Can betting pools influence the future of Ethereum? Livestakes is about to find out

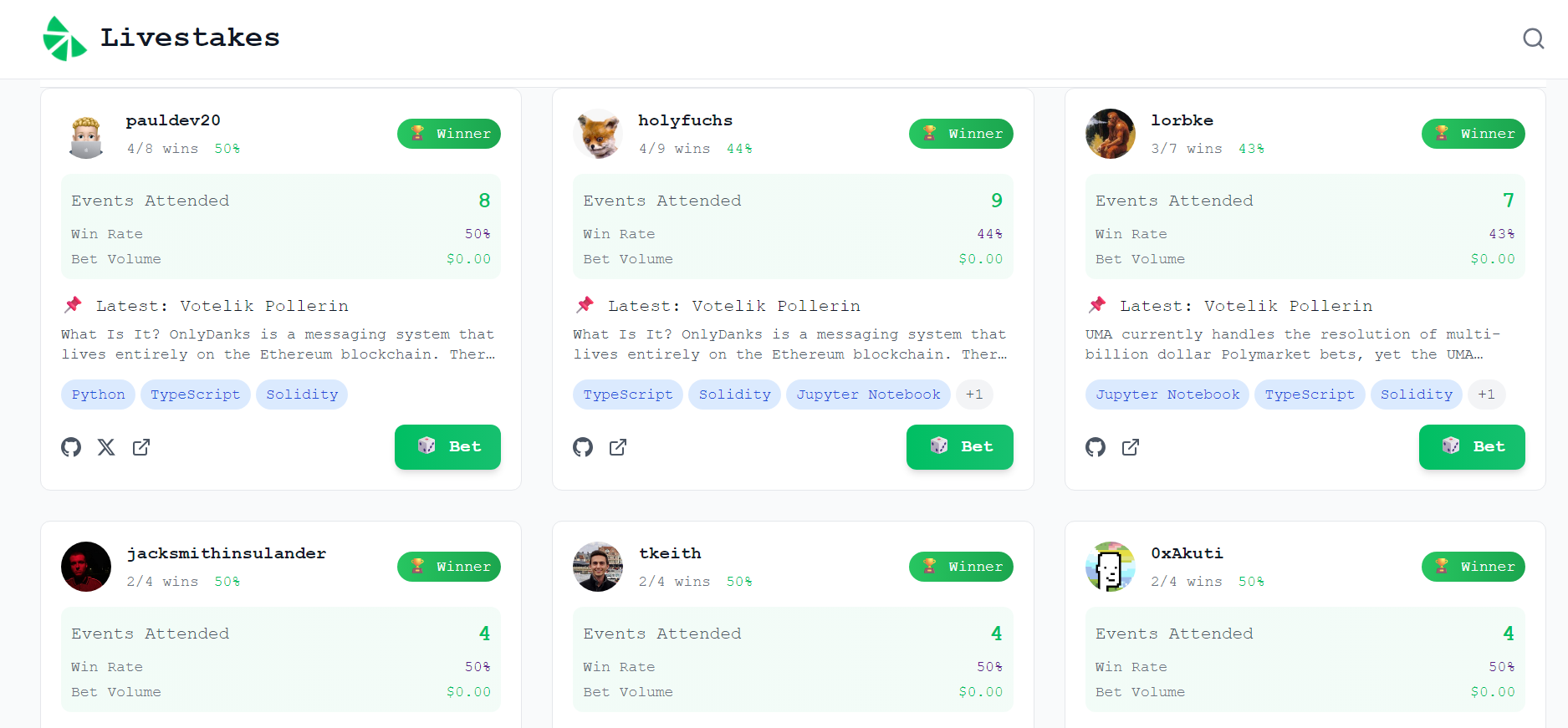

Born out of ETHGlobal, Livestakes is an emerging platform that lets users bet on hackathon winners. Will betting platforms grow to shape the future of Ethereum?

- Livestakes promises a prediction market that lets traders bet on hackathon contestants while also using the bets to form a separate prize pool for the winner.

- Prediction markets like Livestakes could potentially influence the future of Ethereum by placing more power in the hands of the community.

On the ETHGlobal 2025 stage in early July, the project was first introduced to the public as a betting platform that can “make hackathon winners make more money.”

Livestakes’ Content Strategist, known simply as Ziz, explained how the platform funnels in the money from bettors and creates a separate prize pool from the two established in the hackathon: the global main prize and the side track pool.

“What we are enabling is a completely separate pool. Let’s say everyone who’s betting, it reaches up to $100,000. Now we have an extra $100,000 allocated for people who are winning the hackathon,” said Ziz in his introduction speech.

In the end, the prize pool is distributed at an 80-20 ratio, with 80% divided equally between the winning bettors, while 20% goes to the hackathon winner the people were betting on. In theory, it should be able to provide a feedback loop for funding future projects born out of the hectic chaos of Ether’s hackathons.

Livestakes not only functions as a betting marketplace for traders with an appetite for placing bets, it also promises funding for would-be developers trying to find their footing. Established by a team of three, the platform’s site can be found on Livestakes.fun.

The project aims to support developers by providing funding through betting pools, similar to existing betting markets like Polymarket and Kalshi. But it adds an element of exposure, as it provides traders with short vertical videos that explain who the developers are and what their projects are about.

“It’s all this hype and energy craze that you see in meme markets, but now we have it at hackathons. So more money is coming here, more attention,” continued Ziz.

Prediction markets may shape the future of ETH

Platforms like Livestakes suggest a future where prediction markets are more than just side attractions, they become active participants in Ethereum’s innovation economy.

By letting the crowd vote with their wallets, Livestakes builds financial momentum around developer teams before they even win official prizes, potentially turning them into community favorites and attracting further support for their projects in the near-future.

Earlier in June, Ethereum’s own co-founder Vitalik Buterin was rumored to take part in an upcoming funding round for Polymarket that could see the prediction market receiving $200 million. This is not surprising, considering Buterin was one of the main investors in the market’s Series B funding round back in 2024, which yielded $70 million.

In the spirit of Ethereum’s own decentralization model, prediction markets like Livestakes could put more power in the hands of the community. As they are granted the ability to fund the projects they believe in. Ethereum’s future may be shaped less by centralized planning and more by coordinated conviction.

You May Also Like

Is Hyperliquid the new frontier for innovation?

Stronger capital, bigger loans: Africa’s banking outlook for 2026