Bitcoin Whale Transfers $375M to Hyperliquid, Sparks Market Speculation

A Bitcoin whale move involving 3,000 BTC sent to the decentralized exchange Hyperliquid has caught traders’ attention. The transaction raised several questions about motive and timing, as only a fraction of the Bitcoin has been sold so far. Analysts suggest this could be an early sign of shifting strategies among major holders.

Whale Activity Draws Market Attention

The whale’s 3,000 BTC transfer, worth about $373 million at current prices, was spotted by blockchain trackers earlier this week. Reports confirm that roughly $39 million of that total has already been sold while the wallet still holds more than $3.4 billion in Bitcoin.

Analysts believe this movement reflects repositioning, not panic. Whales often test liquidity on exchanges like Hyperliquid before making larger market decisions.

Also Read: Top Crypto Whale Activity: Ancient Bitcoin Wallets Move, Ethereum Sell-Offs Hit, Solana Rallies

As of early October 2025, Bitcoin trades at nearly $124,200 after recently reaching a record high of $125,245. This price surge adds context to the whale’s timing, suggesting that the move may be driven by profit-taking at peak levels.

Source: X (Formerly Twitter)

Source: X (Formerly Twitter)

What This Could Mean For Bitcoin Traders

Possible Shift Toward Ethereum And Altcoins

On-chain data shows that major investors are shifting their portfolios. One whale recently swapped over $4 billion in Bitcoin for Ethereum, sparking talk that institutions are exploring DeFi’s yield and liquidity options. If confirmed, the move looks more like a portfolio reallocation than a sell-off.

Volatility And Leverage Risks

Hyperliquid’s deep liquidity and leveraged trading environment can magnify volatility when major wallets move funds. A prior high-leverage whale trade on the platform nearly triggered a cascade of liquidations during a dip. If more Bitcoin from this address hits the market, traders could face another wave of short-term price swings.

