Amdax Unveils Euronext-Bound Bitcoin Treasury Targeting 1% Supply – Europe’s MicroStrategy?

Amsterdam-based crypto service provider Amdax has announced the launch of AMBTS B.V., a new Bitcoin treasury company with ambitions to become one of the largest institutional holders of Bitcoin in Europe.

The firm is preparing to list AMBTS on Euronext Amsterdam, with the bold long-term goal of accumulating 1% of Bitcoin’s total supply, a milestone that would firmly place it among the largest global corporate holders of Bitcoin.

Amdax Says Europe Needs Its Own Bitcoin Treasury Giant to Compete Globally

The move comes at a time of rising demand for Bitcoin amid persistent inflation, geopolitical instability, and increasing regulatory clarity in Europe. With institutional investors searching for assets that offer diversification and a hedge against macroeconomic risks, Bitcoin has emerged as a favored option due to its low correlation with traditional markets.

Amdax believes Europe must strengthen its own digital asset infrastructure if it wants to compete with the United States and Asia, where corporate adoption of Bitcoin has already reached large scale.

Amdax, founded in 2019, has built a reputation as one of the Netherlands’ most regulated and compliant crypto service providers. It became the first company to register with the Dutch Central Bank in 2020 and was among the earliest firms to receive approval under Europe’s new Markets in Crypto-Assets Regulation (MiCA) framework.

The company also completed independent ISAE 3000 audits, showing its focus on governance and risk management. Chief executive Lucas Wensing said the timing is right for Europe to see its own version of a corporate Bitcoin giant.

“With now more than 10% of supply held by corporations, governments, and institutions, we believe the time has come to establish a Bitcoin treasury company in Europe. A listing on Euronext will provide institutional investors here with new, regulated instruments to gain exposure,” Wensing said.

AMBTS will operate as a stand-alone company, with independent governance but strong connections to Amdax’s infrastructure and expertise.

The new treasury is in the advanced stages of preparing for an initial public offering on Euronext Amsterdam and will first raise capital through a private financing round. Proceeds from that round are expected to be deployed directly into Bitcoin accumulation, marking the first step in its treasury strategy.

Over time, the company plans to leverage capital markets to expand its holdings in multiple phases, seeking to grow BTC per share for its investors while building toward the 1% supply target.

The benchmark for such ambitions remains MicroStrategy, the U.S.-based software firm that has become synonymous with corporate Bitcoin adoption.

