Fed Rate Cut Bitcoin: Why Analysts Remain Skeptical of a $120K Surge

BitcoinWorld

Fed Rate Cut Bitcoin: Why Analysts Remain Skeptical of a $120K Surge

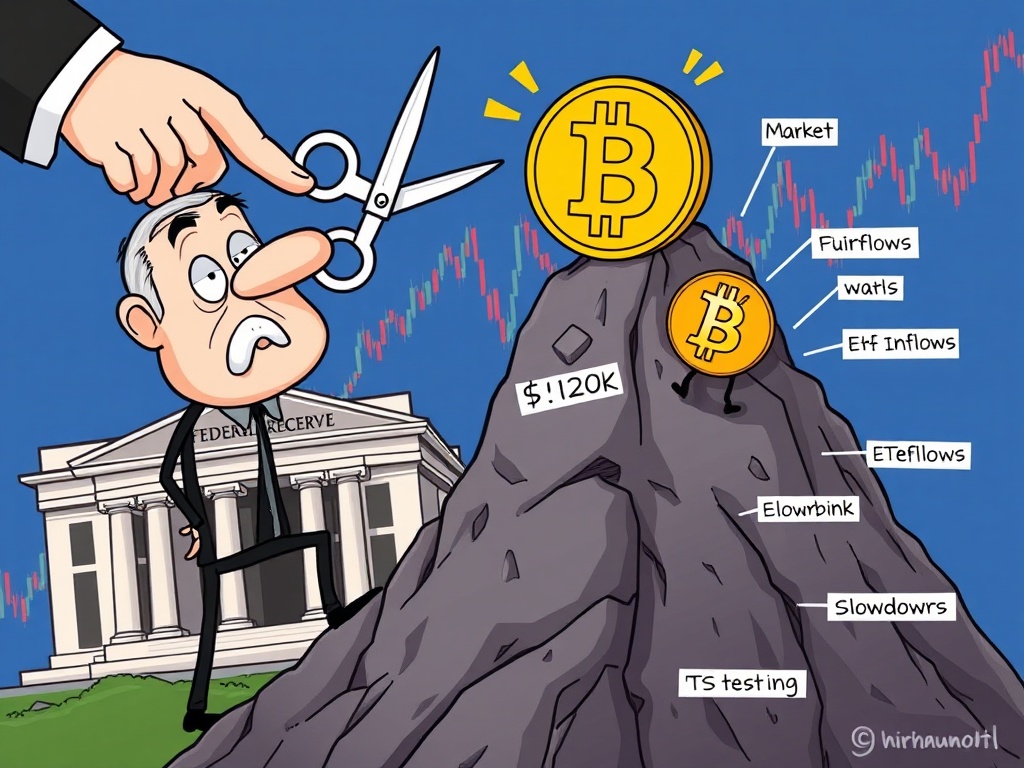

The cryptocurrency world is buzzing with anticipation, but a potential Fed rate cut Bitcoin analysts suggest, might not be the magic bullet for a massive price surge. Many hoped a dovish stance from the U.S. Federal Reserve would catapult Bitcoin to new heights, perhaps even the elusive $120,000 mark. However, expert opinions reveal a more nuanced and cautious outlook.

Understanding the Fed Rate Cut Bitcoin Conundrum

The upcoming Federal Open Market Committee (FOMC) meeting looms large, with many eyes on the U.S. Federal Reserve’s potential decision on interest rates. While a rate cut is generally seen as a positive for risk assets like Bitcoin, the reality might be more complex than it appears. According to Rachel Lucas, a crypto analyst at BTC Markets, the market has already largely factored in a rate reduction. This ‘pricing in’ effect means that the immediate positive impact could be diminished.

Lucas further highlights two significant headwinds for Bitcoin’s upward trajectory:

- Institutional Profit-Taking: Large investors who bought in at lower prices may be cashing out, creating selling pressure.

- Stagnant ETF Inflows: The initial excitement around spot Bitcoin ETFs seems to have cooled, with new money not flowing in as rapidly as before.

These factors combined suggest that even with a rate cut, the path to $120,000 for Fed rate cut Bitcoin could be significantly constrained.

