Is the Binance listing effect weakening? Market, project quality and narrative are the three key factors for the rise of coin prices

Author: andrew.moh , Crypto KOL

Compiled by: Felix, PANews

Lately, securing a place on major crypto exchanges (particularly Binance) has become a real catalyst for the project.

“When Binance?” or “When listing Binance?” These statements have become commonplace in the crypto community. There are two key factors driving this phenomenon:

Liquidity

As one of the largest centralized exchanges in the world, Binance has excellent liquidity, ensuring seamless, high-volume trading.

Listing on Binance can enhance the project and increase its attractiveness and trading activities.

Reputation

Binance Labs, a subsidiary of Binance, is a benchmark for industry credibility. When a project is recognized by Binance Research, it will greatly increase user awareness. With the support of Binance, user trust soars.

"If Binance participates in the investment, this project will definitely be a winner."

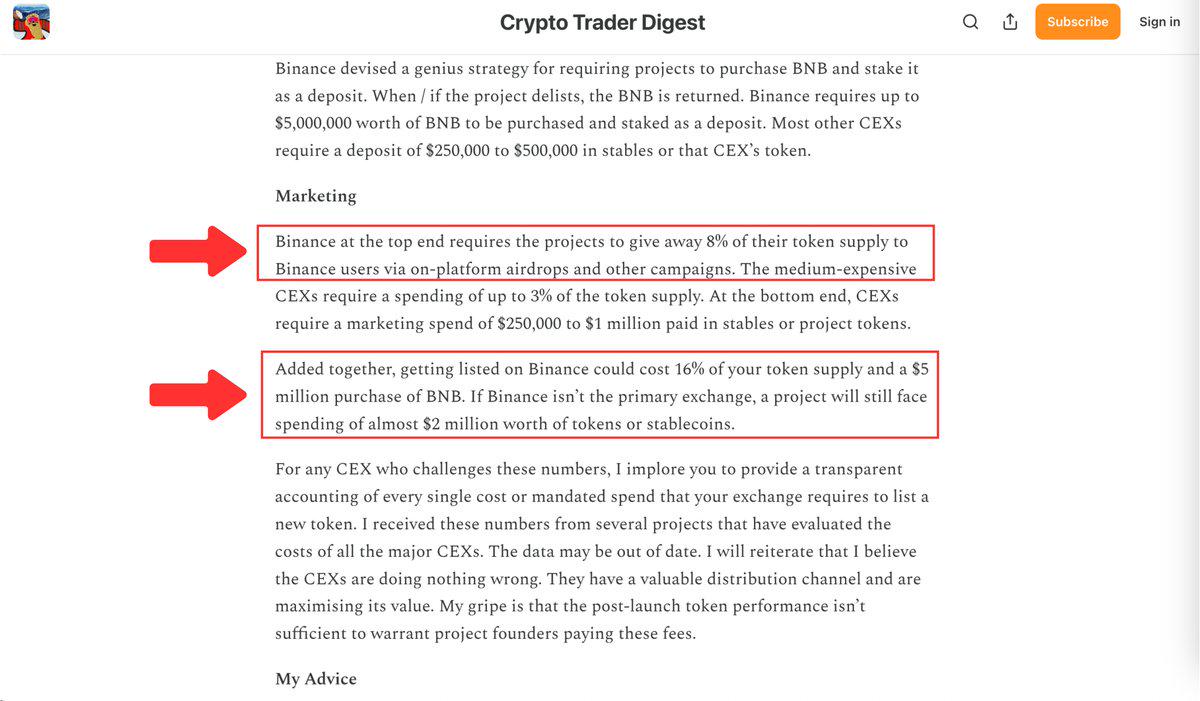

Previously, BitMEX co-founder Arthur Hayes wrote that Binance charges a listing fee of up to 8% of the total token supply, and requires projects to purchase and pledge BNB, which will be returned when it is delisted, equivalent to US$5 million (other exchanges require a deposit of US$250,000 to US$500,000 in stablecoins or their tokens).

Related reading: Arthur Hayes to crypto project owners: Instead of trying every possible way to list on Binance, it is better to go directly to DEX

Projects that want to be listed on Binance or other exchanges must invest a lot of money.

Many TGE projects with higher FDV often cause retail investors to suffer losses.

