KindlyMD Shares Plunge 55% After CEO David Bailey Urges Short-Term Traders To Sell

Shares in the healthcare-turned-Bitcoin treasury company KindlyMD plummeted over 55% after CEO David Bailey urged short-term traders to sell if they are only looking for quick profits.

“For those shareholders who have come looking for a trade, I encourage you to exit,” Bailey wrote in a letter to shareholders. ”We view this moment as a critical opportunity for us to establish our base of aligned shareholders who are committed to our long-term vision.”

KindlyMD share price (Source: Google Finance)

That steep drop has taken the company’s share price plunge to more than 89% in the past month, its lowest since February. Trading volumes have spiked to a record high.

KindlyMD Wants Shareholders That Are Aligned With Long-Term Vision

Since the inception of KindlyMD’s Bitcoin strategy, the company has raised $742 million, established a 5,700-plus token BTC treasury, “built a seasoned leadership team,” and launched a $5 billion at-the market (ATM) program “in partnership with eight leading financial institutions,” Bailey said in the shareholders letter.

KindlyMD has also closed its first investment in a Dutch BTC treasury company called Treasury, committed to a $30 million investment into Japan-based BTC treasury firm Metaplanet, and secured an option to acquire Bitcoin Magazine owner BTC Inc.

“The foundation we build over the next few weeks and months will propel our strategy forward, for those that want to be part of it,” Bailey wrote. “This transition may represent a point of uncertainty for investors, and we look forward to emerging on the other side with alignment and conviction amongst our backers.”

Bailey Believes In Bitcoin’s Long-Term Strength

KindlyMD’s share price woes started around the same time the Nasdaq-listed company merged with Nakamoto Holdings to create a Bitcoin-native holding company.

Following the merger, KindlyMD remains the public parent company and still trades under the ticker “NAKA,” but Nakamoto has become a wholly-owned subsidiary that will operate the Bitcoin treasury business under the Nakamoto brand.

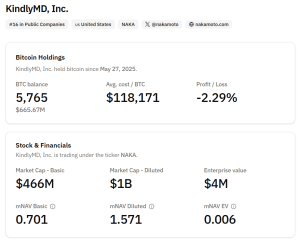

KindlyMD is currently ranked as the 16th-largest corporate holder of Bitcoin globally, with 5,765 BTC on its balance sheet, data from Bitcoin Treasuries shows.

Overview of KindlyMD’s BTC holdings (Source: Bitcoin Treasuries)

In recent weeks, the Bitcoin treasury space has come under pressure as premiums for these companies continue to compress. This is something that Bailey pointed to in his letter to shareholders, and added that he is determined to endure the current bearish landscape.

“After more than 13 years of building through Bitcoin’s cycles, including four bear markets with 70%+ drawdowns, we know resilience and discipline separate those who endure from those who fade,” he said.

“We believe in Bitcoin’s long-term strength as the global reserve asset, and we believe that its growth trajectory through public markets is inevitable for global adoption,” he added.

Bailey added that “Bitcoin has moved firmly into the mainstream of finance.”

“What was once dismissed as a fringe experiment has become a trillion-dollar asset, held by institutions, sovereigns, public companies, and millions of individuals worldwide,” he wrote.

The KindlyMD CEO also predicted that every class of investors across every major capital market “will recognize the need for exposure.”

Over the past week, Bitcoin has climbed 2%, according to CoinMarketCap, after a minor uptick in the last 24 hours.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Qatar wealth fund commits $25bn to Goldman investments