From NEET subculture to alcohol micro-strategies, here’s a look at the recent hype on the Solana blockchain.

What are the "interesting" targets among the monotonous running water disks?

While the recent trend toward cryptocurrency compliance has been evident, with seemingly every blockchain project being associated with "compliance," "institutions," and "policy trends," the on-chain craze surrounding Memecoin and ICM projects appears far from over. As if to capitalize on the "last wave" of on-chain enthusiasm, various platforms have chosen to deploy their ultimate moves at this time.

BlockBeats has compiled and introduced several of the stocks that have performed well recently.

NEETs who don't work

Neet (not in employment, education, or training) originally referred to young people (specifically those aged 16-24) who were neither employed nor receiving education or vocational training. In millennial Japan, the age range of the term "NEET" was expanded to include those aged 15-34. It became widely associated with the culture of "otaku" and "staying indoors," and for a long time, it was also associated with "staying at home."

As Internet culture spread, the term gradually spread to subculture circles in Europe and the United States, especially anonymous communities (such as 4chan /r9k/ and Reddit). By the 2010s, NEET had gradually evolved into a self-identity and cultural identity of "liberals." From the messages on 4chan, it can be seen that most of them say whatever they want, discriminate against women, discriminate against blacks, and are self-centered. NEET is not necessarily a real identity, but a network personality. People who call themselves "NEET" often emphasize that they are out of touch with the mainstream society, reject social rules, and even "take pride in it." It is both self-deprecating and a kind of "alternative identity."

Neet is widely used on 4chan's /r9k/ subreddit (Robot9000). /r9k/ was originally developed by 4chan founder Christopher Poole in 2008 as a filtering system for original content. Its design was intended to prevent spamming and copypasta, which also contributed to the subreddit's vibrant culture. The screenshot shows a discussion on /r9k+1/ (Robot9001), an improved version of /r9k/.

Although the token's value quadrupled in a single minute when PumpFun founder Alon first bought $NEET, and then quickly plummeted below its pre-purchase market value, its price trend has remained stable. Besides having many "big brothers" who call out orders and a strong community culture, its Twitter presence is also quite strong.

After checking with Cookie, who was the first to call out $neet in the Chinese community, we learned that Primed is responsible for Neet's Twitter operations. Under his and the community's management, accounts within the token system have shifted away from price discussions and focused on promoting cultural trends. Price movements driven by communication itself are far more authentic and healthy than those driven by market manipulation. Excellent communication, a strong community culture, and a supportive team have combined to create a rare "interesting meme" in today's system.

Left: Reached 12 million views, right: Musk forwarded and brought 100 million views

How is Believe's ICM progress?

With the demise of fellow competitors Bags and Heaven, Believe has gradually returned to the forefront of discussion today. Its official token, LaunchCoin, has finally rebounded after a nearly month-long decline. Roy, CEO of Cluely, the recently popular "interview cheating tool" in the AI community, shared a photo with Believe founder Ben Pasternak today, leading the community to speculate on the possibility of some kind of collaboration between the two.

Left: Cluely CEO, Right: Believe Founder

Believe seems determined to abandon concepts such as "100% cost-to-turn the flywheel" and re-establish its positioning as an "ICM platform concept." After he and his girlfriend Evelyn Ha stayed at the extremely expensive "Aman Tokyo" last time, coupled with the slow progress of the platform and the gradual "return to zero" of the ecosystem, various emotions added up to cause some "heated discussions" in the community. Ben seems to have refocused on Believe. First, he directly acquired Abode for a better product UI, and some interesting projects have chosen Believe to issue again. What about the new and old labels that are currently doing well on Believe?