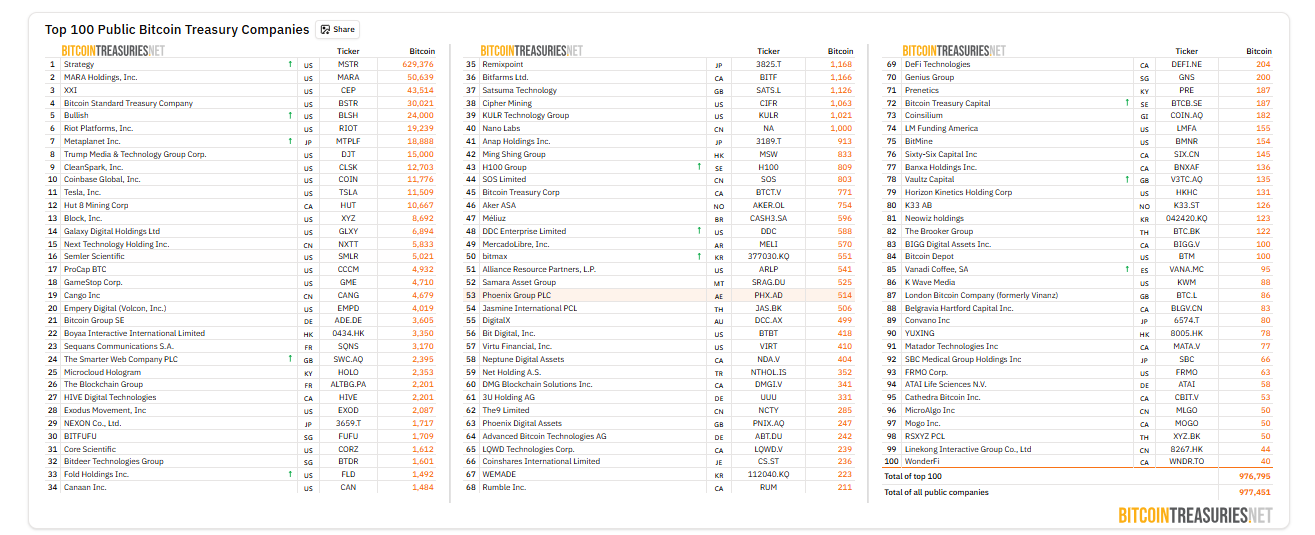

According to BitcoinTreasuries.net, MicroStrategy currently holds 629,376 BTC, making it by far the largest public holder of the asset. In total, public companies now control around 977,000 BTC across 100 firms, a number that has grown by nearly 14% in the past month alone.

Source: BitcoinTreasuries.net

Source: BitcoinTreasuries.net

Other corporate holders include Marathon Holdings with over 50,000 BTC, Germany’s Bitcoin Standard Treasury Company with 30,000 BTC, and Japan’s Metaplanet with nearly 19,000 BTC. Tesla continues to retain close to 10,000 BTC.

Collectively, entities ranging from corporations to governments now hold about 3.67 million BTC globally. Meanwhile, U.S. Treasury Secretary Scott Bessent confirmed the government will not be buying Bitcoin for its Strategic Reserve.

Speaking with Fox News on Aug. 14, Bessent said the reserve will be funded only through seized assets, not market purchases. “We’re not going to be buying that, but we are going to use confiscated assets and continue to build that up,” he said, estimating the reserve’s current value at $15–20 billion.

The clarification dampened hopes among Bitcoin advocates who expected fresh U.S. government demand.

Bitcoin Slides Below $116K as $500M in Longs Wiped Out—But Bulls Eye Higher Targets

The crypto market stumbled at the start of the week, with Bitcoin falling more than 2% to $115,255 after touching a fresh all-time high above $124,000 last week.

At its lowest point, the flagship cryptocurrency briefly dipped to $114,706, as over $500 million in leveraged long positions were liquidated across the market.

According to data from CryptoNews, Bitcoin has dropped 2.5% in the past 24 hours and 3.6% over the past week, though it remains up 25% year-to-date, second only to gold’s 29% gain among major asset classes.

Analyst Charlie Bilello noted that this is the first time Bitcoin and gold have taken the top two spots in his annual asset rankings. Despite the recent volatility, Bitcoin has delivered an extraordinary 38.9 million percent total return since 2011, dwarfing gold’s 126% over the same period.

Still, signs of weakening momentum are emerging. Glassnode data shows the number of whale addresses holding over 10,000 BTC has fallen to its lowest level this year, while wallets holding 1,000–10,000 BTC are also declining, pointing to profit-taking at recent highs.

Technical indicators suggest Bitcoin could consolidate between $112,000 and $120,000 through Q3, with some traders warning of a potential dip below $112,000.

Well-followed trader “Cyclop” suggested Bitcoin may repeat its early 2025 pattern, when a 32% pullback formed a rounded base before fueling the rally past $120,000.

His charts point to a possible retracement toward $90,000–95,000 before another move higher, echoing Strategy Chair Michael Saylor’s view that “volatility is a gift to the faithful.”

Despite short-term turbulence, long-term bulls argue Bitcoin’s scarcity and institutional adoption will continue driving higher highs, with some analysts eyeing a push toward $130,000 once new liquidity returns.

You May Also Like

Unprecedented Surge: Gold Price Hits Astounding New Record High

Ripple CTO Explains How The XRP Ledger ‘Will Take Over The World’