Trump Sues New York Times for $15 Billion Over Meme Coin Damage Claims

TLDR

- President Trump filed a $15 billion defamation lawsuit against The New York Times, claiming their 2024 reporting damaged his meme coin project and other business interests

- The lawsuit targets four Times reporters and alleges their articles and book harmed Trump’s brand value and business reputation

- Trump’s TRUMP meme coin launched in January 2025, hit a $73 billion valuation, then crashed 88% to $8.6 billion

- The suit claims Times coverage was timed to hurt Trump Media & Technology Group stock and his 2024 campaign

- The New York Times called the lawsuit “without merit” and said it won’t be deterred by intimidation tactics

President Donald Trump filed a federal defamation lawsuit Monday against The New York Times for $15 billion. The suit claims the newspaper’s 2024 reporting damaged his meme coin project and other business ventures.

The lawsuit targets four Times reporters and Penguin Random House. It alleges they published false information that harmed Trump’s business reputation. The suit was filed in U.S. District Court for the Middle District of Florida.

The named reporters are Susanne Craig, Russ Buettner, Peter Baker and Michael S. Schmidt. Craig and Buettner wrote a book called “Lucky Loser: How Donald Trump Squandered His Father’s Fortune and Created the Illusion of Success.”

Trump claims the Times articles and book caused “enormous” economic losses. The suit says these publications damaged his brand value and business interests. The lawsuit specifically mentions harm to his Solana meme coin project’s reputation.

The articles and book were all published in fall 2024. Trump launched his TRUMP meme coin in January 2025, just days before his inauguration. This timeline shows the reporting came months before the token’s creation.

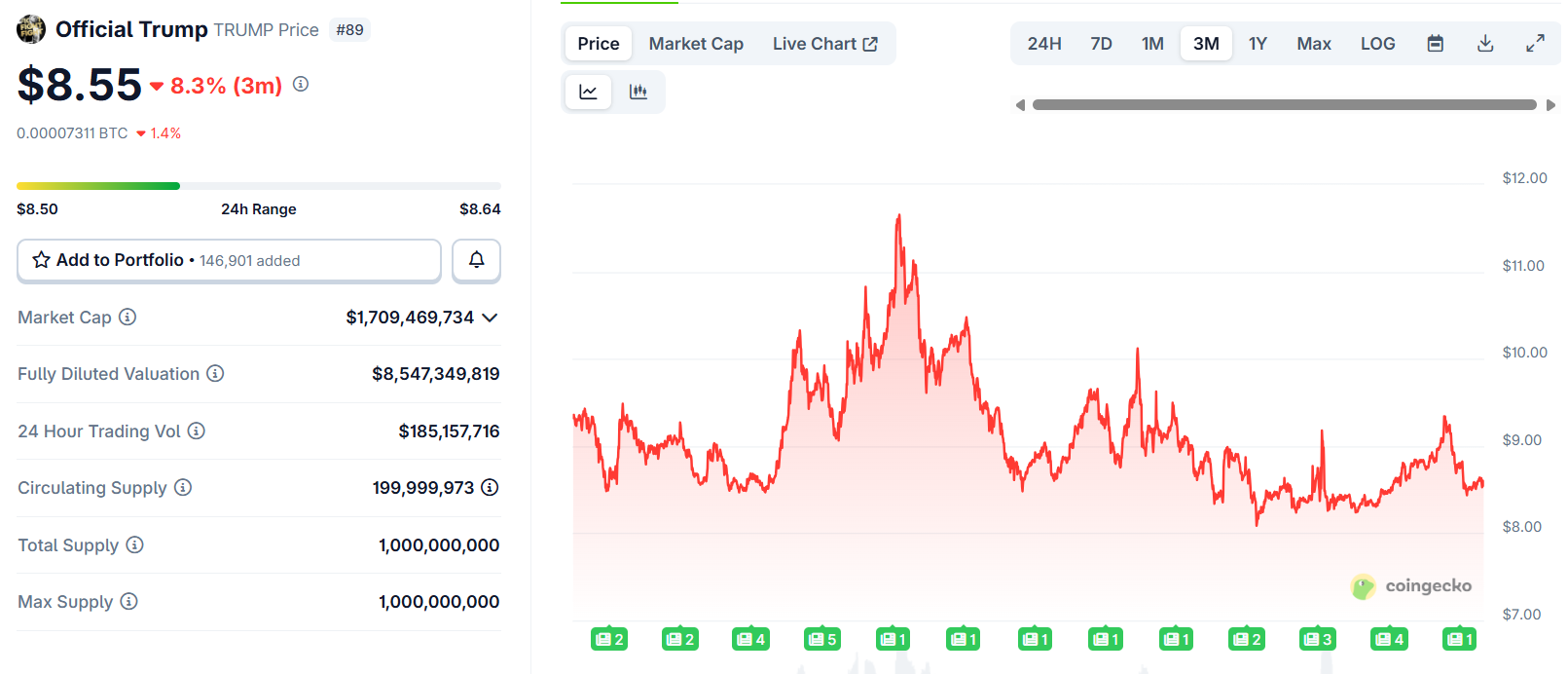

The TRUMP token initially soared after launch. It reached a fully diluted valuation over $73 billion shortly after going live. The token has since lost most of its value.

Crypto Ventures Boost Trump Wealth

The meme coin has crashed 88% from its peak. It now sits at an $8.6 billion valuation as of the lawsuit filing. Despite this drop, Trump’s crypto ventures have increased his wealth.

TRUMP Price

TRUMP Price

Trump and his family saw their net worth rise by $6 billion earlier this month. This increase came when trading launched for WLFI, the governance token for World Liberty Financial. WLFI is the Trump family’s crypto platform.

The lawsuit claims the Times tried to sink Trump’s 2024 campaign. It also alleges the newspaper attempted to prejudice judges and juries against him. The suit says the Times became a “full-throated mouthpiece for the Democrat Party.”

The lawsuit points to a Times editorial endorsing Kamala Harris. It also references three long-form articles that challenged Trump’s business success narratives. These pieces analyzed past scandals and examined his character.

Times Responds to Legal Challenge

The suit alleges the book’s publication was timed with “The Apprentice” movie trailer. This movie covers Trump’s rise in the 1980s. The lawsuit claims these events together caused Trump Media & Technology Group stock to drop.

Trump Media & Technology Group runs his Truth Social platform. The company is majority-owned by Trump and has invested heavily in crypto recently. The lawsuit does not mention World Liberty Financial as an affected business.

The New York Times responded to the lawsuit Tuesday. A spokesperson called the suit “without merit” and lacking legitimate legal claims. They said it was an attempt to stifle independent reporting.

The Times said they would not be deterred by intimidation tactics. They pledged to continue pursuing facts and standing up for journalists’ First Amendment rights. The newspaper vowed to keep asking questions on behalf of the American people.

The lawsuit came hours after the Times published an investigation. This report linked World Liberty’s business success to a U.S.-UAE agreement about AI chips.

The post Trump Sues New York Times for $15 Billion Over Meme Coin Damage Claims appeared first on CoinCentral.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Ethereum Name Service price prediction 2026-2032: Is ENS a good investment?