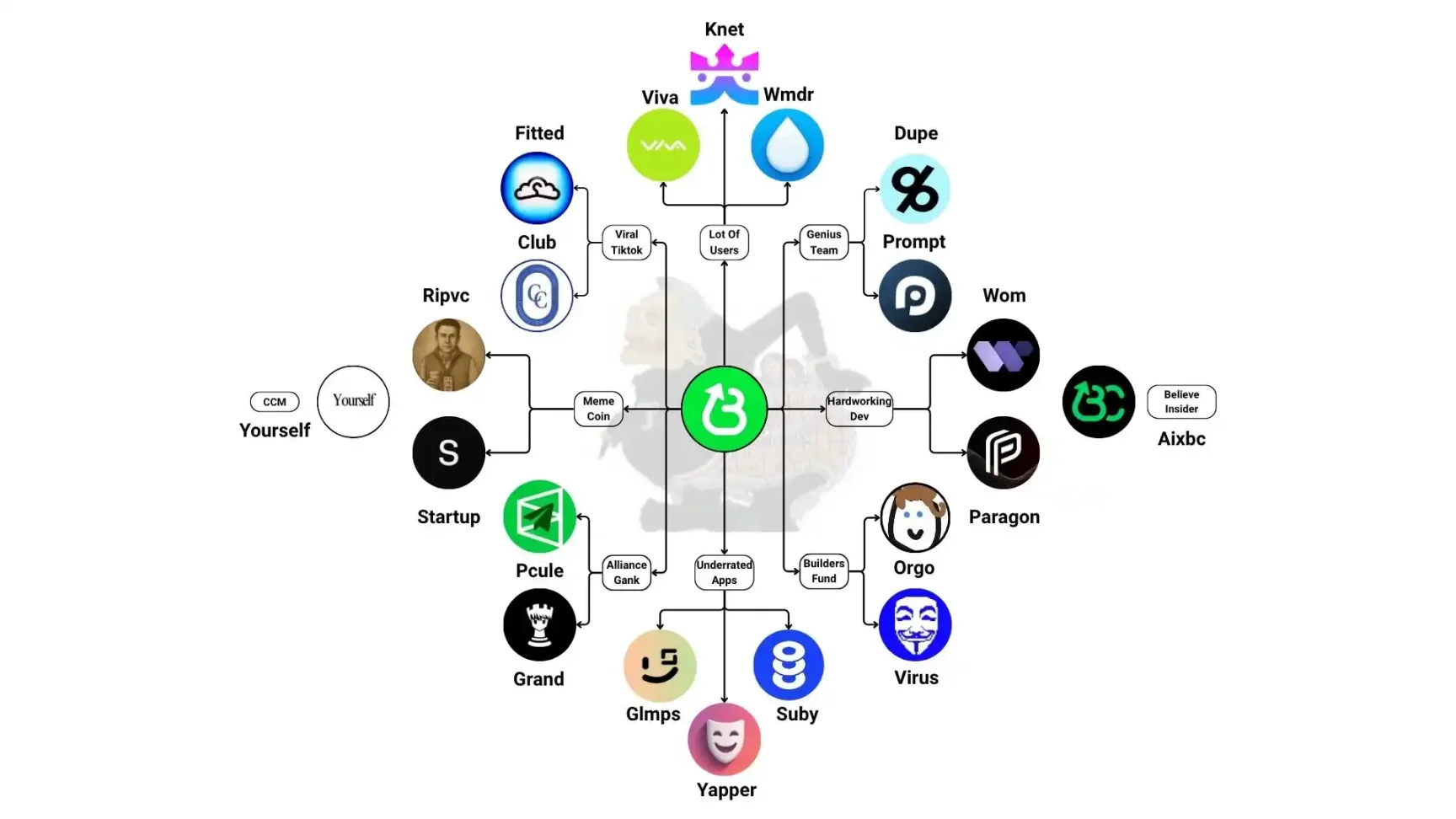

Believe the existing ecosystem. Image source: @PaceTerminal

HUCH: CS2 Skin Lending Platform

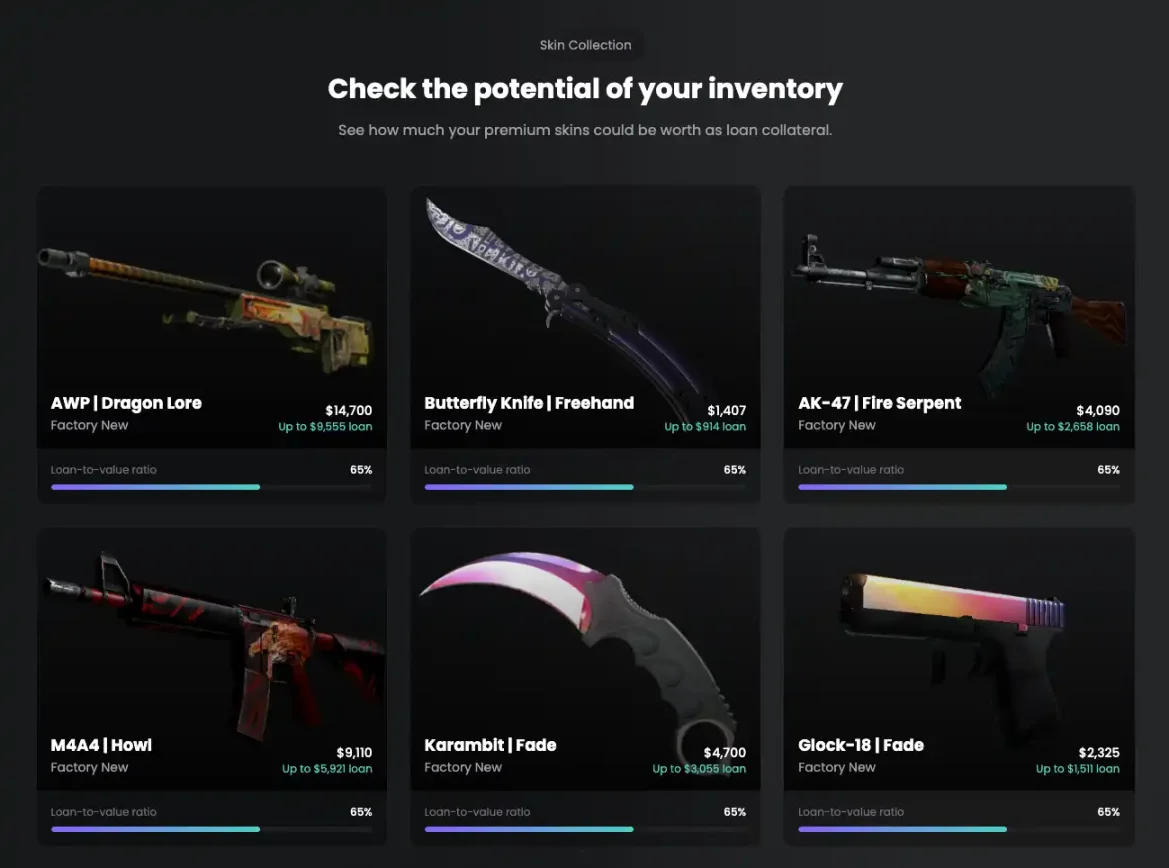

HUCH is an on-chain lending platform for CS2 skins. In July, it won the University Prize in the gaming track of the Colosseum and Solana hackathon. It launched on Believe on August 24th and currently maintains a market capitalization of approximately $1.5 million.

The overall basic concept of the product is actually quite simple. The team believes that Counter Strike 2 skins now have a huge market of nearly billions of dollars, but lack the liquidity to match it. CS2 skins and DeFi products have considerable similarities in financial attributes, so they want to create an on-chain platform that converts game assets into financial instruments through mortgage lending.

The team integrates real-time market data for accurate valuations, and players can use their CS2 skins as collateral to obtain instant cash loans (65% of the value).

Interestingly, before the launch of HUCH, founder Hugo claimed that he sold his Apple computer to promote HUCH and attended a summit event held by the well-known crypto "public office space" Mtn DAO. This was also appreciated by Cobra from the Mtn community, and they discussed in X whether to sponsor him a computer. This proposal received a lot of response from the community, and many team members of the project expressed their willingness to sponsor him.

Kled: AI data transaction matching platform

Kled is an on-chain AI data trading intermediary platform designed to connect AI developers with data copyright holders, providing trading channels for various data types, including video, audio, and text. The project received $2 million in funding from K5 Capital (K5 has previously invested in projects such as Uber and Xai). Founder Avi Patel, a former University of Illinois at Urbana-Champaign dropout, founded the music copyright platform Nitrility in 2023 and launched Kled in 2024.

