Bitcoin Upward Trend Expected to Continue Through 2025: Coinbase Analysts

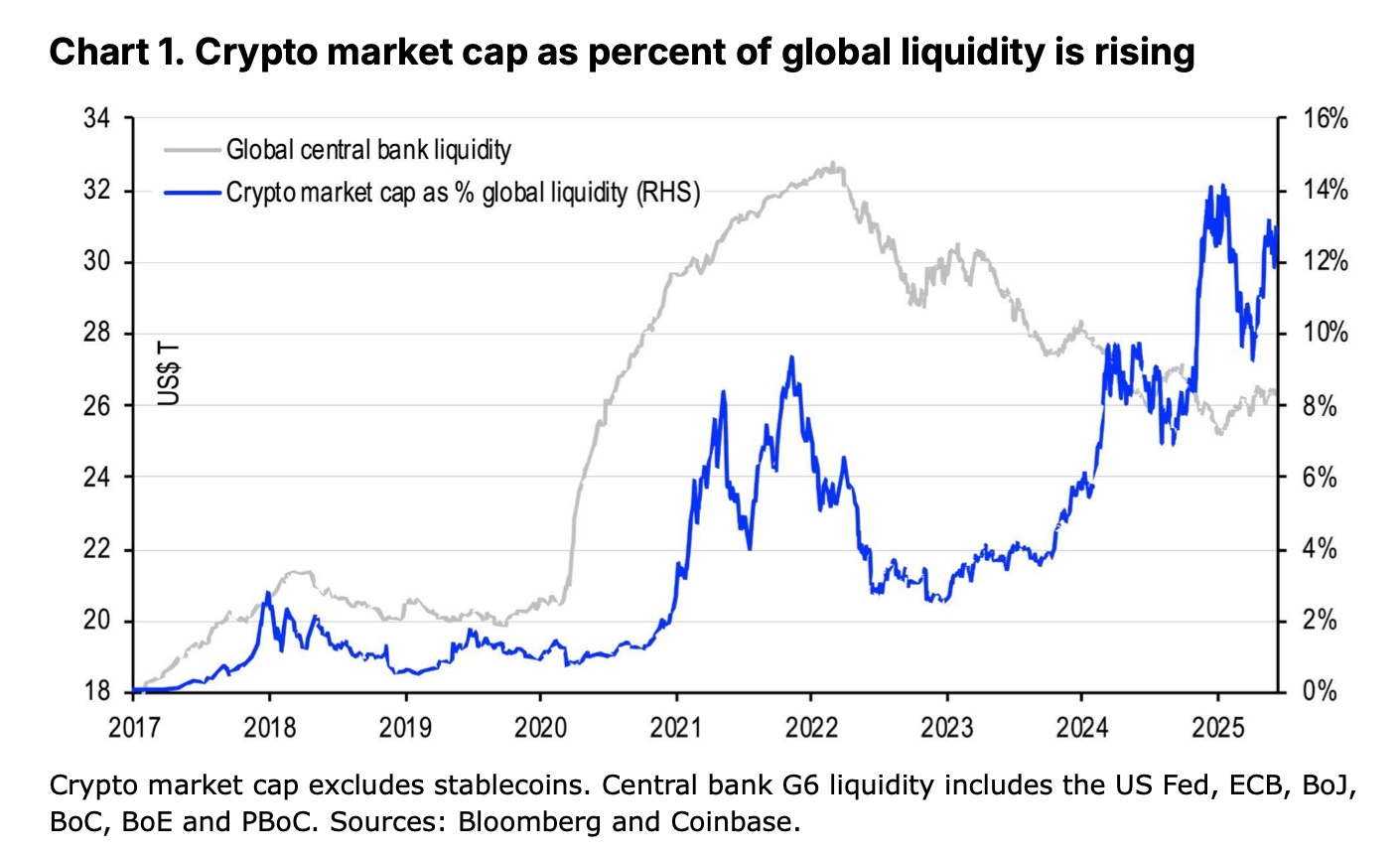

Coinbase Institutional forecasts a positive outlook for the cryptocurrency market in the second half of 2025, driven by improved economic growth, corporate adoption, and regulatory progress.

Coinbase Report Highlights Three Key Crypto Themes for Second Half 2025

Coinbase Institutional projects a constructive outlook for the cryptocurrency market in the second half of 2025. The analysis cites better-than-expected U.S. economic growth, potential Federal Reserve rate cuts, increased adoption by corporate treasuries, and progress toward U.S. regulatory clarity as key positive drivers.

Source: Coinbase Institutional Monthly Outlook.

Source: Coinbase Institutional Monthly Outlook.

Three main themes underpin this view. First, the specter of a U.S. recession has diminished significantly, with recent economic data suggesting stronger growth than anticipated. While a slowdown remains possible, Coinbase believes conditions are unlikely to cause broad asset prices to revert to 2024 lows. Second, corporate adoption of crypto, particularly bitcoin, has become a significant source of demand.

However, Coinbase notes a trend of new public companies primarily focused on accumulating crypto using leveraged funding. While boosting demand, this strategy introduces potential medium-to-long-term systemic risks related to forced or discretionary selling pressure to service debt. The firm assesses these risks as manageable in the very short term.

Third, U.S. regulatory shifts have been supportive. Stablecoin legislation, advancing through Congress with bipartisan support, holds the greatest promise for near-term enactment. A comprehensive crypto market structure bill, the CLARITY Act, was also introduced, aiming to delineate oversight between the CFTC and SEC.

Risks include potential U.S. Treasury yield curve steepening from government spending bills and the aforementioned systemic concerns from corporate crypto vehicles. Despite these risks, Coinbase expects bitcoin’s upward trend to continue, while altcoin performance may depend more on specific factors like pending ETF decisions.

You May Also Like

Thyroid Eye Disease (TED) Treatments Market Nears $4.3 Billion by 2032: Emerging Small Molecule Therapies Targeting Orbital Fibroblasts Drive Revenue Growth – ResearchAndMarkets.com

Virtus Equity & Convertible Income Fund Announces Special Year-End Distribution and Discloses Sources of Distribution – Section 19(a) Notice