Bitcoin (BTC) Price Prediction: Bitcoin Poised for $150K as Halving Cycle and US Government Shutdown Drive Rally

The rally has been supported by growing interest in Bitcoin-linked ETFs and macro-driven buying amid political uncertainty in Washington. Analysts say the price of Bitcoin today reflects its increasing role as a hedge against inflation and traditional market instability, attracting both retail and institutional investors.

Bitcoin Hits New Milestones Amid Macro Factors

Bitcoin (BTC) has surged past $125,000, marking fresh all-time highs as investors react to macroeconomic developments and growing institutional inflows. The rally has been supported by Bitcoin-linked ETFs and safe-haven buying amid the ongoing US government shutdown. Market watchers see this as a sign of BTC’s increasing role as a hedge against traditional financial uncertainty.

BTC jumps nearly 10% amid the US government shutdown, proving sometimes the worst events bring the best pump. Source: @TedPillows via X

“Sometimes the worst events bring the best pump,” said crypto analyst Ted Pillows, referencing Bitcoin’s nearly 10% surge since October 1, 2025, following congressional failure to pass federal funding bills. The government shutdown, rather than hurting Bitcoin, triggered expectations of Federal Reserve policy easing, weakening the dollar and boosting the price of Bitcoin.

Halving Cycle Spurs Long-Term Optimism

Bitcoin’s strong performance also aligns with its historic four-year halving cycle, which reduces mining rewards and historically precedes bull runs. IBCIG noted, “The pattern hasn’t changed, just the price. 2013 → 2017 → 2021 → 2025. Halving. Rally. New highs.” This cyclical behavior has guided long-term Bitcoin price predictions, suggesting substantial upside potential.

Bitcoin follows its historic halving pattern—rallying toward $150K, proving history may repeat itself. Source: @ibcig via X

Past cycles highlight this trend: after the 2012 halving, BTC rose to ~$1,150; after 2016, it peaked at ~$20,000; and post-2020, it reached ~$69,000. The 2024 halving has already pushed BTC from roughly $30,000 to $122,000, a +307% gain, indicating early momentum that could propel Bitcoin toward $150K if historical patterns and market conditions persist.

Institutional Inflows Drive the Rally

This rally differs from previous retail-driven booms because institutional investors are taking the lead. Spot Bitcoin ETFs have seen $35 billion in inflows this year, with projections reaching $50 billion by mid-2025. Heavy allocations in funds like BlackRock’s iShares Bitcoin Trust (IBIT) and ARK 21Shares Bitcoin ETF (ARKB), including single-day inflows above $1.17 billion, demonstrate large-scale participation in BTC.

Institutional capital is amplifying the impact of traditional market uncertainty, providing stability to Bitcoin prices even during brief corrections. Analysts highlight that these inflows, coupled with ETF accessibility, have shifted Bitcoin from a speculative asset to a mainstream financial instrument.

Technical Analysis: Trend Holds Firm

Even when there was a short-term correction later after some above-estimate US inflation readings, Bitcoin recovered lost ground shortly above $124K. Technical levels such as the 20-week simple moving average (SMA) held up well with firm support levels. Momentum indicators such as the stochastic oscillator suggest new buying pressure, and the uptrend is likely to continue.

BTC forms a perfect descending triangle above a strong demand zone, signaling a potential volatility spike. Source: @Karman_1s via X

Bitcoin is anticipated to probe $130K in the near future with potential to reach $150K by later in 2025. The intersection of technical support, cycle consistency history, and institutional backing powers a strong basis for BTC price projections throughout the year.

Looking Ahead: Bitcoin Aims at $150K

Bitcoin’s latest boom is looking to the cumulative effect of halving cycles, macroeconomic volatility, and institutional investment. Analysts are optimistic, valuing Bitcoin at potentially testing $130K in the short term while maintaining a long-term valuation of $150K for 2025.

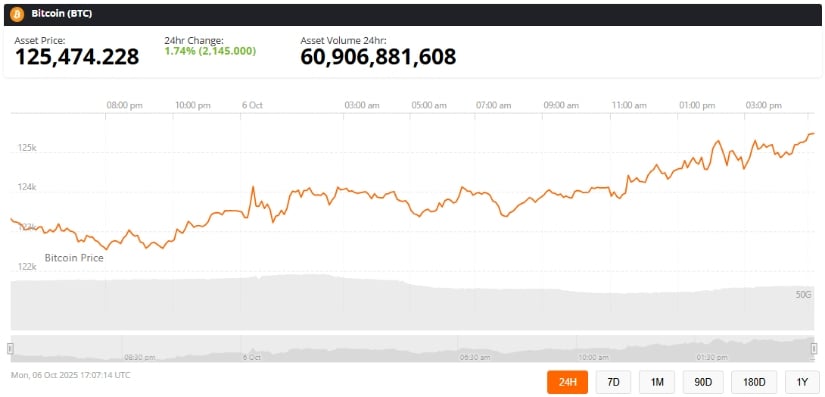

Bitcoin (BTC) was trading at around $125,474, up 1.74% in the last 24 hours at press time. Source: Bitcoin Price via Brave New Coin

Backed by solid technical foundations, all-time high ETF inflows, and previous cycles overlapping, Bitcoin is far from disappearing from the global arena. As BTC holds firm despite political and economic turmoil, its path to new all-time highs grows more believable.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

The best IPO stocks to watch in 2026