Block Targets Mining Decentralization With Air-Cooled Proto Rig Delivering up to 819 TH/s

This week, Block, Inc. (NYSE: XYZ) launched Proto Rig, a modular bitcoin mining system designed for durability, and Proto Fleet, a free open-source management platform, marking a strategic push to decentralize mining hardware and software.

End of Disposable Miners? Block’s Proto Rig Adds 10-Year Lifespan

The announcement at Core Scientific’s facility — where operational Proto Rigs are already deployed — signals Block’s entry into the competitive ASIC mining market under its Proto division, following its initial bitcoin mining chip sales. Proto Rig replaces disposable hardware models with upgradeable infrastructure. Its modular design enables operators to swap individual hashboards instead of entire units, transforming miners from 3–5 year assets into 10-year investments.

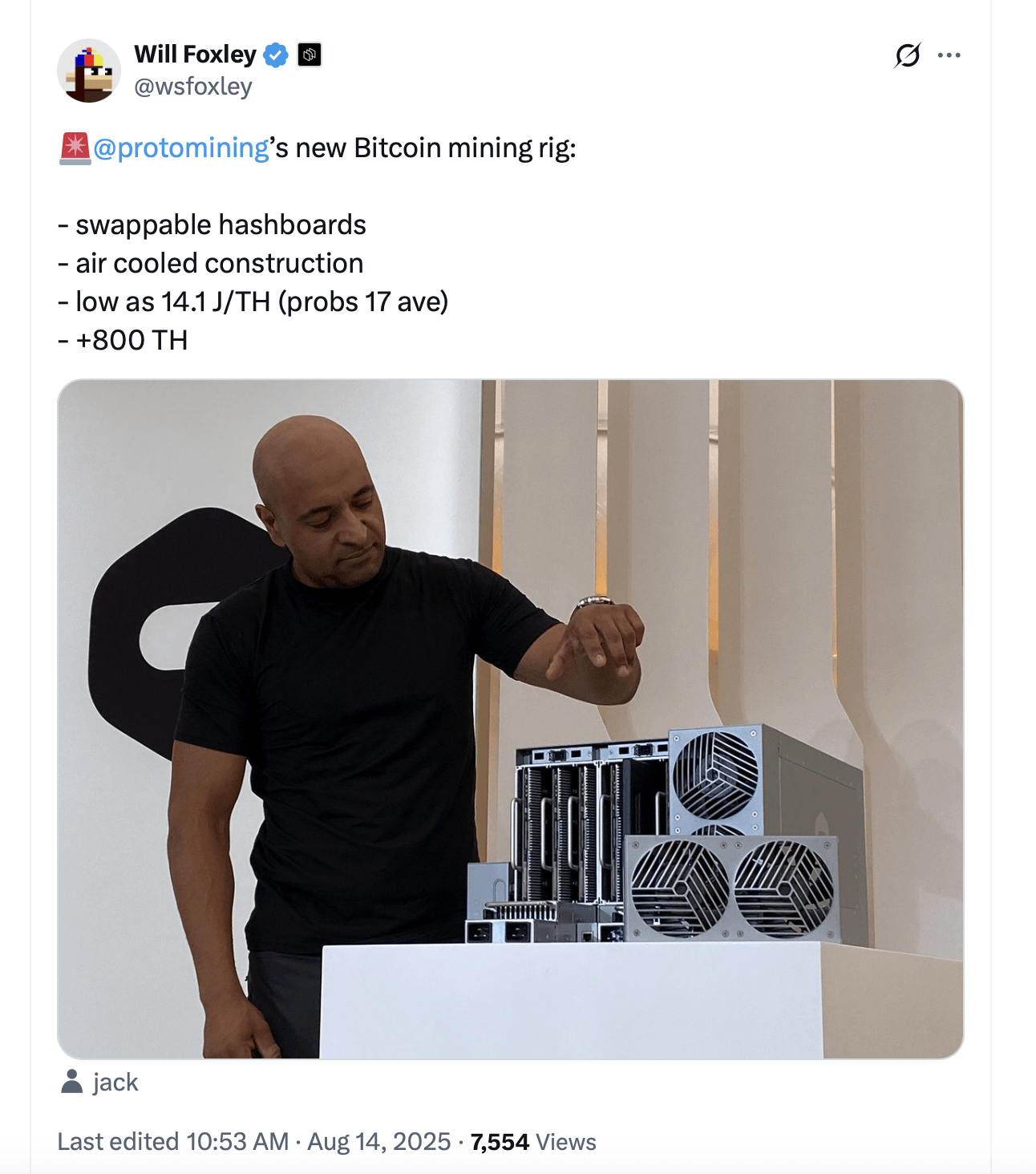

Thomas Templeton, Block’s Hardware Lead, criticized legacy equipment: “Machines break often, are hard to repair, expensive, and time-consuming to upgrade.” Proto Rig’s tool-free, in-place repairs reduce downtime from “hours, days, or weeks to seconds,” while lowering upgrade-cycle costs by 15–20%. The air-cooled unit (390mm W × 290mm H × 500mm D) houses nine swappable hashboards, delivering up to 819 terahash per second (TH/s) or 91 TH/s per board, at an efficiency of 14.1 joules per terahash (J/TH).

It draws up to 12,000 watts from 208–240V power sources via three included 8-foot C20-to-C19 cables. Weighing 110 pounds (5.38 lbs per hashboard), it fits standard racks and supports immersion cooling retrofits. With 1.5× higher power density per rack foot than traditional miners, it maximizes existing facility layouts without costly retrofits. Backward compatibility with legacy infrastructure and hot-swappable components minimizes operational disruptions.

The system’s control board, power supply units (4,000W each), and fan modules are serviceable onsite. “We set out to change [mining hardware] — and contribute to hardware decentralization,” Templeton added. The team stressed that Proto Rig’s design specifically addresses chronic industry challenges: power utilization inefficiencies, frequent downtime, and rapid hardware obsolescence.

Launched concurrently, Proto Fleet consolidates power-scaling, diagnostics, monitoring, and maintenance tools into a single open-source platform. Templeton noted bitcoin mining software “hasn’t really caught up with advances in software more broadly,” complicating operations. The free software reportedly eliminates the need for fragmented third-party tools, enabling miners of all sizes to streamline workflows and maximize uptime.

The firm noted that both products advance Block’s goal of decentralizing bitcoin mining. Proto Rig’s accessible design invites broader participation from builders, while Proto Fleet’s open-source model democratizes management capabilities. “A big part of Proto’s effort to decentralize mining,” the release emphasized, noting the software is free “for anyone to use.” Proto Rig is actively mining at Core Scientific’s Dalton facility, serving as a live proof-of-concept. While unit pricing remains undisclosed, Block positions the system as a long-term infrastructure investment rather than a disposable tool.

You May Also Like

Crucial US Stock Market Update: What Wednesday’s Mixed Close Reveals

Forbes' 2026 Crypto Investment Trends Outlook: Institutionalization, Tokenization, Stablecoins, and the AI Machine Economy