Bitcoin’s Short-Term Whales Now Hold $10.1B in Paper Gains. Is a Cash Out Next?

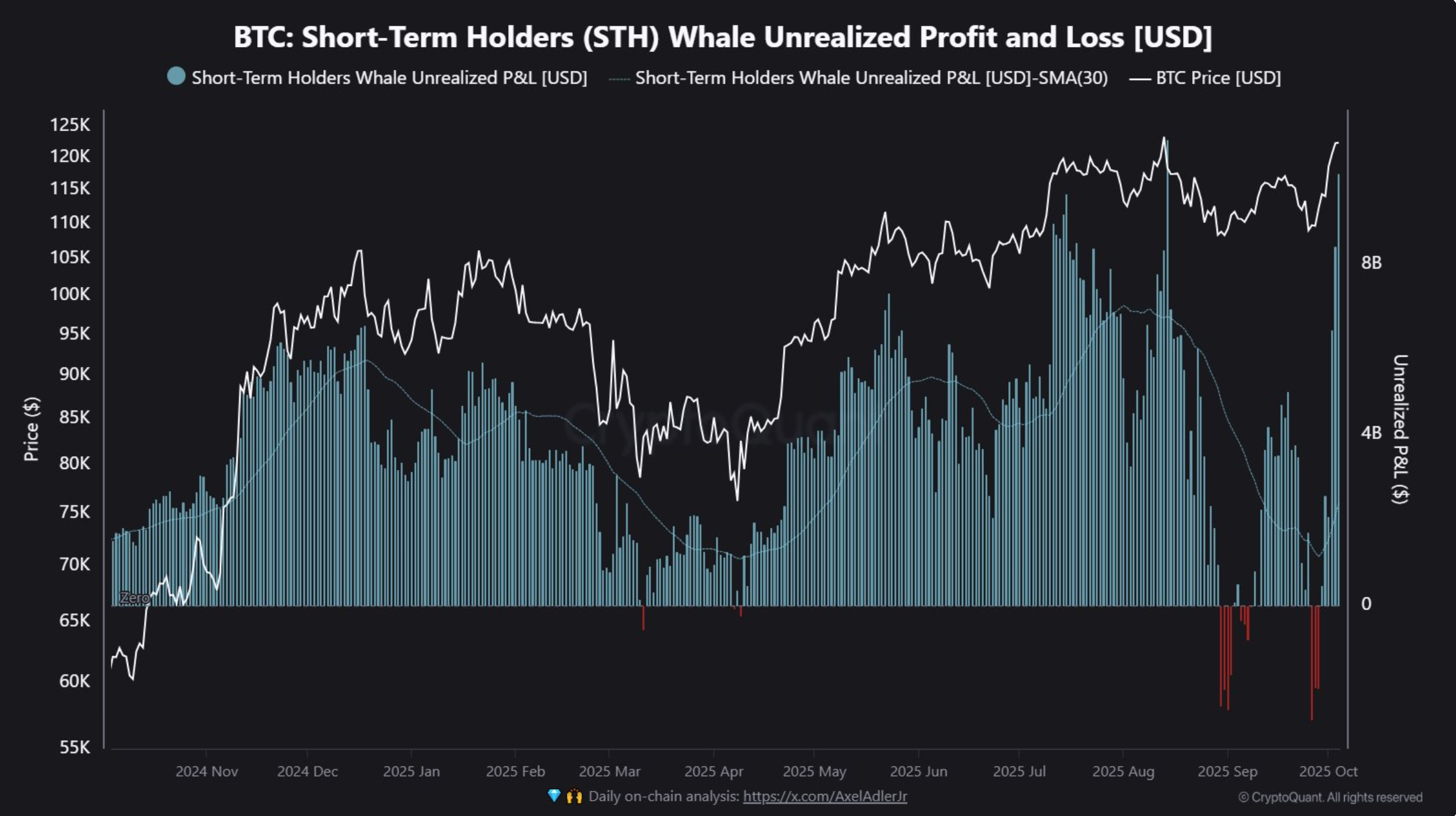

Bitcoin’s latest push through record levels has left short-term holder (STH) whales sitting on their fattest paper profits of the cycle of about $10.1 billion, according to CryptoQuant data.

These are entities holding more than 1,000 BTC that only entered the market in the past five months — the so-called “weak hands” of the cohort who usually fold first when volatility spikes.

The unrealized profit tally is the highest this cycle, a swing that reflects how quickly fortunes can change in bitcoin. Just weeks ago, late September’s dip left this same group underwater. Now, thanks to ETF inflows, a U.S. shutdown backdrop, and softer dollar conditions, they’re suddenly sitting on tens of billions in gains.

But that’s where the risk comes in as short-term whales aren’t famous for patience.

A $10 billion profit pool is exactly the kind of setup that tempts some holders to take chips off the table, testing how much new demand really stands behind the rally.

Exchange inflow data already showed $5.7 billion moving from STH wallets into exchanges earlier this week, marking an early sign that profit-taking is not a theoretical risk, but an active one.

Zooming out, this cycle has already seen massive hand-offs between long-term holders (LTHs) and the shorter-term crowd.

Earlier this week, analytics tool Checkonchain pointed out that 3.45 million BTC have shifted from LTH wallets to STHs since the cycle began — rivaling the 2016–17 transfer wave, only this time at prices roughly 100 times higher.

Whether that distribution caps momentum or simply fuels the churn that keeps rallies alive depends on the bidding pressure in the coming weeks.

For now, that backdrop looks strong enough to soak up some profit-taking. But if STH whales hit the sell button en masse, $10.1 billion in unrealized gains could flip into realized pressure quickly.

You May Also Like

Wealthfront Corporation (WLTH) Shareholders Who Lost Money – Contact Law Offices of Howard G. Smith About Securities Fraud Investigation

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!