Falcon Finance unveils USDf expansion and RWA redemption plans

Falcon Finance is expanding its USDf stablecoin reach, launching fiat on- and off-ramps across LATAM, Turkey, MENA, Europe, and the U.S., while adding real-world asset redemption options.

- In 2025, Falcon Finance will add fiat on- and off-ramps in LATAM, Turkey, MENA, Europe, and the U.S., introduce physical gold redemption in the UAE, and support tokenized assets such as T-bills and stablecoins.

- In 2026, the protocol will launch a RWA engine for corporate bonds and private credit, expand gold redemption to MENA and Hong Kong, and roll out institutional-grade USDf products and investment funds.

Falcon Finance, the next-generation dual-token synthetic dollar protocol, has released an updated whitepaper, outlining its ongoing yield strategies and an expanded roadmap for global adoption and institutional integration.

The main update centers on expanding how USDf, Falcon Finance’s stable, overcollateralized synthetic dollar, can be used and redeemed across both digital and real-world assets. In 2025, the protocol will extend its fiat rails in LATAM, Turkey, MENA, Europe, and the U.S., enabling users to deposit and withdraw USDf in their local currencies.

This year, the protocol will also introduce physical gold redemption in the UAE, giving users the option to convert their USDf into gold. Alongside this, USDf will support tokenized assets such as T-bills, stablecoins, and select cryptocurrencies.

In 2026, Falcon Finance plans to launch a modular Real-World Asset engine, enabling the tokenization of corporate bonds, private credit, and other financial instruments into USDf-backed onchain liquidity. The protocol will also expand physical gold redemption services to additional financial hubs in the MENA region and Hong Kong, while rolling out institutional-grade USDf products and investment funds.

These updates come on the heels of several key milestones for the project. Most notably, USDf has recently surpassed 1 billion in circulation, ranking it among the top ten Ethereum-based stablecoins by market cap. The protocol also completed its first “live mint” of USDf against a tokenized U.S. Treasury fund, achieving an overcollateralization ratio of 116%, independently verified by ht.digital.

How Falcon Finance’s USDf earns yield

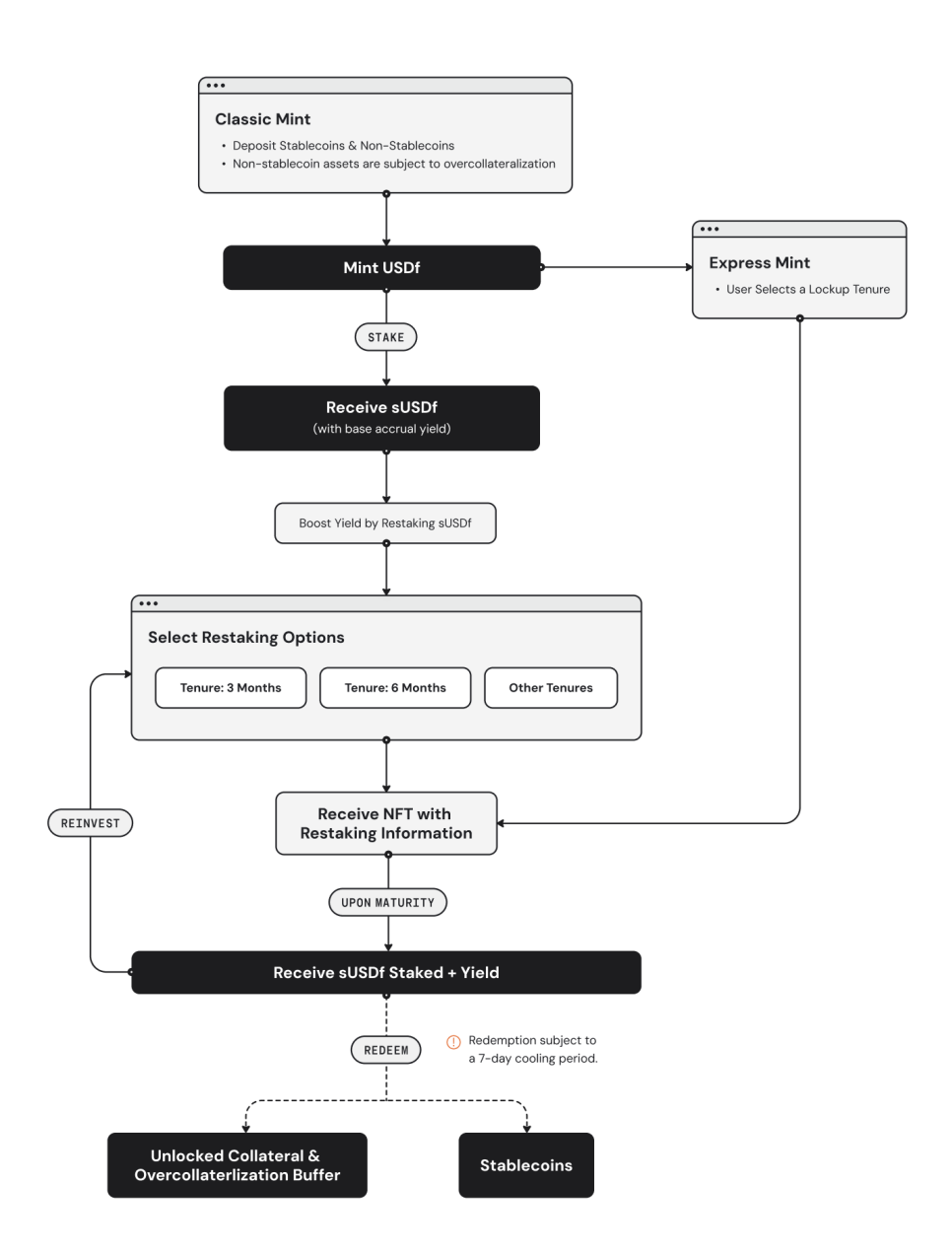

USDf is created when users deposit eligible collateral into the Falcon Finance protocol. This collateral can include stablecoins, major cryptocurrencies, or tokenized RWAs. For non-stablecoin assets like BTC or ETH, an overcollateralization ratio ensures that each USDf is fully backed, protecting both users and the protocol from market volatility.

Once minted, USDf can be staked to generate sUSDf, a yield-bearing token that accrues income through Falcon Finance’s diversified institutional-grade strategies, such as funding rate and price arbitrage. Users can redeem sUSDf for USDf, or, for non-stablecoin deposits, they can reclaim their original collateral along with any accrued overcollateralization buffer.

You May Also Like

Pippin (PIPPIN) Price Prediction 2026–2030: Can PIPPIN Hit $0.70 Soon?

Will Cardano Reach $10 by 2030? Analysts Break Down ADA’s Growth Cycles