From DeFi full stack to RWA infrastructure, the "outdated internet celebrity" Arbitrum is becoming the preferred platform for institutional entry

Author: Cheeezzyyyy

Compiled by: Tim, PANews

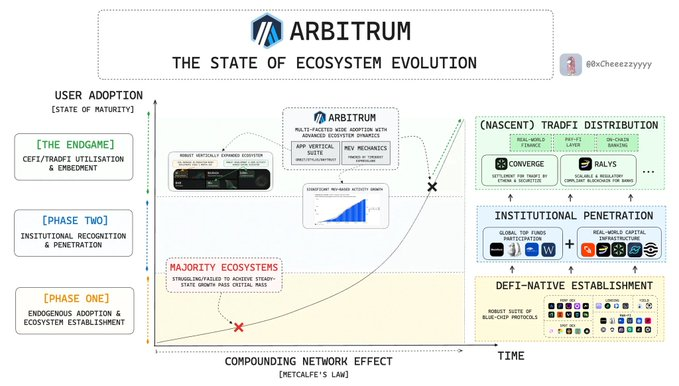

In recent years, Arbitrum has not only not stopped expanding, but it is also entering a unique stage of ecological exploration, playing a game that few people can participate in.

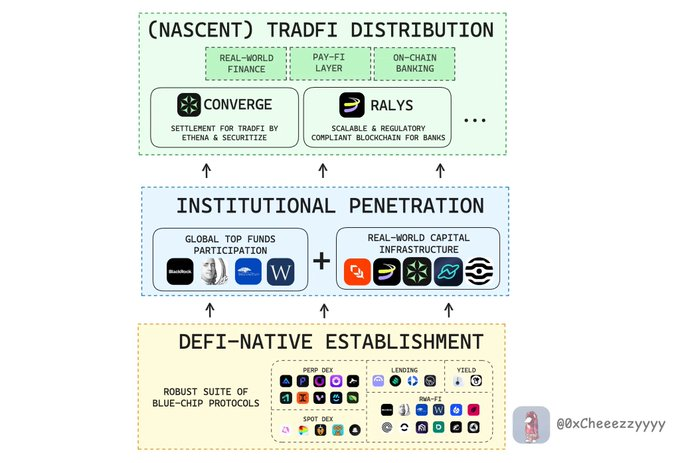

This evolution redefines the boundaries of crypto adoption: DeFi native stage → institutions gradually enter → the prototype of the financial system begins to emerge

Key insights

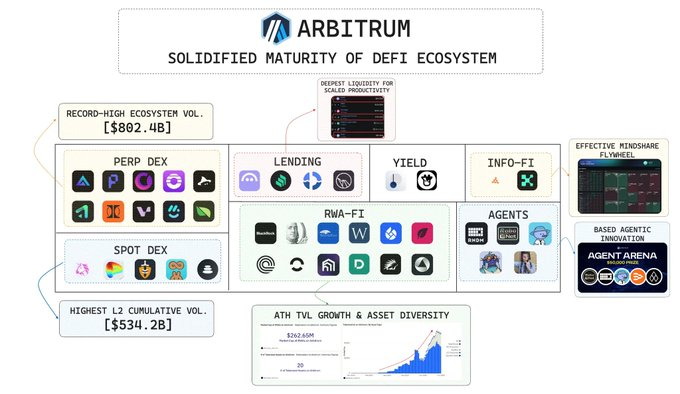

Arbitrum has already entered the mature stage of the ecosystem and has formed a full-scale and mature market segment layout in the DeFi track.

And now, it has achieved a crucial milestone:

- Spot DEX: L2 cumulative transaction volume ranks first, reaching US$534.2 billion

- Perpetual contracts: Total trading volume reached $802 billion, a record high

- Lending services: Liquidity depth is greater than US$1.2 billion, which can increase productivity through credit.

- RWA-Fi: Growing to an all-time peak of $262.5 million, covering 20 assets

Arbitrum's self-sustainable growth is reflected in three aspects: strong user growth, deep liquidity, and continued activity in various business lines.

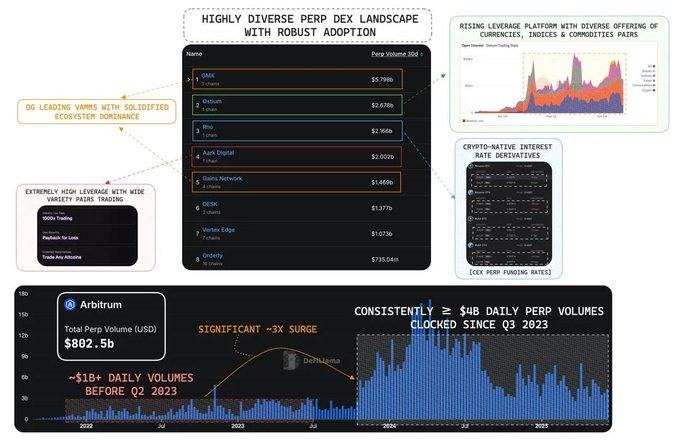

In the third quarter of 2021, in the early stages of the virtual automated market maker (vAMM) led by GMX and Gains Network, Arbitrum built the basic structure of perpetual contract DEX.

