BTC Surpasses $100K! Insights into Binance's Listing Strategy and Wealth Impact

Original source:Biteye

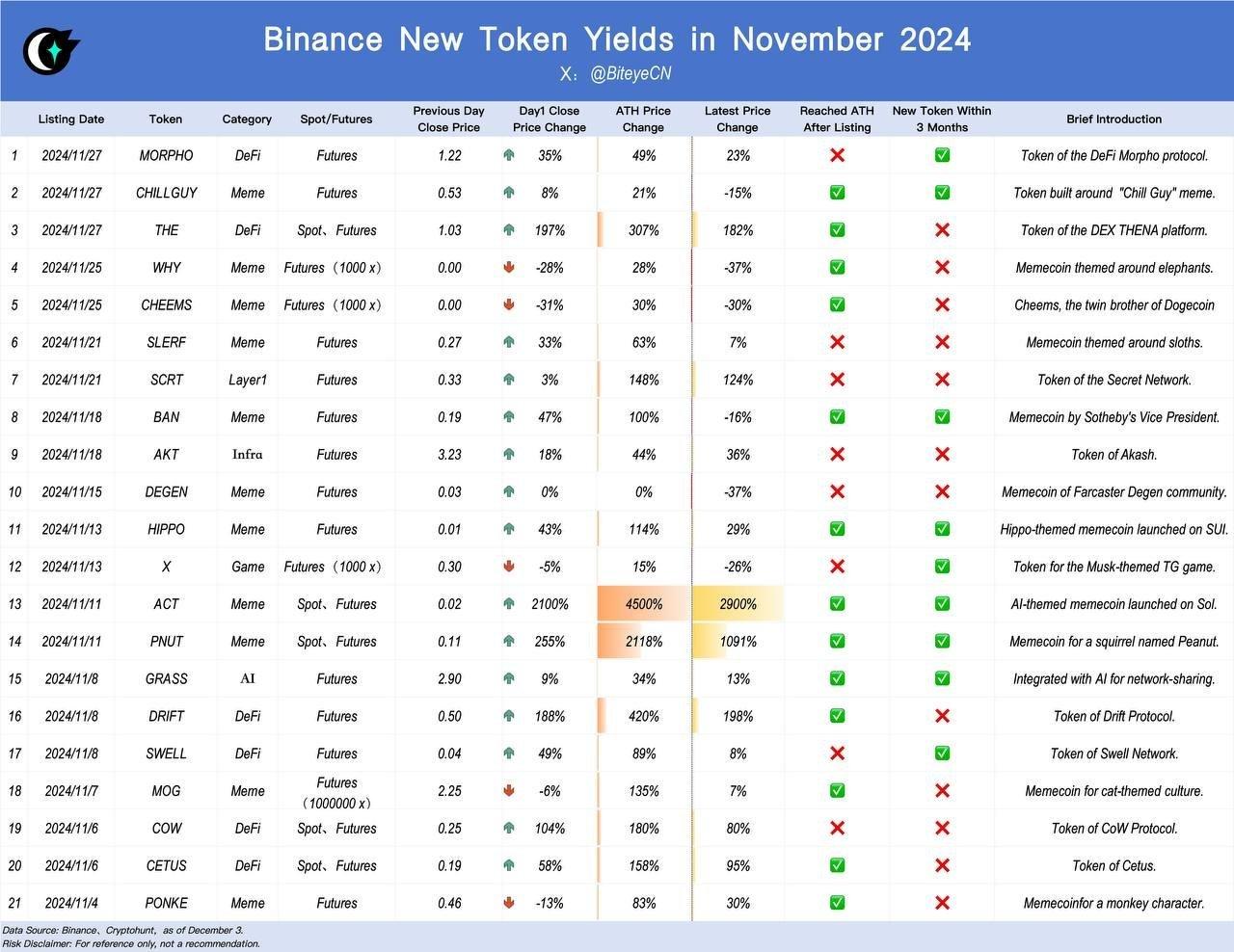

In November, Binance drew significant market attention with the explosive performance of ACT and PNUT, which delivered impressive returns within hours of listing. ACT surged by up to 4500% on its first day, while PNUT peaked at an impressive 2118%. These milestones have reignited discussions around the so-called "Binance Listing Effect." This article dives deeper into the data to decode Binance's listing strategy and its role in shaping market dynamics.

Performance Analysis of Binance’s Newly Listed Tokens

Historical data shows that a substantial number of tokens listed on Binance reach all-time highs (ATH) shortly after their debut - a trend we call “The First-Day Phenomenon: A Wealth-Generating Opportunity”. This trend is illustrated by ACT, which gained an impressive 2100% on its first day, with a peak surge reaching 4500%, while PNUT recorded a 255% increase on day one and peaked at 2118%. Among non-Meme tokens, THE stood out in its category with a first-day peak of 197%.

Source: https://x.com/BiteyeCN/status/1864981700318761258

Notably, over 60% of newly listed tokens on Binance hit ATH post-listing. The performance of newly listed tokens over the past three months has been particularly remarkable, with 9 of them quickly reaching all-time highs (ATH) after listing on Binance. Even among 12 established tokens, 7 achieved new peaks after listing, underscoring the platform's ability to reinvigorate mature projects while driving growth for emerging ones.

Binance’s listing strategy, rooted in market trends and user-centric focus, transcends simple trend-chasing by deeply aligning with market dynamics and community needs. By focusing on emerging sectors, such as Meme tokens like CHILLGUY and BAN, Binance effectively captures market enthusiasm and capitalizes on opportunities at the right moment.

