Aave gears up for Aave V4 launch, bringing unified cross-chain liquidity to DeFi

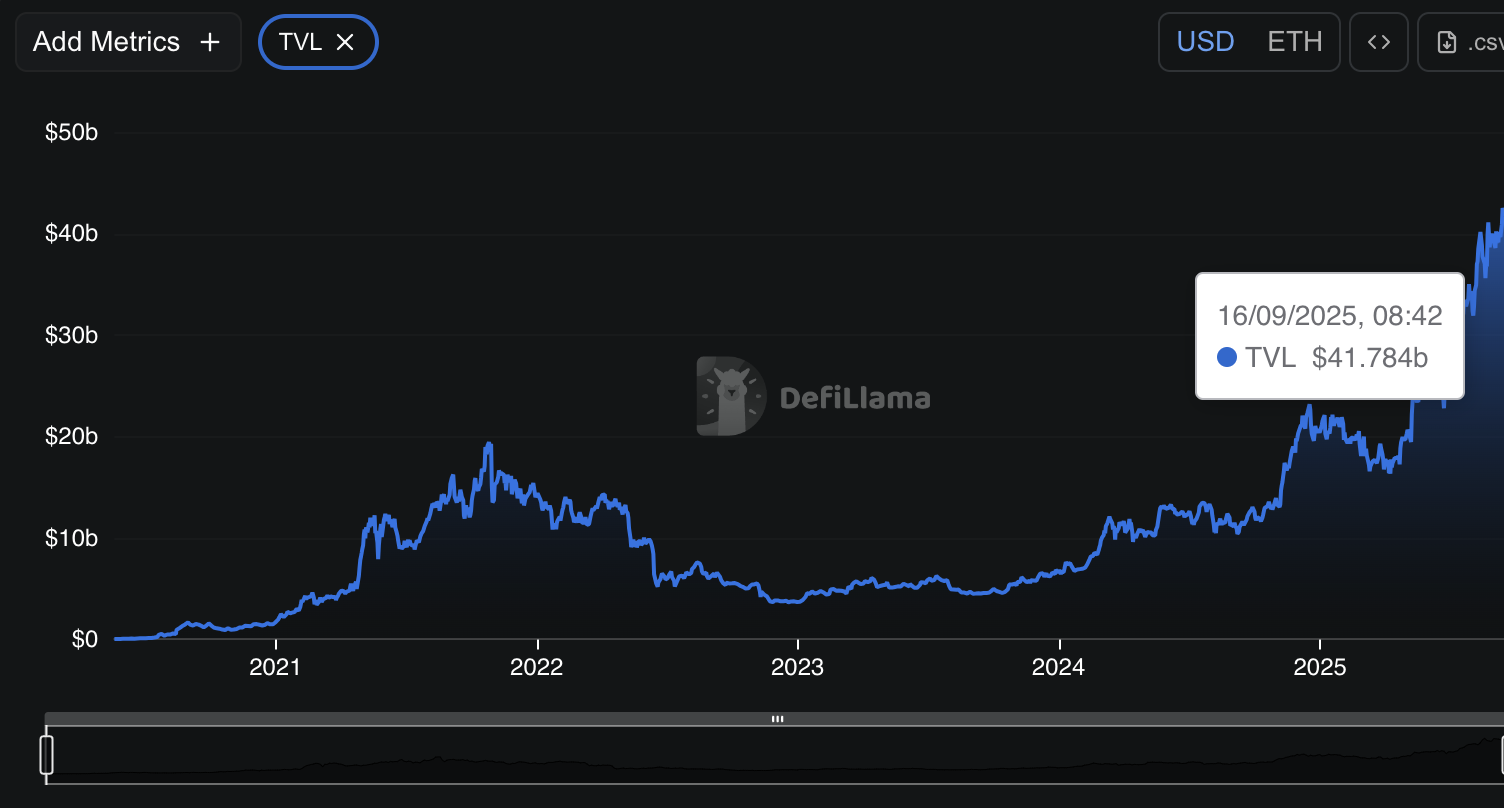

Aave V4 is set to launch in Q4 with unified cross-chain liquidity, as Aave cements its position as the market leader in DeFi lending with record-high $41.7 billion TVL.

- Aave V4 upgrades introduce the Cross-Chain Liquidity Layer, enabling users to borrow and collateralize across both EVM and non-EVM chains.

- Aave now holds nearly half of the sector’s total liquidity, with V4 expected to further accelerate growth by unlocking cross-chain capital efficiency and broader liquidity access.

