Crypto ETFs near $1 trillion milestone as record inflows signal growth

Crypto ETFs are approaching the $1 trillion milestone after a record-breaking $30 billion in weekly inflows, signaling renewed investor confidence despite ongoing market consolidation.

- Crypto ETF inflows hit $30 billion in one week.

- Bitcoin ETFs alone add over $1 billion in net inflows.

- Market confidence grows as total ETF assets near $1 trillion.

The cryptocurrency market is witnessing a major milestone as total assets under management in crypto exchange-traded funds approach the $1 trillion mark. The surge is being driven by a significant wave of institutional inflows, highlighting renewed investor appetite for digital assets even as price action across the market remains largely consolidative.

Bitcoin ETFs saw only $4.5 million in outflows since Oct. 10, ending a nine-day streak that had brought in over $5 billion.

Crypto ETF inflow key points

- Record ETF Inflows: Over $30 billion in inflows have been recorded within the past seven days.

- Strong Institutional Interest: ETF inflows are approaching historical highs, indicating continued market confidence.

- Bitcoin ETF Strength: Bitcoin ETFs alone have attracted over $1 billion in recent net inflows, underscoring sustained institutional demand.

The crypto ETF market has shown exceptional growth over the past week, nearing the $1 trillion valuation milestone for the first time. The move follows a wave of institutional and retail inflows that have boosted overall sentiment despite broader market volatility.

The influx of capital across major crypto ETFs highlights a clear shift in investor behavior toward long-term accumulation rather than short-term speculation.

A total of $30 billion in inflows has been recorded in just the past seven days, setting a new record for capital entering the crypto ETF market within a single week. This figure underscores the rising confidence among investors who continue to allocate capital even as prices remain within corrective structures.

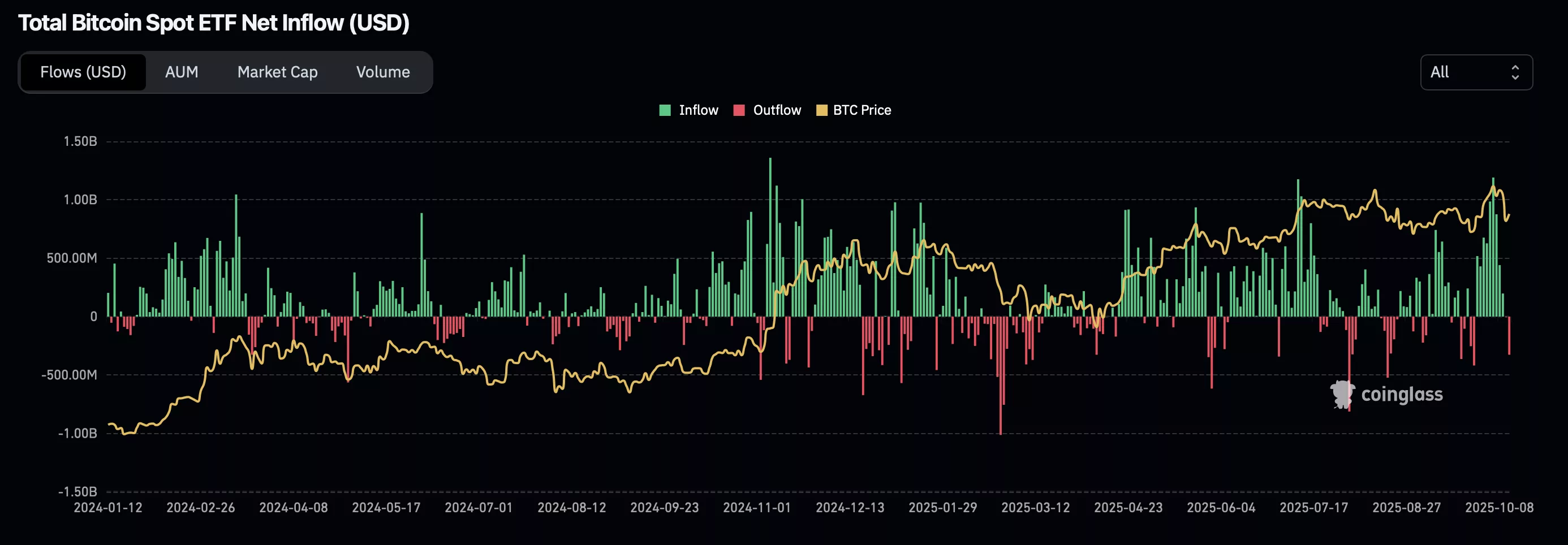

Bitcoin (BTC) has remained the primary beneficiary of this surge in inflows. Data indicate that net inflows into Bitcoin ETFs have surpassed $1 billion recently, suggesting a growing accumulation phase from large-scale investors. The chart data reveals sharp green spikes corresponding with these inflows, even as price action consolidates after a heavy corrective move.

From a structural standpoint, Bitcoin’s consolidation amid growing ETF inflows highlights strong conviction in the asset’s long-term outlook. While near-term volatility persists, the steady rise in institutional investment provides a foundation for future price stability and potential expansion.

The record-breaking inflows across multiple ETF products show that investor confidence remains strong despite broader macro uncertainty. The willingness to hold and accumulate during periods of consolidation reflects a growing belief in the long-term performance of cryptocurrencies and blockchain-based assets.

What to expect in the coming price action

If ETF inflows continue at the current pace, total crypto ETF holdings could surpass the $1 trillion mark by the end of the week. This would represent a significant psychological milestone for both institutional and retail participants, reaffirming the expanding role of regulated investment products in the crypto ecosystem.

You May Also Like

Simplenight Introduces Trust-Driven Multi-Agent AI to Support Complex Human Decisions Across Digital Ecosystems

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

Trump Media to distribute new digital tokens to DJT shareholders

Copy linkX (Twitter)LinkedInFacebookEmail