Dow Jones up 300 points as weak labor market fuels rate cuts bets

Signs of weakness in the labor market are fuelling bets that the Fed might cut interest rates sooner.

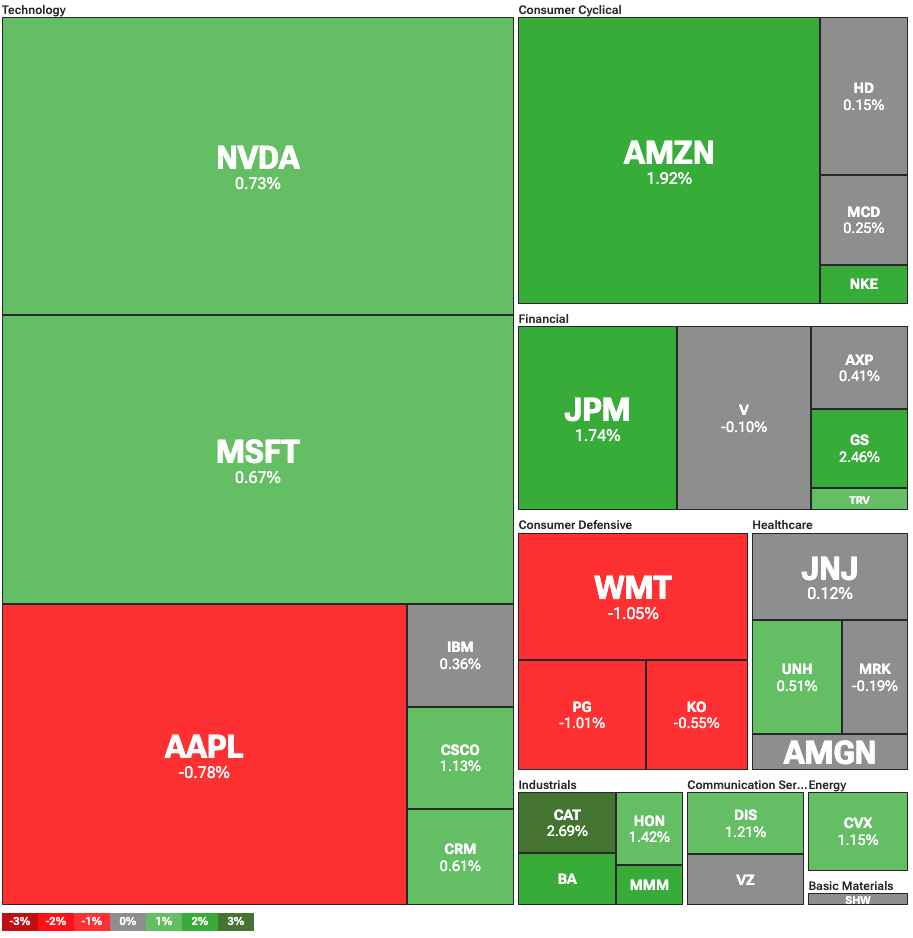

Markets are up, with the S&P 500 near record levels, as traders are betting on rate cuts. On Thursday, June 26, Dow Jones led the market rally, up 343 points, or 0.80%. At the same time, the S&P 500 was up 0.65%, trading at 6,132 points, approaching the February record high of 6,144 points. The tech-heavy Nasdaq was up 0.70%.

Nvidia continues to rally after reaching an all-time high on Wednesday. The company reclaimed the top spot among all global firms by market cap, surpassing Microsoft at $3.77 trillion. The stock’s surge had also triggered a rally among other semiconductor firms across Asia.

Stock markets have largely absorbed the end of Middle East tensions, and are now looking at the Federal Reserve for cues. In this context, Thursday’s labor market data was seen as a good sign, especially for risk stocks.

The Department of Labor’s survey showed that insured unemployment claims were at 1.974 million. The figure rose by 37,000 from the revised levels of last week. What is more, this was the highest level of insured unemployment since November 2021, at the height of the pandemic.

Fed to finally cut rates?

Weak labor market statistics, while bad for the economy in general, may push the Fed to cut interest rates. This news comes after continued pressure from U.S. President Donald Trump. On Wednesday, Trump stated that he was close to picking a replacement for Fed Chair Jerome Powell.

Trump openly criticized Powell for not cutting interest rates. Still, the President shied away from directly stating that he would replace Powell before the end of his term in 2026. In any case, Powell consistently resisted pressures from the White House, defending the Fed’s independence.

You May Also Like

ADA Price Prediction: Here’s The Best Place To Make 50x Gains

Is it ‘over for Solana’? 97% network activity crash sparks fresh debate