PayPal Adds Crypto To P2P: Bitcoin, Ethereum, & More Coming Soon

PayPal has announced crypto integration for its P2P system, adding support for Bitcoin and more alongside a new feature called PayPal Links.

PayPal To Allow Users To Transfer Crypto With Personalized Payment Links

According to a press release, PayPal has expanded its peer-to-peer (P2P) offerings to include cryptocurrencies. US users will soon be able to send and receive these tokens directly within the app, transferring not only to PayPal and Venmo, but also to other digital asset wallets. Bitcoin, Ethereum, and PYUSD are in the list of coins confirmed to be supported so far.

The news comes a couple of months after PayPal’s July announcement about adding a “Pay with Crypto” feature to help merchants accept digital asset payments in a convenient manner. This new integration into the P2P system would now allow everyday users to seamlessly transfer cryptocurrencies to friends and family.

The digital asset integration isn’t the only new feature that PayPal has revealed. Starting today, users in the US can start creating personalized payment links via “PayPal Links.” These are one-time links that users can share with others to send and receive money.

“For 25 years, PayPal has revolutionized how money moves between people. Now, we’re taking the next major step,” said Diego Scotti, General Manager, Consumer Group at PayPal. “Whether you’re texting, messaging, or emailing, now your money follows your conversations.”

According to the payments processor giant, P2P and other consumer payments saw solid growth in the second quarter of 2025, with volume jumping 10% year-over-year.

The company’s latest P2P expansion ties into its greater “PayPal World” initiative, a global platform that connects digital payments systems and wallets from around the world. PayPal World is expected to launch in late 2025, but for now, no specific timeline is known for when Bitcoin and other cryptocurrencies will become available in the P2P system.

PayPal has also reassured users on the tax side of P2P transfers, noting, “as always, friends-and-family transfers through Venmo and PayPal are exempt from 1099-K reporting. Users won’t receive tax forms for gifts, reimbursements, or splitting expenses, helping ensure that personal payments stay personal.”

Bitcoin Has Stalled In Its Recovery Surge

Bitcoin has steadily made its way up since the bottom at the start of the month, but over the last few days, the coin has taken to sideways movement as its price is still trading around $115,400.

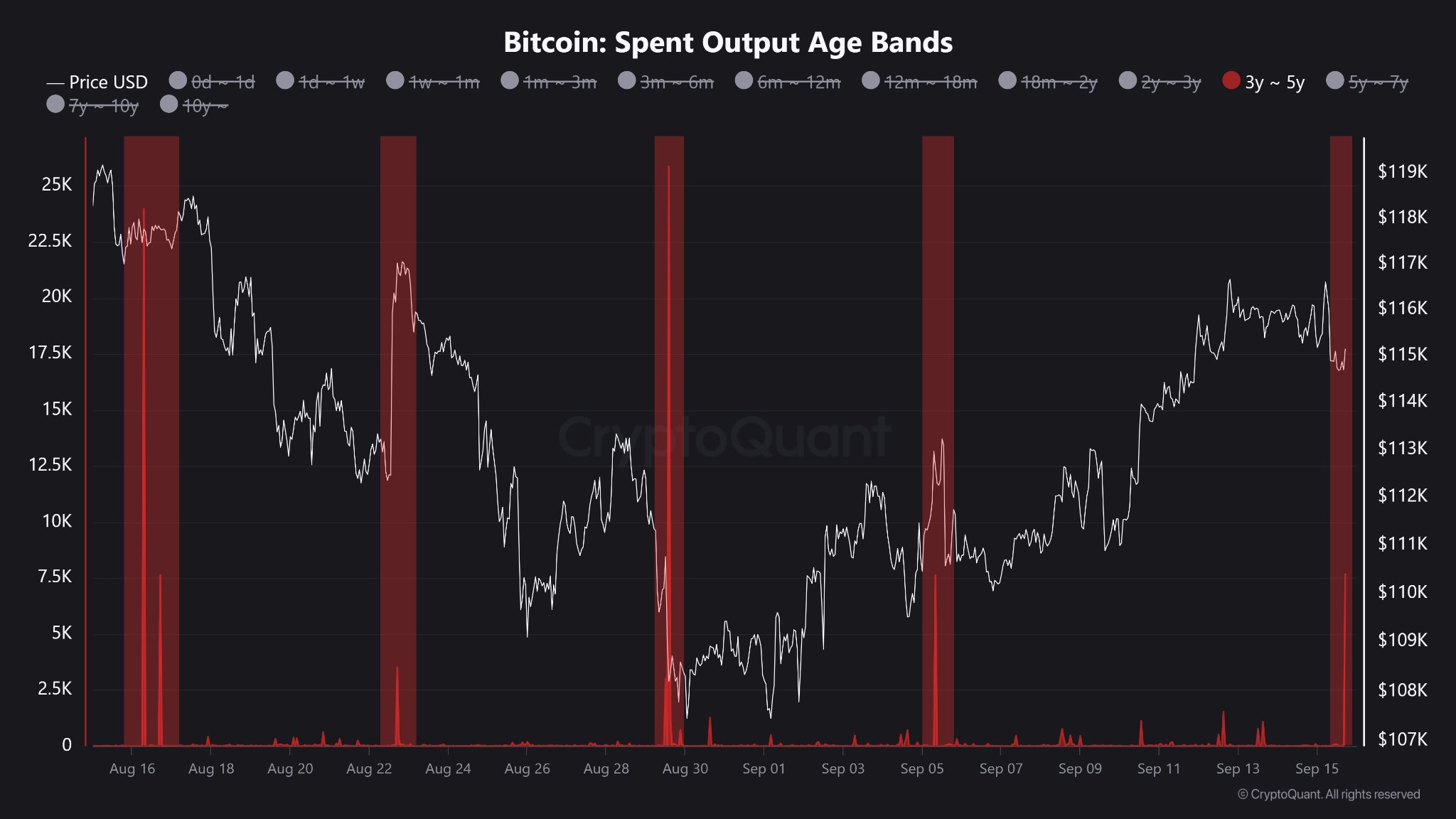

Below is a chart that shows how the price action has looked for the cryptocurrency over the past month.

The sideways movement may be about to break, however, if the pattern related to dormant transactions is anything to go by. In a post on X, CryptoQuant community analyst Maartunn has pointed out how BTC has just seen a large movement of coins aged between 3 to 5 years old.

In the chart, Maartunn has identified an interesting pattern. “Notice how this metric aligns with the sharp price reactions in recent times,” explains the analyst. Given that another such movement of dormant coins has surfaced, it’s possible that Bitcoin may be due some volatility.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Ethereum Name Service price prediction 2026-2032: Is ENS a good investment?