Bitcoin SOPR Shows Market Nearing Post-Correction Levels

Bitcoin is once again testing investor conviction as it fights to stay above the $110,000 level following last Friday’s sharp correction that triggered a massive leverage wipeout across the market. After one of the most volatile sessions of the quarter, traders are watching closely to see whether BTC can stabilize or if more downside pressure will emerge.

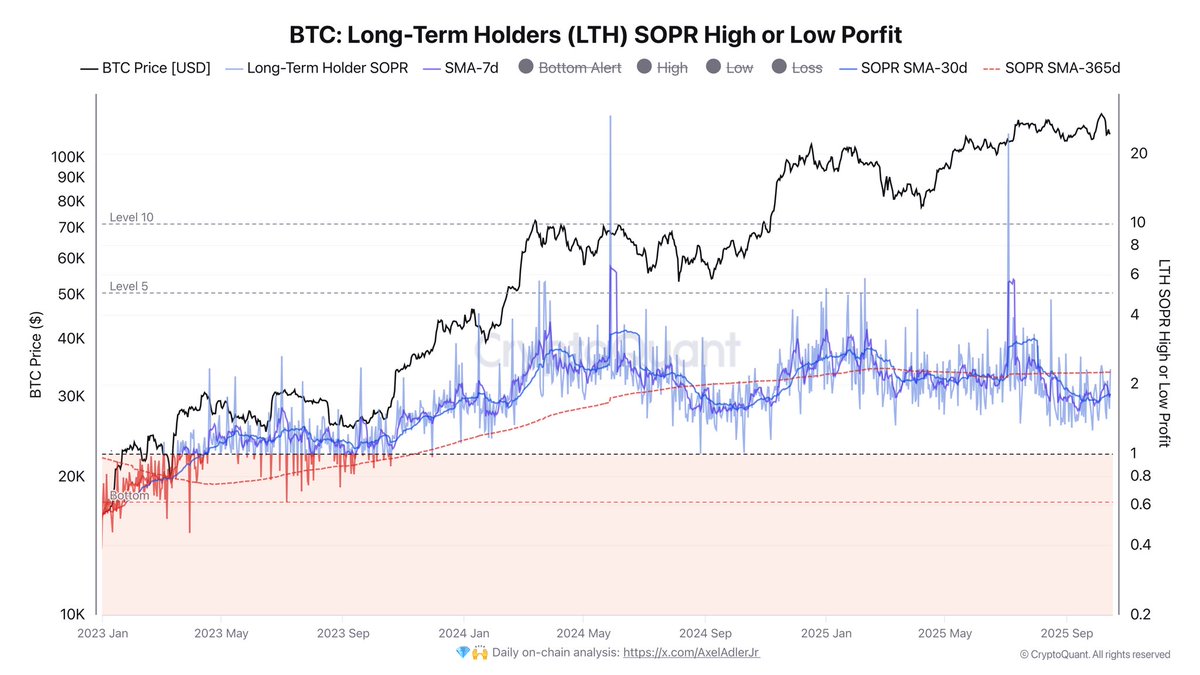

According to on-chain data shared by Darkfost, Long-Term Holders (LTHs) are continuing to exert significant pressure on the market. Their Spent Output Profit Ratio (SOPR) — a key metric tracking realized profits — currently stands at 2.32, showing that this group is selling coins at an average gain of over 130%.

Such elevated profitability levels often coincide with phases where long-term investors take profits after extended rallies, contributing to selling pressure and short-term weakness. Despite this, Bitcoin’s ability to defend its current range suggests underlying demand remains resilient.

Long-Term Holders Still Taking Profits, But Signs of Exhaustion Emerge

Analyst Darkfost points out that while the Long-Term Holders’ (LTH) SOPR currently sits at 2.32, the shorter-term averages are starting to soften. The weekly SOPR (7-day moving average) has fallen to 1.82, and the monthly SOPR (30-day) sits at 1.79, both trending downward since the summer. Although these figures remain below the annual average of 2.25, they indicate a gradual cooling of realized profits — a sign that selling pressure may be easing.

This dynamic reflects a crucial transition point for Bitcoin’s market structure. As long-term holders continue to realize profits above 1.0, they’re selling coins at a gain, effectively capping momentum and weighing on price recovery. Yet, the current decline in SOPR averages hints that this wave of profit-taking may be nearing exhaustion. Historically, such drops in realized profit levels have preceded market stabilization and, eventually, recovery phases.

Darkfost highlights that the current setup closely resembles the October 2024 correction, when Bitcoin’s SOPR bottomed near similar levels before the next major upswing. If history rhymes, the ongoing contraction in LTH profitability could signal that the worst of the correction is behind us. Still, further moderation in SOPR remains key for the market to fully reset and for sustainable upside momentum to re-emerge.

Bulls Defend $110K Zone Amid Weak Momentum

Bitcoin continues to hover around $111,500, showing signs of stabilization after last Friday’s steep sell-off. The 8-hour chart highlights a fragile recovery structure, with BTC struggling to regain key moving averages and momentum fading below the $117,500 resistance, which remains a major supply zone.

The 50-day (blue), 100-day (green), and 200-day (red) moving averages are beginning to converge — a sign of compression that typically precedes a strong directional move. For now, BTC is trading below all three, suggesting that sellers still dominate the mid-term trend. Holding above $110,000 is crucial; a decisive break below could open the door to retesting the $105,000–$106,000 range, where strong demand previously emerged.

Reclaiming $114,000–$115,000 would be the first sign of strength, potentially triggering a push toward the $117,500 barrier. However, volume remains muted, implying that traders are cautious as the market digests recent volatility.

Bitcoin’s price action points to a consolidation phase, with buyers and sellers in temporary equilibrium. If bulls can protect the $110K region and momentum rebuilds, BTC could attempt a gradual recovery, but failure to do so risks extending the correction further.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

Monero price faces downside risk as rebound volume fades at key support zone

Mind Network, in partnership with Zama, launched the first A2A privacy payment solution x402z based on fully homomorphic encryption (FHE).