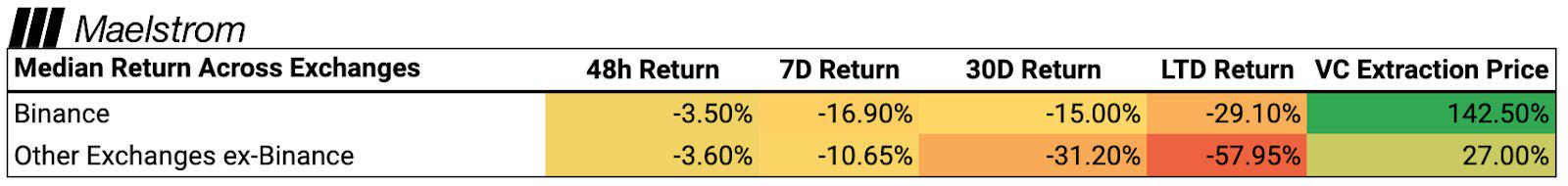

Meanwhile, the VCs made a killing, selling for a whopping 142.5%.

VanEck pointed out that investment funds are too focused on short-term gains, which affects users and projects. Hayes suggested caution when prioritizing Binance listings.

However, projects listed on Binance often succeed due to their strong communities and technologies. More and more truly valuable projects are following this trend.

However, high listing fees force projects and VCs to pursue short-term profits, which will have a negative impact on investors' performance in 2024.

So the question remains: Is listing on Binance necessarily a driving force behind the price increase?

Price appreciation will depend on many key factors beyond just Binance listing, including:

-

Market Conditions

-

Project Quality

-

The hype surrounding its narrative

etc.

1. Market conditions

Market conditions are the biggest factor that directly affects token prices.

The following table shows:

-

Of the 37 tokens that Binance will launch in 2024, all but five are at a “break-even” price.

-

NEIRO has risen 294% since its launch on September 16, with FDV reaching approximately $690 million

-

Most of the tokens listed on Binance in 2024 have fallen, with more than half falling by at least 30-80%.

-

The worst performer is AEVO, which has fallen more than 88% since it first went online in February.

So what do you think of the tokens listed on Binance?

Judging from these statistics, you may lose trust in every project listed on Binance. (If you invest in a project listed on Binance in 2024, your current winning rate is only 13.5%)

This is a normal phenomenon due to market conditions.

BTC is approaching $70,000 and has risen from $42,000. But why are almost all altcoins still on the downside?

2. Project Quality

You might think that Binance Labs is a reputable VC firm. Projects that want to be listed on Binance have more than just a financial story. It also means:

-

Good product quality/innovation

-

Large community

Binance Labs will strictly review each project to ensure that only the best projects are selected.

The seed tag on Binance is available for:

-

Innovation Zone Token, designed to trade new tokens while protecting other tokens from volatility risk

-

Innovative tokens with potential for future listings

But Binance always releases announcements related to monitoring tags.

-

Tokens with high volatility and low liquidity

-

Low market value projects

-

Delisting risk

-

Suspicious operations endanger users

They will be tagged with monitoring tags.

If this continues, these projects will be delisted from Binance. If this happens, it will be a disaster for both the projects and their holders.

3. Hype around narrative

Web3 users are buzzing about “narratives” as we enter 2024. From AI to DePIN to RWA, each narrative contains a story that promises to lead the way, and the crypto industry is rapidly moving towards mass adoption.

But you can see how the market reacts to these narratives. Almost all of the current narratives have some merit, but most are in trouble.

As can be seen from the table above, 4 out of the 5 rising projects are meme projects. Memes seem to be the magic ticket to attract millions of users.

According to CMC data, there are 11 meme projects among the top 100 memes by market capitalization.

-

7 memes have a market value of over $1 billion.

It is expected that in the next bull market, at least 3 more memes will have a market value of $1 billion.

Summarize

Listing on Binance seems to be the dream of every Web3 project, but it’s not just about price. Projects listed on Binance are likely to be carefully scrutinized by top VCs.

However, the development status of a project is not guaranteed. If users only invest in projects listed on Binance, then it is time to rethink their investment strategy. Price narrative is not everything, so it is recommended to invest wisely and keep a clear mind.

Related reading: Analysis of the effect of listing coins on the five major exchanges: How much can it drive the price of coins to rise? How long will it rise?

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth