Circle's IPO attempt is met with doubts: valuation almost halved, a desperate attempt to monetize under pressure from profits?

Author: Nancy, PANews

After years of unsuccessful preparations for an IPO, Circle, the issuer of the stablecoin USDC, recently submitted an application to the US SEC to be listed on the New York Stock Exchange. However, the valuation has been nearly halved, the revenue is highly dependent on US debt, and the high commission has eroded profits, which has also caused the market to question Circle's business prospects.

Valuation almost halved, equity sold to Coinbase in exchange for full USDC issuance rights

The day before the U.S. House of Representatives plans to amend and vote on the stablecoin regulatory bill GENIUS Act, the U.S. SEC website document shows that Circle submitted an S-1 document to the SEC, intending to conduct an initial public offering with the stock code "CRCL" and apply for listing on the New York Stock Exchange. At the same time, Circle has hired JPMorgan Chase and Citibank to assist in its IPO. These two institutions were also members of the financial advisory team for Coinbase IPO.

However, Circle did not disclose in detail the specific number of shares issued and the target price range in this prospectus. But Circle's valuation has changed several times with the market environment and its own scale, from US$4.5 billion in the SPAC merger transaction in 2021, to US$9 billion after the revision of the merger agreement in 2022, and then to a secondary market transaction valuation of approximately US$5 billion in 2024. According to Forbes, in this traditional IPO plan, Circle's target valuation is between US$4 billion and US$5 billion, which has shrunk by nearly half from its peak.

Circle has completely controlled the issuance rights of USDC before the IPO. According to The Block, Circle acquired the remaining 50% of Centre Consortium's equity, which was previously held by Coinbase, for $210 million in stock in 2023. Centre Consortium is a joint venture responsible for issuing USDC stablecoins, jointly established by Coinbase and Circle in 2018.

Circle disclosed in the "Major Transactions" section of the prospectus that "In August 2023, at the same time as the signing of the cooperation agreement, we acquired the remaining 50% equity of Centre Consortium LLC from Coinbase." The transaction consideration was paid with approximately 8.4 million shares of Circle common stock (a total of US$209.9 million at fair value). After the acquisition, Centre became a wholly-owned subsidiary of Circle and was dissolved in December 2023, with its net assets transferred to another wholly-owned subsidiary of Circle. Coinbase also disclosed that it obtained Circle equity through an agreement grant rather than a cash purchase. This also means that Circle uses company shares in exchange for full control of USDC, and this transaction will not directly affect Circle's cash flow.

In fact, Circle had already begun preparing for its IPO as early as 2021, and had reached a merger agreement with SPAC company Concord Acquisition, planning to go public through the SPAC route, but the transaction was postponed due to failure to obtain SEC approval, and was eventually terminated at the end of 2022. In January 2024, Circle again revealed that it had secretly submitted an IPO application and stated that it would proceed after the SEC completed the review process.

Compared with previous attempts, the background of this application has changed significantly: the scale of the stablecoin market has achieved a qualitative leap, with strong growth momentum, and the influence of stablecoins including USDC in global finance continues to increase; at the same time, the United States has a positive attitude towards compliant stablecoins, creating more room for the development of the stablecoin track, including giants such as JPMorgan Chase, PayPal, Visa, Fidelity and Ripple are all laying out stablecoins, and the Trump family project WLFI also plans to promote stablecoins. At the same time, as the US crypto regulatory policy becomes clearer, crypto companies such as Kraken, eToro, Gemini and CoreWeave are seeking IPOs.

Revenue is highly dependent on US debt, and Coinbase's high commissions eat up profits

However, Circle's IPO prospects are facing multiple questions, and its core business model and profitability have sparked heated discussions in the market.