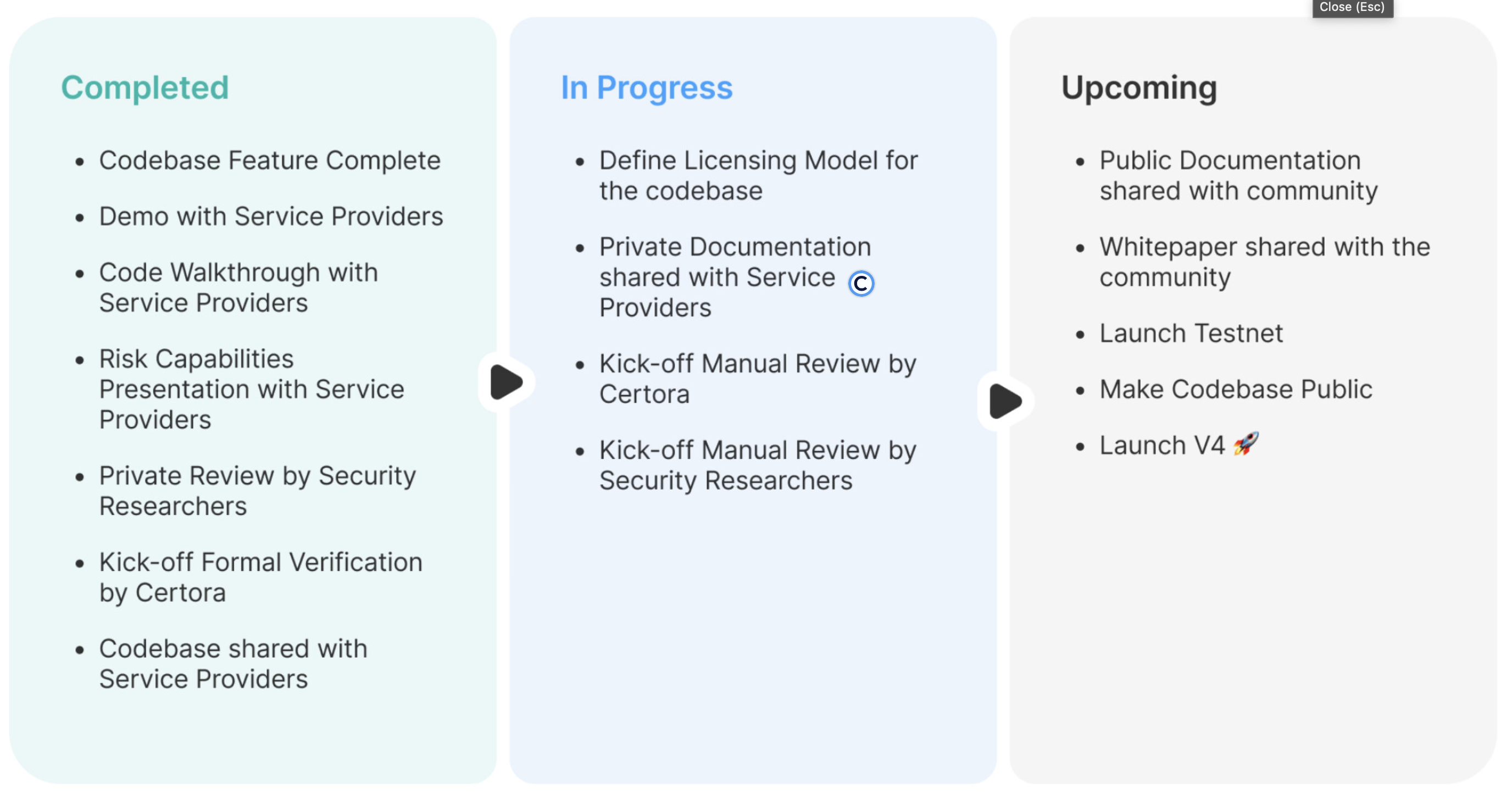

Aave Labs (AAVE) has published the official launch roadmap for Aave V4, outlining completed milestones and upcoming stages as V4 undergoes final review, testing, and deployment, with the launch slated for Q4 this year.

Aave V4 introduces several major upgrades over its predecessor Aave V3. Central to the update is the Cross-Chain Liquidity Layer (CCLL), which aggregates liquidity across multiple blockchains, enabling users to collateralize assets on one chain and seamlessly borrow on another. The layer leverages Chainlink’s Cross-Chain Interoperability Protocol to facilitate these cross-chain transactions and expands support to both EVM and non-EVM chains, such as Aptos.

Ahead of the full launch, Aave Labs will release public documentation, a testnet with a new user interface, and a public codebase, enabling the community and service providers to trial V4 workflows.

Aave V4: scaling DeFi lending with market leadership

Aave V4 builds on the success of V3 by enhancing scalability, flexibility, and cross-chain functionality while maintaining the protocol’s security and efficiency. By enabling broader liquidity access and a more modular design, V4 positions Aave to capture greater market share in lending and borrowing across multiple chains.

As of September, Aave remains the clear market leader in DeFi lending, with over $41.7 billion TVL—nearly half of the sector’s $84.1 billion TVL—its highest level to date, according to DeFiLlama data.

You May Also Like

Thyroid Eye Disease (TED) Treatments Market Nears $4.3 Billion by 2032: Emerging Small Molecule Therapies Targeting Orbital Fibroblasts Drive Revenue Growth – ResearchAndMarkets.com

Virtus Equity & Convertible Income Fund Announces Special Year-End Distribution and Discloses Sources of Distribution – Section 19(a) Notice