Furthermore, Binance prioritizes projects with compelling narratives, strong community support, and moderate market caps - exemplified by ACT and PUNT, which secured its listing thanks to its transparent mechanics and highly engaged community.

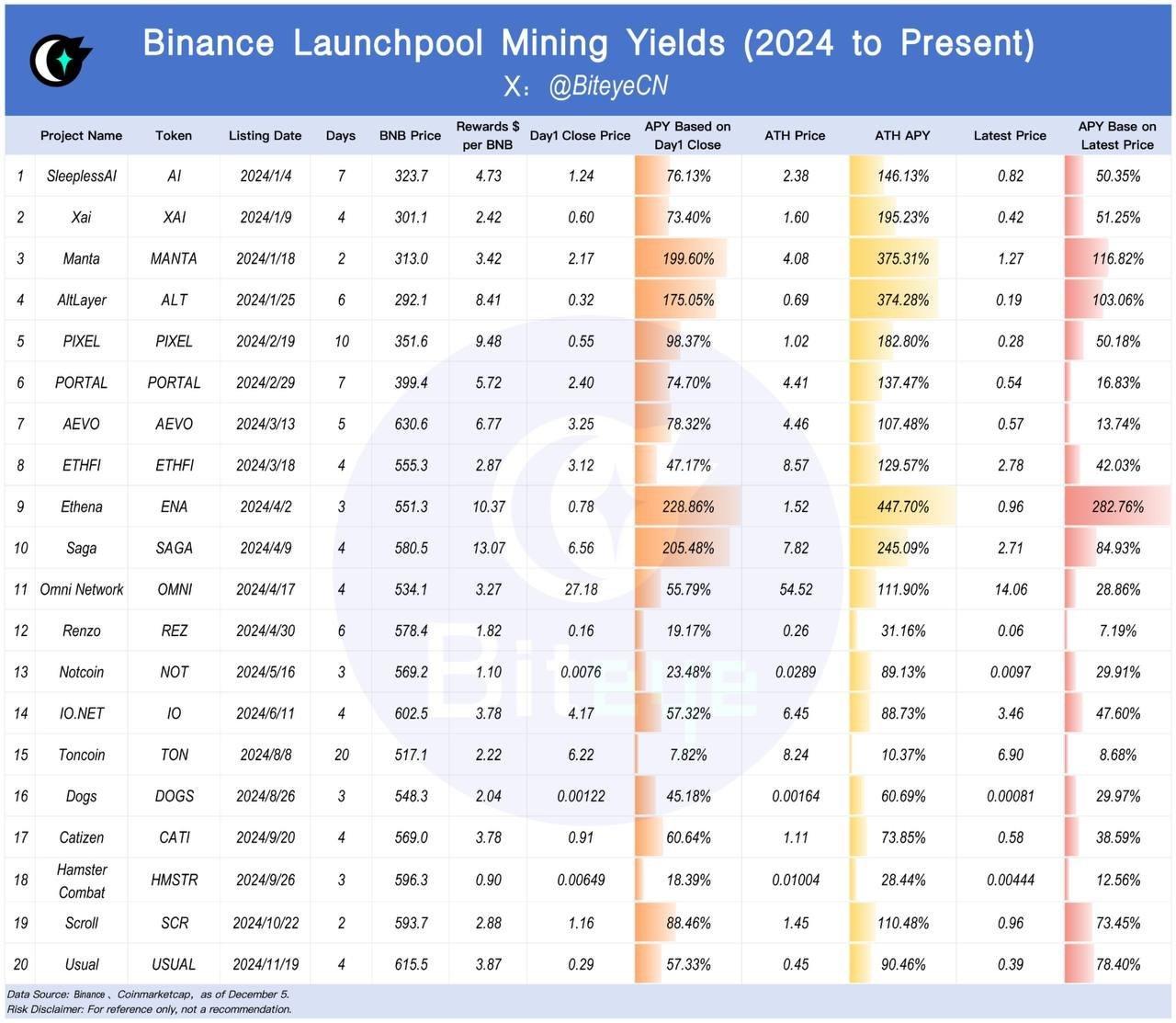

Analyzing Binance Launchpool Returns

Binance’s Launchpool offers a secure, low-risk platform for users to stake assets like BNB and FDUSD, enabling them to maximize returns through stable mining. The following chart, derived from Binance’s publicly available data and compiled by Biteye, illustrates the annualized returns of projects across their full mining cycles in 2024.

Source: https://x.com/BiteyeCN/status/1864981700318761258

Several projects have delivered exceptional annualized yields exceeding 200%, establishing Launchpool as a vital avenue for engaging with newly listed tokens. For instance, Ethena (ENA) recorded a first-day APY of 288.86% and a peak APY of 447.7%. Similarly, Manta achieved a peak APY of 375.31%, showcasing significant profit potential. Meanwhile, Usual started with an initial APY of 57.33%, eventually climbing to 78.4% over time.

These high yields are a result of Binance Launchpool’s careful selection of projects with strong fundamentals. By aligning user benefits with robust project foundations, Binance ensures sustainable token performance, enhancing both user returns and overall market confidence.

Binance’s market-driven listing strategy consistently identifies high-potential projects by combining trend responsiveness with a commitment to quality. Meanwhile, Launchpool amplifies user opportunities through low-barrier, high-reward participation. As BTC surpasses $100K, Binance’s innovative and adaptable approach positions it as a key driver of the market’s future.

You May Also Like

CME Group to launch options on XRP and SOL futures

Bipartisan Bill Targets Crypto Tax Loopholes and Stablecoin Rules: Report