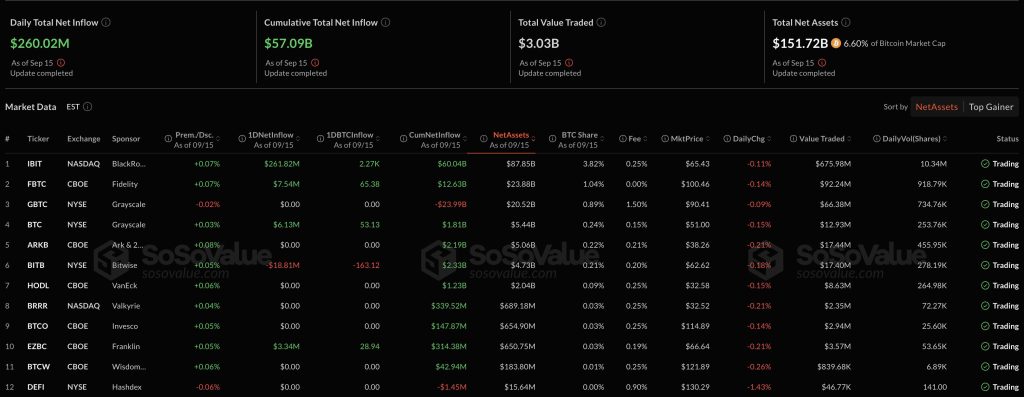

Bitcoin spot exchange-traded funds (ETFs) in the United States extended their winning streak on September 15, posting a combined net inflow of $260.02 million, according to data from SoSoValue.

The inflows marked the sixth consecutive day of gains, reinforcing renewed institutional interest in the asset class.

Bitcoin ETFs and Ethereum ETFs Draw Consecutive Daily Inflows

U.S. Spot BTC ETFs Source: Sosovalue

U.S. Spot BTC ETFs Source: Sosovalue

BlackRock’s iShares Bitcoin Trust (IBIT) once again led the field, recording $261.82 million in daily net inflows. That brings its historical inflows to $60.04 billion, making it the dominant player in the market.

Fidelity’s FBTC followed with $7.54 million, raising its cumulative inflows to $12.63 billion. Meanwhile, Bitwise’s BITB posted the largest outflow of the day, losing $18.81 million, though its total net inflows still stand at $2.33 billion.

The surge pushed the combined net asset value of Bitcoin spot ETFs to $151.72 billion, representing 6.6% of the total Bitcoin market capitalization.

Cumulative inflows across Bitcoin products now total $57.09 billion. Daily trading activity remained strong as well, with $3.03 billion worth of transactions recorded on Monday.

The streak of inflows builds on momentum earlier in the week. On September 12 alone, Bitcoin ETFs attracted $552.78 million, led by IBIT with $366.2 million and Fidelity’s FBTC with $134.7 million.

That session capped four straight days of positive flows, totaling $1.7 billion and reversing the weakness seen in early September, when funds recorded their first weekly outflows since June.

Ethereum ETFs are also seeing renewed demand after a period of turbulence. On September 15, BlackRock’s ETHA logged its strongest inflow of the month, adding $363.19 million worth of Ether, or 80,768 ETH.

The one-day gain lifted ETHA’s total assets to $17.09 billion and daily trading volume to $1.5 billion, marking a sharp rebound from more than $787 million in outflows recorded earlier in the month.

Grayscale’s ETHE added $10 million on the day, while Fidelity’s FETH saw $13.46 million in outflows. Despite recent volatility, cumulative inflows across all Ethereum ETFs have climbed to $13.72 billion, with assets under management at $30.35 billion.

The turnaround reflects a broader resurgence in crypto investment products. CoinShares reported that digital asset funds drew $3.3 billion in inflows last week, the largest since July.

Bitcoin led with $2.4 billion, while Ethereum reversed eight consecutive days of outflows to post $646 million in net inflows over four days.

With both Bitcoin and Ethereum ETFs now drawing steady inflows, analysts suggest institutional appetite remains strong despite ongoing market volatility.

92 Crypto ETF Applications Await SEC Review as Altcoin Funds Gain Momentum

The U.S. Securities and Exchange Commission (SEC) is currently reviewing 92 cryptocurrency exchange-traded fund (ETF) applications, according to Bloomberg Intelligence analyst James Seyffart.

The figure marks an increase from April, when 72 applications were pending, showing the accelerating pace of filings as asset managers push to expand regulated access to digital assets.

Most of the new proposals face October deadlines and center on altcoins such as Solana, XRP, and Litecoin. Solana leads the pipeline with eight filings, followed by seven for XRP, making the two tokens the most sought-after beyond Bitcoin and Ethereum.

Industry heavyweights, including Grayscale, Bitwise, and 21Shares, are among those seeking approval, with some proposals also targeting Ethereum staking products.

Meanwhile, new launches are imminent. The REX-Osprey XRP ETF, trading under the ticker XRPR, is set to debut this week after clearing the SEC’s 75-day review period under the Investment Company Act of 1940.

It will be the first U.S. ETF to provide spot exposure to XRP. Within days, a Dogecoin ETF from the same issuer, DOJE, is expected to follow, marking the country’s first memecoin ETF.

REX-Osprey previously introduced a Solana staking ETF in July, though inflows have been modest, and also filed for a BNB staking product.

Other filings point to broadening institutional interest. Bitwise has filed for a spot Avalanche ETF, structured as a Delaware statutory trust with Coinbase Custody as the administrator, while 21Shares has proposed an active crypto ETF and leveraged products tied to Dogecoin and Sui.

The flurry of applications comes as regulated crypto investment products gain traction globally.

Analysts say approval of altcoin ETFs could open new avenues for institutional capital, deepening liquidity across major tokens and potentially reshaping market dynamics.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

While Ethereum and Hedera Hold Steady, ZKP Crypto Shakes the Market with a $1.7B Raise in Motion