Ethereum ETFs hit pause: $59m flows out as ETH pulls back from all-time highs

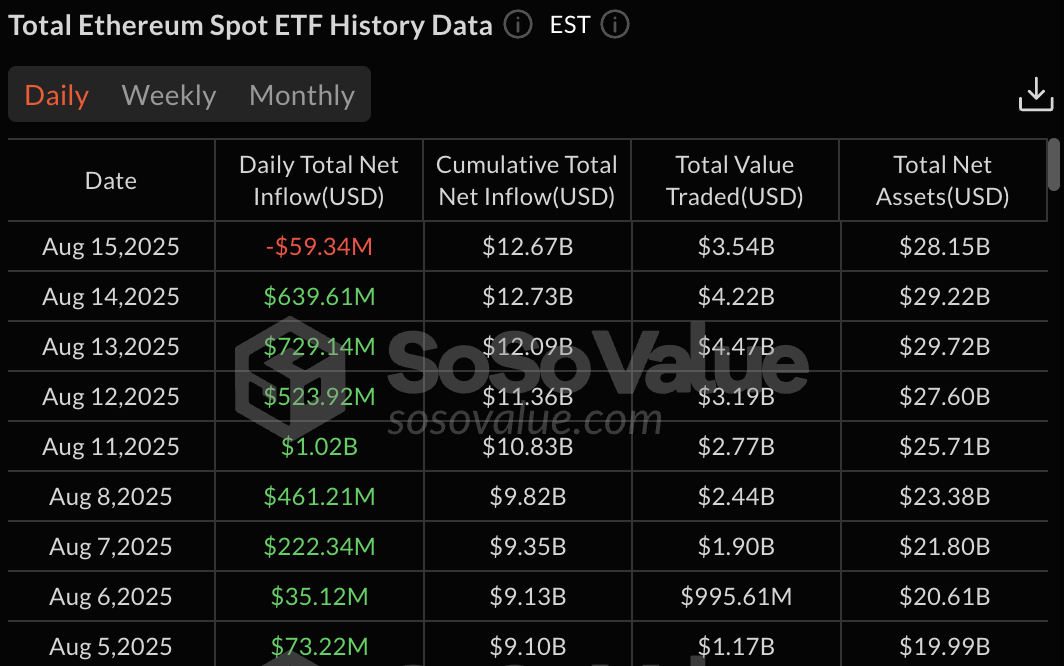

U.S. spot Ethereum ETFs recorded net outflows of $59.34 million on August 15, ending an eight-day streak that brought $3.7 billion in total inflows.

The reversal comes as Ethereum (ETH) retreated from near all-time highs to current levels around $4,450.

According to SoSoValue data, only BlackRock’s ETHA maintained positive flows with $338.09 million in single-day inflows, while other major ETFs posted outflows.

Grayscale’s ETHE led withdrawals with $101.74 million in outflows, followed by Fidelity’s FETH at $272.23 million.

Ethereum price surge drives institutional interest

The recent surge in inflows coincided with Ethereum’s rally to $4,788. This brought ETH within 3% of its all-time high of $4,891.

The price surge attracted institutional investment through ETF products, resulting in cumulative total net inflows of $12.67 billion across all Ethereum ETF products.

Daily Ethereum ETF inflow data: SoSo Value

Daily Ethereum ETF inflow data: SoSo Value

BlackRock’s ETHA has accumulated $12.16 billion in cumulative inflows since launch. This makes it the leading Ethereum ETF in terms of assets.

Fidelity’s FETH holds $2.74 billion in cumulative inflows, despite the recent outflows. This has helped it earn its position as the second-largest Ethereum ETF.

VanEck’s ETHV and Franklin’s EZET reported zero flows for the day, and smaller ETFs including ETHW, CETH, and QETH posted mixed results.

ETF flows mirror price action

The correlation between Ethereum’s price movement and ETF flows shows how institutional investors respond to market strength.

The eight-day inflow streak began as Ethereum broke above key resistance levels and surged as prices approached all-time highs.

Current outflows may show profit-taking after substantial gains or rotation into other cryptocurrency products.

Ethereum’s retreat from $4,788 to $4,450 has cooled retail enthusiasm. However, as Lookonchain reported, an Ethereum ICO participant transferred 334.7 ETH after over ten years of dormancy.

The participant invested only $104 in the ICO and achieved a 14,629x return.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Bitcoin Maintains Edge in Market Fluctuations