Today, user growth has entered a stable and mature stage, and the high user retention rate is clearly confirmed in the daily transaction volume trend:

- Since the third quarter of 2023, daily trading volume has increased by about 3 times ($1 billion → $4 billion)

- Cumulative trading volume reached US$802.5 billion

Since then, the sustainable DEX ecosystem has achieved diversified evolution, and professional players continue to emerge:

- Rho Protocol: Native cryptocurrency interest rate derivatives (centered on centralized exchange funding rates)

- Aark Digital: Ultra-high leverage trading (leverage up to 1,000 times)

- Ostium: Multi-asset allocation coverage (foreign exchange/stock index/commodities)

The ecosystem shows a trend of high user stickiness and product innovation in parallel, confirming its sustainable nature of self-sustaining and dynamic evolution.

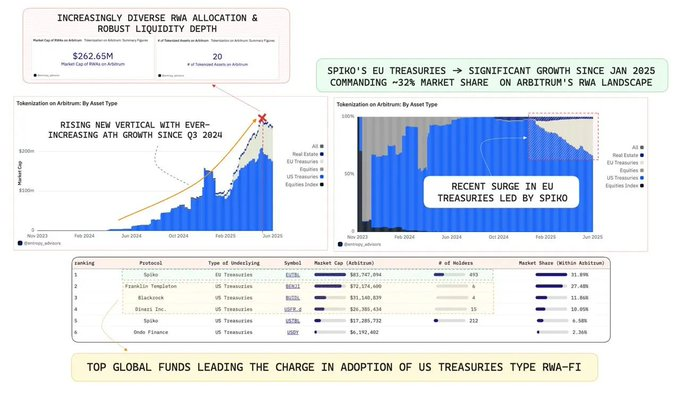

As of the third quarter of 2024, the total locked value (TVL) of Arbitrum's RWA-Fi segment is accelerating to a historical peak of US$262.7 million.

With support from a diverse and growing roster of global fund players, this momentum further solidifies Arbitrum’s position as the enterprise-grade tokenized DeFi space.

It is worth noting that $EUTBL issued by Spiko Finance now leads the EU government bond tokenization market, accounting for about 32% of the market share, surpassing the following competitors:

- $BENJI by Franklin

- BlackRock’s $BUIDL

All this suggests that institutional-level adoption is no longer theoretical.

As institutional giants lead the way, it’s also worth noting the growing diversity within the Arbitrum sub-ecosystem.

This spans RWA integration and DeFi native innovation.

This fusion creates a rich landscape that meets multiple needs:

- Institutional allocators seeking compliant income-generating assets (such as government bonds and credit bond markets)

- Crypto-native users pursuing permissionless leverage, structured products, or long-tail yield strategies

Arbitrum positions itself as an all-inclusive ecosystem by covering two specific user groups:

- The ability to attract capital from all sectors, from DeFi to TradFi.

- Arbitrum's Orbit and Stylus are becoming the core engines of growth in multiple fields, providing the ability to build exclusive chains for vertical scenarios across industries.

This is in line with the "application chain theory", which holds that customization + flexibility are essential to optimizing infrastructure.

The adoption rate of this technical framework is currently increasing rapidly:

- 83 official ecosystem partners

- 41 mainnet launches (up 32% since April 2024)

- 21 testnets + 21 under development

- The total locked value (TVL) of the Arbitrum ecosystem (excluding ArbitrumOne) exceeds $320 million

If this trend continues, the framework will quickly gain recognition from the entire industry as the enterprise-level infrastructure for the new generation of blockchain applications.

Arbitrum is gaining favor from more and more large institutions, and this attention is supported by dual verification at the practical application demand and infrastructure level.

- Global Funds: BlackRock, Franklin Templeton, Invesco, and Wellington Management are building RWA-Fi liquidity

- Infrastructure: Plume Network, Novastro, and re.al are bridging real-world capital to the chain

Today, the final issuance network of traditional finance has begun to emerge:

- Converge is building an institutional-grade settlement layer (e.g. Ethena, Securitize).

- Rayls Labs launches compliant blockchain for banking system

The conclusion is clear: Arbitrum is becoming the infrastructure of choice for real-world institutional deployments.

