Billionaire Michael Saylor Buys 155 More Bitcoin – Here’s Why it Matters

Strategy (formerly MicroStrategy), led by executive chairman and co-founder Michael Saylor, has once again expanded its already massive Bitcoin holdings.

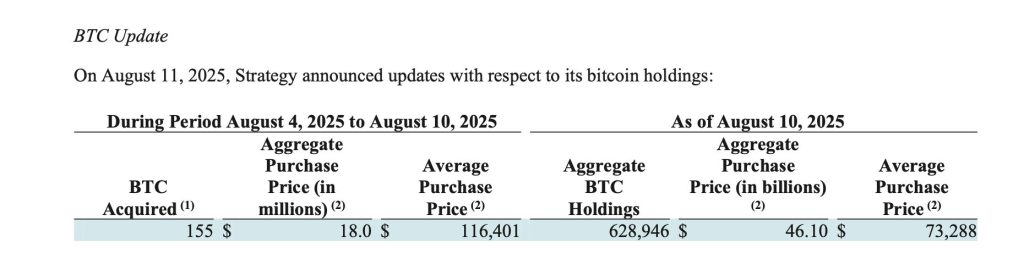

In a filing dated August 11, 2025, the company revealed it had purchased an additional 155 BTC between August 4 and August 10, 2025. The acquisition cost approximately $18 million, with an average purchase price of about $116,401 per Bitcoin.

This latest acquisition shows the company’s continued conviction in Bitcoin as a long-term store of value, even at elevated market prices. Strategy has been one of the most aggressive corporate buyers of Bitcoin since it began its accumulation strategy in 2020.

A Record-Breaking Bitcoin Balance Sheet

Following this latest purchase, Strategy’s total Bitcoin holdings now stand at 628,946 BTC. The company’s cumulative investment in Bitcoin amounts to roughly $46.10 billion, translating to an average purchase price of $73,288 per bitcoin.

These figures cement Strategy’s position as the largest publicly traded corporate holder of Bitcoin by a wide margin. The company’s Bitcoin yield for the year-to-date in 2025 is an impressive 25%, reflecting strong gains in the asset’s market value this year.

Why This Acquisition Stands Out

The timing of this acquisition stands out, as Bitcoin prices have surged in 2025, driven by institutional adoption, increased integration into traditional financial markets, and macroeconomic factors such as persistent inflation and currency debasement fears. Buying at over $116,000 per Bitcoin shows Strategy’s confidence in further upside potential.

Saylor has repeatedly stated that Bitcoin represents “digital gold” and a superior form of money. His strategy has been to convert a large portion of Strategy’s balance sheet into Bitcoin, financing some purchases through debt and equity offerings. This latest move suggests that Saylor sees continued strength in the market, despite already substantial gains this year.

Market Implications and Investor Reactions

Strategy’s Bitcoin accumulation has made its stock a proxy for Bitcoin exposure among traditional equity investors. Following previous purchase announcements, MSTR shares have often mirrored Bitcoin’s price movements, rising as sentiment around the cryptocurrency improves.

Investors and analysts will be watching closely to see how this additional purchase affects both the company’s market valuation and its future financial results. With over $46 billion in Bitcoin on its books, Strategy’s fortunes are increasingly tied to the performance of the world’s largest cryptocurrency.

You May Also Like

Trust Wallet’s Decisive Move: Full Compensation for $7M Hack Victims

Cashing In On University Patents Means Giving Up On Our Innovation Future