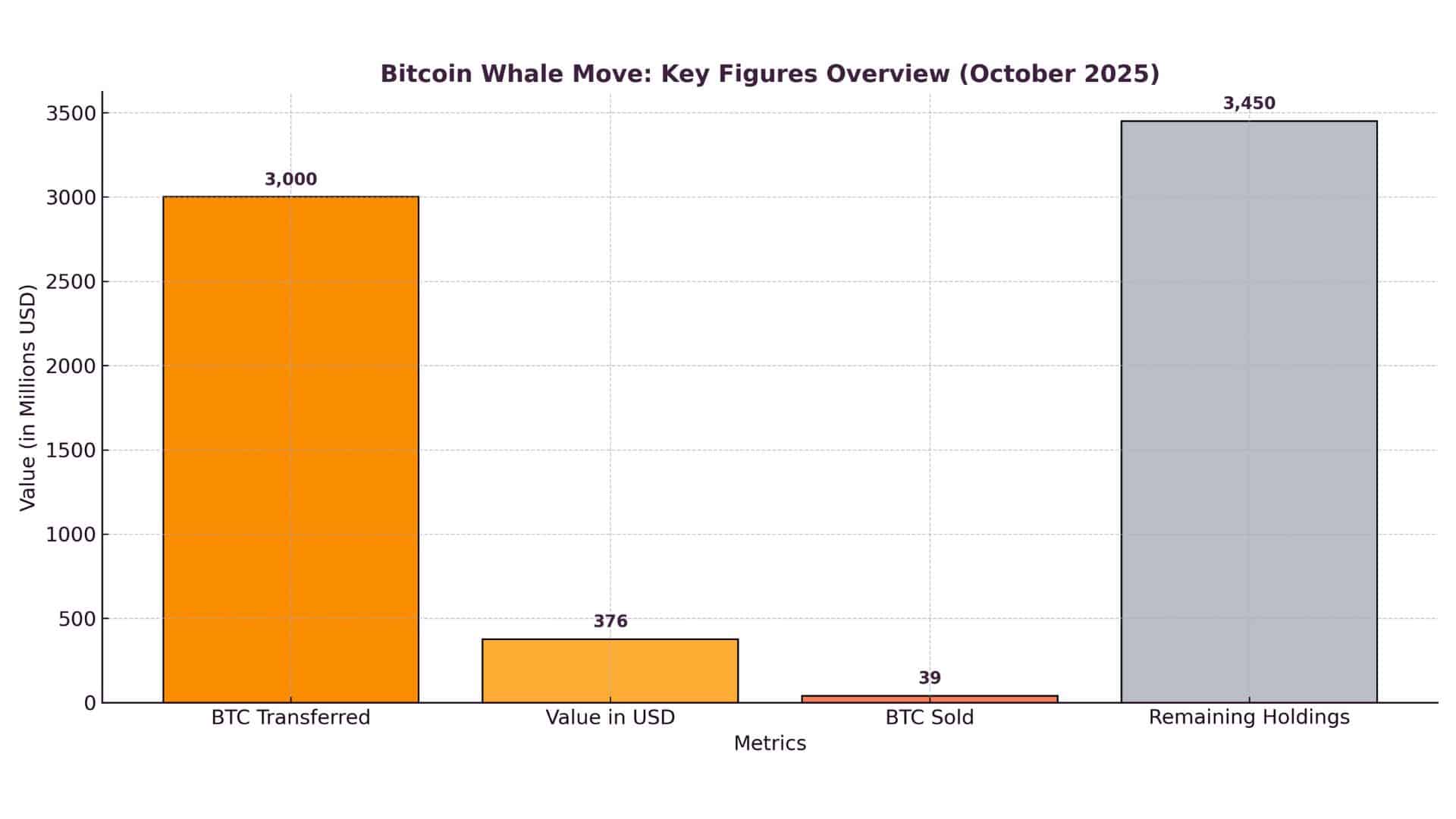

Key Figures From The Whale Move (October 2025)

| Metric | Value (Estimated) |

|---|---|

| BTC Transferred | 3,000 BTC |

| Approx. USD Value | $373 Million |

| BTC Sold / Swapped | $39 Million |

| Remaining Holdings | $3.45 Billion in BTC |

| Exchange | Hyperliquid |

Bitcoin Whale Move To Hyperliquid Shows $375M Transfer With Billions Still Held

Bitcoin Whale Move To Hyperliquid Shows $375M Transfer With Billions Still Held

How Traders Can Respond

People following the Bitcoin whale movement should observe the on-chain data for other transfers, especially if Hyperliquid receives even more Bitcoin flow. When the price is moving near the support level, we can see the selling pressure being absorbed or the market weakening further.

Conclusion

Based on the latest research, Bitcoin whale move trends often highlight quiet but significant changes in how large investors manage exposure. This 3,000 BTC transfer is more of a calculated test than a complete exit from the market.

With Bitcoin near record highs, whales are repositioning their investments while maintaining their core holdings intact. Watching future wallet movements and Hyperliquid volumes may provide early indications about where the market is headed next.

For expert insights and the latest crypto news, visit our platform.

Summary

A major Bitcoin whale transferred 3,000 BTC, worth roughly $373 million, to Hyperliquid. Only a small portion has been sold, sparking debate about intent. Analysts view it as a strategic adjustment at peak prices, rather than a complete exit, and expect further movement to shape short-term volatility.

Glossary Of Key Terms

- Whale: Investor holding large amounts of cryptocurrency.

- On-Chain Data: Blockchain-recorded activity visible to the public.

- Liquidity: How easily assets can be bought or sold.

- Leverage: Borrowed capital used to amplify trade exposure.

- Hyperliquid: A decentralized exchange known for deep liquidity.

FAQs About Bitcoin Whale Move

Q1. Why is this Bitcoin whale move important?

It reflects how large holders may be adjusting positions during record-high prices, which can guide market sentiment.

Q2. Will this trigger a price drop?

Not immediately. The scale and timing of any further sales will determine the short-term impact.

Q3. Why sell only a fraction of the holdings?

Whales often sell small portions first to test liquidity and market reaction.

Q4. How can traders use this data?

By tracking on-chain movements and market volumes to identify potential volatility early.

Read More: Bitcoin Whale Transfers $375M to Hyperliquid, Sparks Market Speculation">Bitcoin Whale Transfers $375M to Hyperliquid, Sparks Market Speculation

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

China Launches Cross-Border QR Code Payment Trial