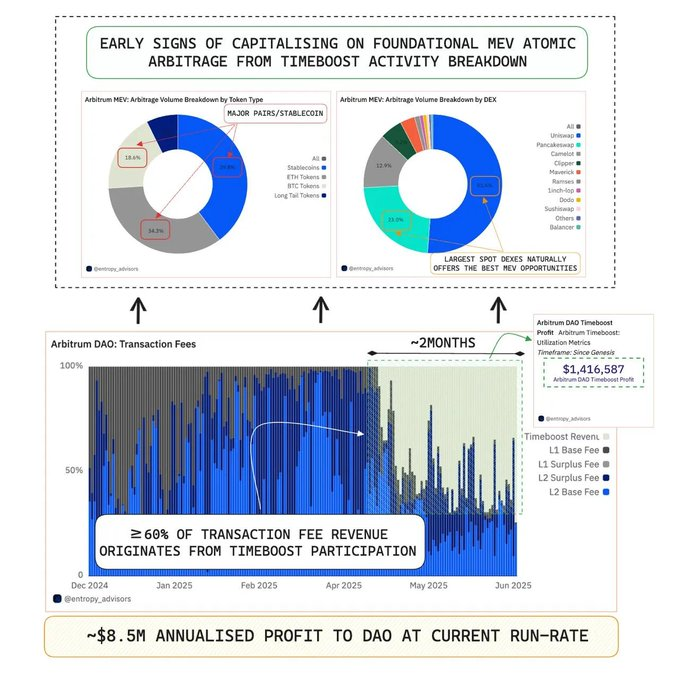

The surge in the MEV phenomenon signals that the ecosystem is moving toward the next stage of mature development.

Arbitrum’s Timeboost auction mechanism introduces an efficient and fair competition model that perfectly mirrors the mainnet’s proposer-builder separation (PBS) model.

- Less than two months after its launch, usage has been quite high.

- 1.42 million DAO income (about 8.5 million annualized)

- Now more than 60% of transaction fee income comes from Timeboost.

We are seeing early signs of MEV atomic arbitrage monetization, with most activity concentrated in high volume trading pairs such as Bitcoin, Ethereum and stablecoins.

I think the next stage of maturity will be marked by long-tail assets taking a larger share of MEV traffic.

Interestingly, Timeboost fast lanes now account for approximately 5% of Aarbitrum’s total transaction volume, and have been on a steady upward trend since their launch.

But even more telling is the volume footprint:

- The current daily trading volume of about $175 million comes from MEV arbitrage

- Arbitrum’s average daily trading volume over the past month was approximately $900 million, of which approximately 21.8% came from the Timeboost fast track

Note that this is significant in my opinion, as it shows that MEV is no longer a fringe phenomenon, but has become a core engine driving substantial trading volume.

As MEV develops into a native revenue stream, this phenomenon not only means the improvement of user maturity, but also indicates that the profit mechanism at the protocol layer has reached a new stage.

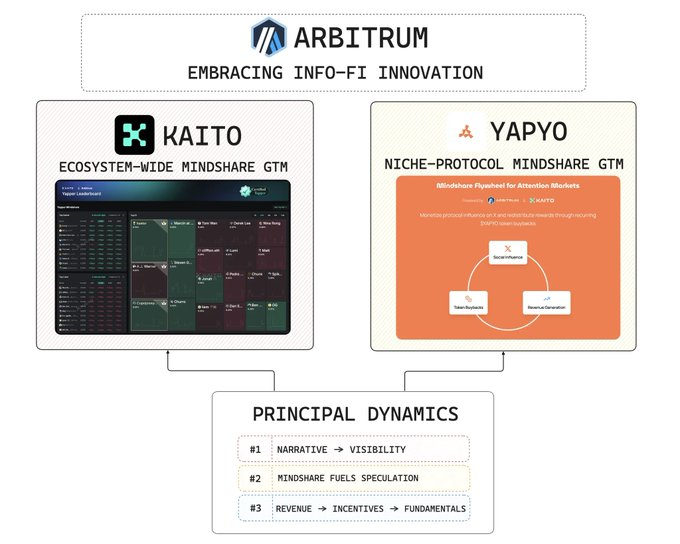

Finally, about the InfoFi application

Arbitrum has attracted attention as a core ecosystem that embraces this narrative, and the recent integration of Yapper rankings with Kaito is a prominent manifestation of this.

The project comes with a 3-month incentive of 400,000 $ARB tokens (approximately $124,000).

Today, an innovative form of second-layer InfoFi is taking shape: Yapyo positions itself as a decentralized consensus hub that blends social collaboration with incentive design.

Details are sketchy but early indications are that $YAPYO is pursuing a niche market entry strategy for a specific protocol, but that’s my personal opinion.

It’s clear from the data that Arbitrum is no ordinary ecosystem.

It has broken through the critical point and is entering a new stage from DeFi to broader on-chain applications.

Its depth of maturity and evolutionary dynamics speak for themselves, so not all chains are playing the same game.

Arbitrum is going its own way.

You May Also Like

UK inflation stays high, potentially pausing interest rate hikes

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future