Stake PRIME or buy PROMPT directly? Wayfinder profit maximization research

Author: DMD

Compiled by: Tim, PANews

Note: This article is not financial advice and is provided for informational purposes only.

Over the past year, I have been sharing estimates of the returns from staking PRIME tokens to earn PROMPT, which have been frequently referenced by the community. After actual verification after the TGE, I am pleased that these estimates have a high degree of accuracy:

The total number of PROMPT points estimated by this model = the amount of locked PRIME × duration × multiplier. Stakers will receive a corresponding share of points based on their staked ratio.

When comparing the model to three different wallets, including my own, the estimated model’s predictions for PROMPT receipts were about 20% higher than the actual amount. I believe this is mainly due to two reasons:

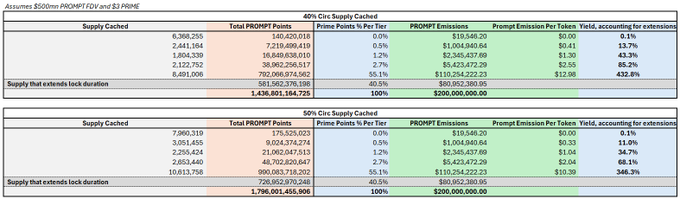

1. I originally expected that 40% of the PRIME in circulation would be staked, but the actual stake ratio was as high as 45%, which means that the total number of points exceeded expectations, resulting in a more obvious dilution effect.

2. The total number of PROMPT points is still uncertain because some stakers may release their stake (which will reduce the total number of points) or continue to extend their stake (which will increase the total number of points).

In addition, the yield estimation is highly dependent on the price of PRIME and PROMPT. When the price of PRIME drops, the yield increases, and users are incentivized to buy more tokens and stake them. Of course, the yield still depends on the final valuation of PROMPT.

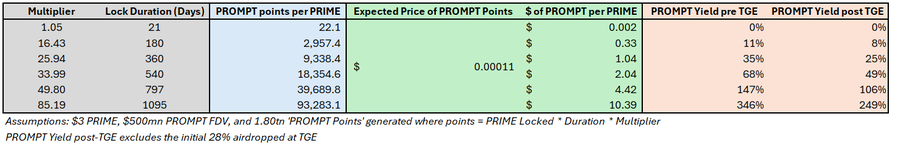

As more information is revealed after the TGE, I think the following table may be the most accurate prediction of the return on staked PRIME. This update takes into account the situation where more PRIME is staked (by generating more PROMPT points) while maintaining the valuation of $500 million FDV. In addition, a new column of data is added to exclude the 28% token share airdropped to the community during the TGE:

Summary: Maximizing staking PRIME tokens now will earn you 106% in the form of PROMPT over the next 797 days.

It is clear from the table above that the revenue opportunities have declined significantly since June 2024. This decline is mainly reflected in two aspects: the multiplier effect continues to decay, while PROMPT points continue to accumulate over time, and the later the participants enter the market, the lower the proportion of points they can obtain. This is particularly true after the TGE, when 28% of the total supply has been released, and new tokens will enter the circulation market every week for users to claim.

Scenario Analysis: Staking PRIME vs. Buying PROMPT

The following analysis compares the two options currently facing market participants: buying PROMPT directly on the open market, or buying PRIME and staking it (earning PROMPT returns in the process). To do this, we will assume that PRIME will be staked to the maximum at the 49.8x return multiplier mentioned above, with a staking period of 797 days.

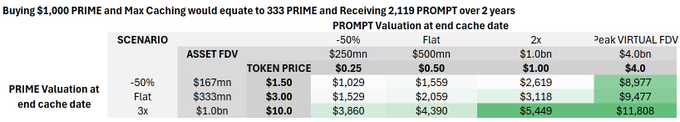

If you buy $1,000 worth of PRIME tokens today, you will get about 333 PRIME. According to the data in the table above, if these tokens are staked to the maximum, 333×39,690 points can be generated, that is, 13.2 million points.

Given that 400 million PROMPT tokens are planned to be distributed to all point stakers in proportion to the total 1.8 trillion points, the current 13.2 million tokens should generate approximately 2,944 PROMPT tokens. Considering that 28% of PROMPT has been distributed, we will make a proportional reduction adjustment, that is, the output of tokens corresponding to this amount of points will be reduced to approximately 2,119 PROMPT. It should be noted that this calculation is not absolutely accurate, because the PROMPT distribution mechanism actually depends on the daily accumulation of points, but the above method provides a concise and intuitive estimation framework for understanding the benefits, and its numerical range is basically reasonable.

The following table applies this number to valuation scenarios for PRIME and PROMPT at the end of the staking period:

On the other hand, for those who buy PROMPT tokens directly, the calculation is simpler. Ultimately, assuming the PROMPT price is $0.5, a $1,000 investment will get you 2,000 PROMPT tokens, which is less than what you can get by buying PRIME tokens and staking them in full.

Of course, for now, the advantage of buying PROMPT directly on the open market is that you can always take profits when PROMPT reaches a local high.

Assuming that at the end of the staking activity, PROMPT is valued at $1 billion and the PRIME price remains stable, the value of the token at the end of the staking period will be $3,118 as described above.

However, given the volatility of cryptocurrencies, PROMPT is likely to hit all-time highs in the next two years (e.g., a fully diluted valuation of $4 billion, similar to the FDV level achieved by the VIRTUAL project at the peak of the AI agent craze), and then fall back to a more reasonable $1 billion FDV valuation range.

If one bought $1,000 worth of PROMPT tokens on the open market today and sold them at the current local high, one would receive $8,000 in profit, which is more than double the value gained by staking PRIME.

Summarize

Those looking to gain exposure to PROMPT, either by fully staking PRIME or purchasing directly on the open market, should consider the following:

- What do you think the final value of PRIME and PROMPT will be at the end of the 2-year staking period?

- What do you think the historical highest price of PROMPT will be in the next two years? Most importantly, can you sell it at the highest point?

Ultimately, this depends largely on individual circumstances. It is an undeniable fact that most investors were unable to successfully sell at market highs. At the same time, as many PRIME holders have experienced firsthand, locking up tokens for over two years and watching their value plummet by 90% is a painful experience. Of course, given PRIME’s leading position in the Web3 gaming space and multiple positive catalysts coming this year, including the highly anticipated releases of Colony and Sanctuary, it is hard for me to imagine PRIME falling more than 50% from its current price.

In addition, the team is already considering creating a new token economic regulation mechanism to achieve deflation of PRIME tokens and thus increase value accumulation, which makes me believe that the downside of the game token has been effectively controlled at this stage.

Finally, I would like to state that none of the above constitutes financial advice, and I am not responsible if there are errors in any of the above calculations.

You May Also Like

The Channel Factories We’ve Been Waiting For

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”