Is a Fed Rate Cut Bitcoin Signal for Economic Slowdown?

Adding another layer of caution to the outlook is Vincent Liu, CIO of Kronos Research. He presents an alternative, less optimistic interpretation of a Fed rate cut. Liu suggests that such a move could, paradoxically, be perceived by the market as a signal of an impending economic slowdown.

In an environment where economic growth concerns are prevalent, investor sentiment tends to shift away from riskier assets. Instead, there’s a flight to safety, which typically benefits traditional safe havens rather than cryptocurrencies. Liu elaborates on how this sentiment could play out:

- Inflation Concerns: Persistent inflation could erode purchasing power and make investors more wary of speculative assets.

- Dampened Investor Sentiment: A general air of economic uncertainty can suppress overall demand for risk assets, including Bitcoin.

Therefore, the very action intended to stimulate the economy could, in this context, dampen demand for Fed rate cut Bitcoin, making the $120,000 target even more challenging to achieve.

Navigating the Path: What Does This Mean for Fed Rate Cut Bitcoin Aspirations?

Given these expert perspectives, the narrative around a straightforward ascent for Bitcoin post-rate cut becomes complicated. The consensus suggests that while a rate cut might provide some short-term relief, it’s unlikely to be the sole catalyst for a meteoric rise to $120,000. The market’s current dynamics indicate that other, more fundamental shifts are required.

For Bitcoin to truly break through the $120,000 resistance level, analysts point to crucial factors:

- Significant Increase in ETF Inflows: A renewed surge of institutional and retail capital into spot Bitcoin ETFs is essential.

- Clear Boost in Liquidity: Broader market liquidity, perhaps driven by more definitive economic recovery signals, would be needed.

Without these powerful tailwinds, the current market structure, coupled with profit-taking and cautious sentiment, seems poised to keep Fed rate cut Bitcoin within its existing range. Investors should remain vigilant, closely monitoring both macroeconomic indicators and specific crypto market data.

In conclusion, while a U.S. Federal Reserve rate cut is a highly anticipated event, its impact on Bitcoin’s price, particularly in reaching the ambitious $120,000 target, appears limited according to leading analysts. The market has largely priced in such a move, and other factors like institutional profit-taking, stagnant ETF inflows, and the potential interpretation of a rate cut as an economic slowdown signal are acting as powerful brakes. For Bitcoin to achieve a substantial breakout, a robust influx of new capital and clearer liquidity boosts are indispensable. The journey for Fed rate cut Bitcoin to $120K is fraught with more complexity than a simple interest rate adjustment.

Frequently Asked Questions (FAQs)

Q: Why might a Fed rate cut not significantly boost Bitcoin’s price?

A: Analysts suggest the market has already priced in a rate cut. Additionally, institutional profit-taking and stagnant inflows into spot Bitcoin ETFs are limiting upward momentum.

Q: How could a Fed rate cut signal an economic slowdown?

A: Some experts believe the Fed might cut rates in response to weakening economic data, which could be interpreted by investors as a sign of an impending slowdown, leading them to avoid riskier assets like Bitcoin.

Q: What factors are currently constraining Bitcoin’s price momentum?

A: Key constraints include profit-taking by institutional investors, a slowdown in new capital flowing into spot Bitcoin ETFs, and general concerns about inflation and economic stability.

Q: What would be needed for Bitcoin to reach the $120,000 level?

A: According to analysts, a significant increase in spot Bitcoin ETF inflows and a clear, broader boost in market liquidity would be crucial catalysts for Bitcoin to overcome current resistance and reach $120,000.

Q: Should investors change their strategy based on these predictions?

A: While these are expert analyses, individual investment decisions should always be based on personal research and risk tolerance. It’s prudent to monitor macroeconomic trends and crypto-specific data closely.

Found this analysis insightful? Share this article with your network on social media to spark a conversation about the future of Fed rate cut Bitcoin and its journey to $120K!

To learn more about the latest explore our article on key developments shaping Bitcoin price action.

This post Fed Rate Cut Bitcoin: Why Analysts Remain Skeptical of a $120K Surge first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

MiCA Deadline Could Make Several French Crypto Firms Illegal

The Transformative Yet Perilous Race Reshaping Medicine In 2025