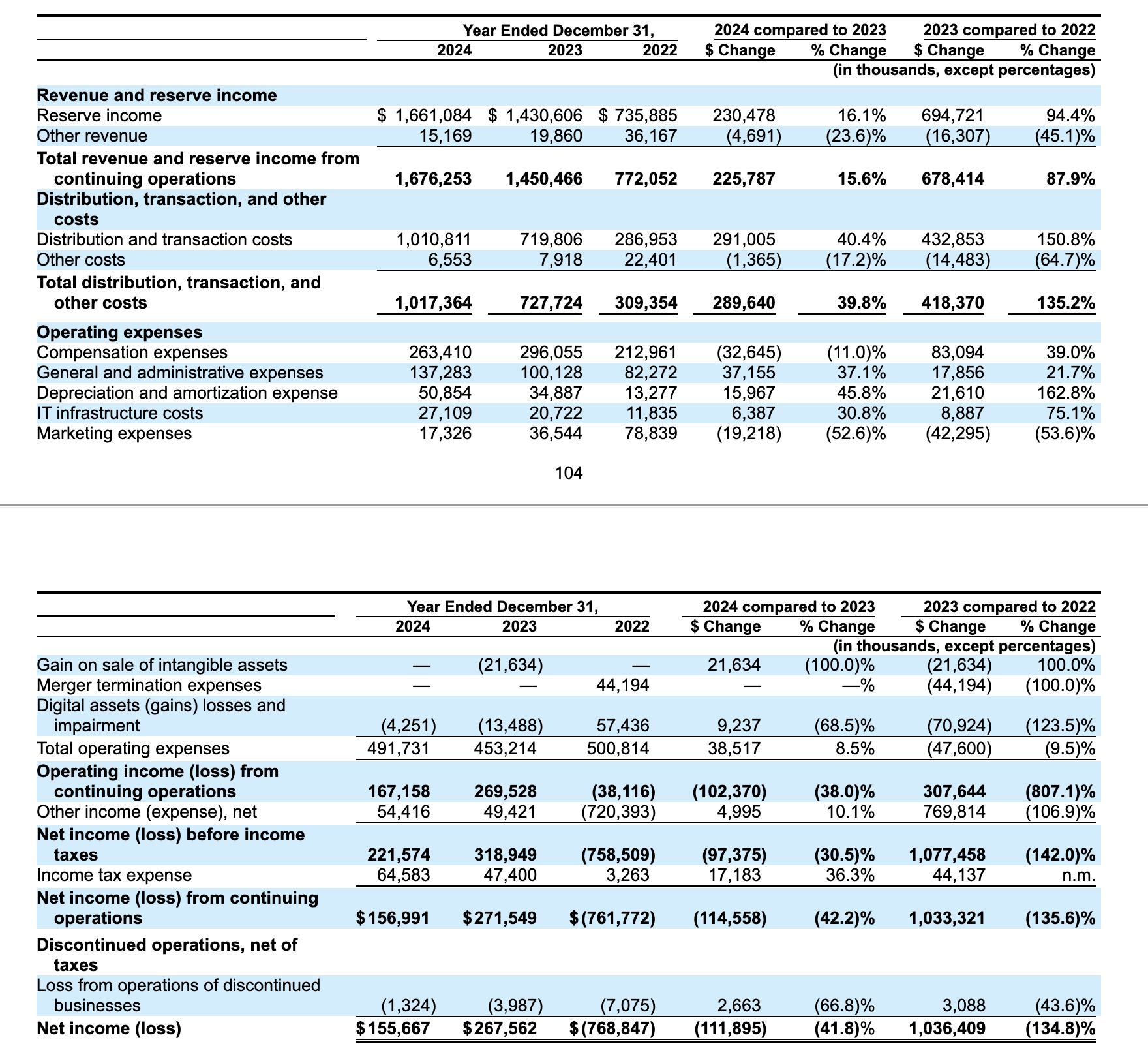

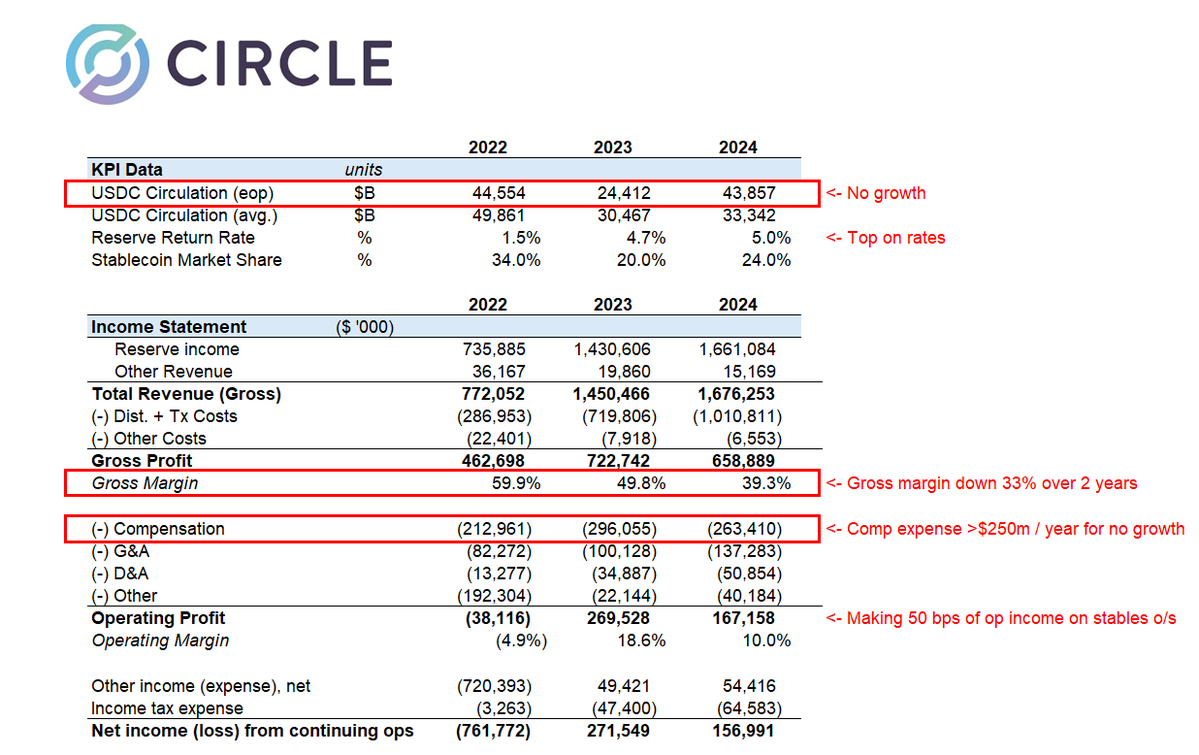

First, Circle's revenue is highly dependent on U.S. Treasury yields, and this model is in jeopardy under the expectation of the Fed's interest rate cut. According to the IPO documents, Circle's total revenue in 2024 is US$1.676 billion, and the revenue growth mainly comes from reserve income, that is, the interest income generated by USDC reserves, accounting for more than 99% of the total revenue, and this part of the interest income mainly comes from U.S. Treasury bonds. In a sense, Circle's revenue model is like a U.S. Treasury arbitrage game.

Secondly, high distribution costs further eroded Circle's profits. Circle's net profit in 2024 was US$155.67 million, down 41.8% from 2023. Behind this decline is a sharp increase in distribution and transaction costs. In 2024, Circle spent a total of US$1.0108 billion, accounting for 60.7% of total revenue , an increase of 40.4% from 2023. Among them, Coinbase is the main distribution platform for USDC. According to Coinbase's previous financial report, Coinbase received US$225.9 million in revenue from USDC in Q4 of 2024 alone, and is expected to receive about US$900 million for the whole year. This means that Circle is spending more money to maintain the circulation of the USDC ecosystem, but revenue growth has not kept pace.

In fact, according to the S-1 listing document, Coinbase, as its core partner, can obtain a 50% share of the remaining income of the USDC stablecoin reserve. Coinbase's share ratio is directly linked to the number of USDC held by its exchange. The document points out that when the USDC hosted by the Coinbase platform increases, its share ratio will increase accordingly; otherwise, it will decrease. In 2024, the proportion of USDC held by the Coinbase platform has increased significantly from 5% in 2022 to 20%.

Matthew Sigel, head of digital asset research at VanEck, said that despite the increase in overall revenue, Circle's sharp increase in distribution and trading costs had a negative impact on its EBITDA (earnings before interest, taxes, depreciation and amortization) and net profit. Circle also warned that Coinbase's business strategy and policies directly affect USDC's distribution costs and revenue sharing, and Circle cannot control or supervise Coinbase's decisions.

However, in order to reduce its dependence on Coinbase, Circle has also been vigorously expanding its global partnerships in recent years, including establishing cooperation with global digital financial companies such as Grab, Nubank and Mercado Libre.

But in the view of Dragonfly Capital partner Omar Kanji, there is nothing to look forward to in Circle's IPO application, and it is completely incomprehensible how it is priced at $5 billion. The interest rate is severely eroded by distribution costs, the interest rate of the core revenue driver has peaked and started to decline, the valuation is ridiculously high, and the annual salary expenditure exceeds $250 million. It feels more like a desperate attempt to cash out and run away before the big players enter the market.

"As Nubank, Binance, and other large financial institutions begin working with Circle, it remains unclear how the market will value its distribution network and Circle's net profit margin. How the market accepts Circle depends in part on how they convey this message to investors, how they execute the story they tell the market, which stablecoin bill wins, and most importantly, how the market evolves and how stablecoins are adopted on a large scale. If USDC is dominant, Circle will be able to obtain a higher valuation multiple even if their commission rate decreases, because the market potential they can expand is huge. In any case, a few points are clear: 1) The model of sharing revenue with B2B partners will exist for a long time; 2) As the overall stablecoin market grows, the profit margin of issuers will shrink; 3) Issuers need to diversify their revenue sources and not just rely on net interest margins." said Wyatt Lonergan, partner at VanEck Ventures.

In general, although the improvement of the US crypto regulatory environment and the boom in the stablecoin track have provided it with a window for listing, under the dual pressure of the Federal Reserve's interest rate cut expectations and soaring promotion costs, it remains unknown whether it can further establish competitiveness through IPOs.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

CME Group to Launch Solana and XRP Futures Options