In the early days, due to contract deployment issues, the $KLED token price plummeted, triggering market panic. However, platform founder Ben (founder of the Believe platform) promptly issued a statement on the X platform to clarify the contract address issue. As the development team continued to update product features, community confidence gradually returned. Kled's market capitalization subsequently rebounded to approximately $10 million, and it was listed on the Moonshot Exchange.

On June 9th, Kled V2 announced its next phase of enterprise contracts, "Kled Pages," and shared partnerships with platforms like YouTube, Twitch, and Google Classroom. It also announced plans for a hackathon with Stanford University and UC Berkeley. This series of developments promises increased B2B revenue and improved scalability for the platform, sparking a surge of fear-mongering (FOMO) within the community and driving the price of $KLED to a new high, reaching a market capitalization of $36 million. After the hype faded, the market capitalization has fluctuated around $10 million, currently trading at $18 million.

Polycule: Polymarket's Telegram trading bot

Polycule is a Telegram trading bot compatible with Polymarket. Users can place orders directly through chat commands, bypassing US access restrictions on Polymarket. This solves the platform's inaccessibility in the US, leading to a $560,000 investment from AllianceDAO. Following Polymarket's official announcement of its partnership with the Telegram bot on X, the platform provides deflationary support for the token by charging a 0.01%–0.05% handling fee on each transaction and setting aside 30% for buybacks and burns.

The decentralized prediction market Polymarket rose to fame for its successful predictions of the 2024 US presidential election, spurring a surge in popularity and trading volume. However, due to regulatory investigations, Polymarket was blocked in the US, preventing US users from directly accessing the platform. This is the context in which Polycule was born – a lightweight Telegram trading bot that connects to Polymarket, allowing users to participate in on-chain YES/NO betting transactions through chat commands without opening a webpage. This bot bypasses domain blockades and allows users to easily participate in prediction markets in regions like the US. By addressing the pain points of Polymarket's mobile and restricted-region use, Polycule secured a $560,000 seed investment from AllianceDAO.

Polymarket officially expressed support for Polycule—its CEO, Shayne, followed the official Polycule account. When a user on X inquired about placing bets via Telegram, Polymarket confirmed the availability of the Polycule bot. This official endorsement propelled the $PCULE token's initial surge. Subsequently, on June 6th, the social platform X announced a partnership with Polymarket, making it an official prediction market partner, integrating Polymarket's data and predictions with content on the X platform. This news pushed the price of $PCULE to a new high.

Polycule currently charges a fee of 0.01%–0.05% per transaction, with 30% used to buy back and burn tokens, providing deflationary support for $PCULE. Leveraging the rise of social trading, Polycule has rapidly expanded its user base, while its fee-burning mechanism has also created a positive feedback loop, driving the token's price upwards.

DAOSFUN limited time return?

Unlike Believe, which focuses on ICM, DAOS.FUN wants to bring the glory of Crypto AI back to the chain.

LLM: Officially endorsed Latino AI memecoin agent

LLM (Latina Language Model) is an AI-themed memecoin issued on the DAOS.FUN platform. Its issuer is none other than the platform's founder, @baoskee. It touts itself as the "first fully autonomous Latino AI agent" character token. Because it shares the same name (and indeed, a similar image) as the ai16z copycat "Large Language Model," the project didn't attract widespread attention during its initial launch, providing a relatively long window for entry.

However, some veteran traders in the Chinese crypto community, such as Noobwillwin and 0xNoNo, got involved early on. According to community information, the founder of LLM reserved approximately 5.14% of the tokens as a holding and also served as an LLM community moderator. This indicates that LLM is not an ordinary community coin, but an AI-backed token endorsed by the official DAOS.FUN team.

Baoskee stated that AI agent technology is experiencing a period of rapid development, and that future application-oriented AI tokens are expected to differentiate themselves from the purely hype of the past "AI season" bubble, driving industry iteration through real products and innovative financial models. While LLM's product offerings haven't demonstrated any significant differentiation from previous crypto AI projects, Baoskee's endorsement has directly boosted its market capitalization to $20 million.

$Drink: A microstrategy for alcohol assets

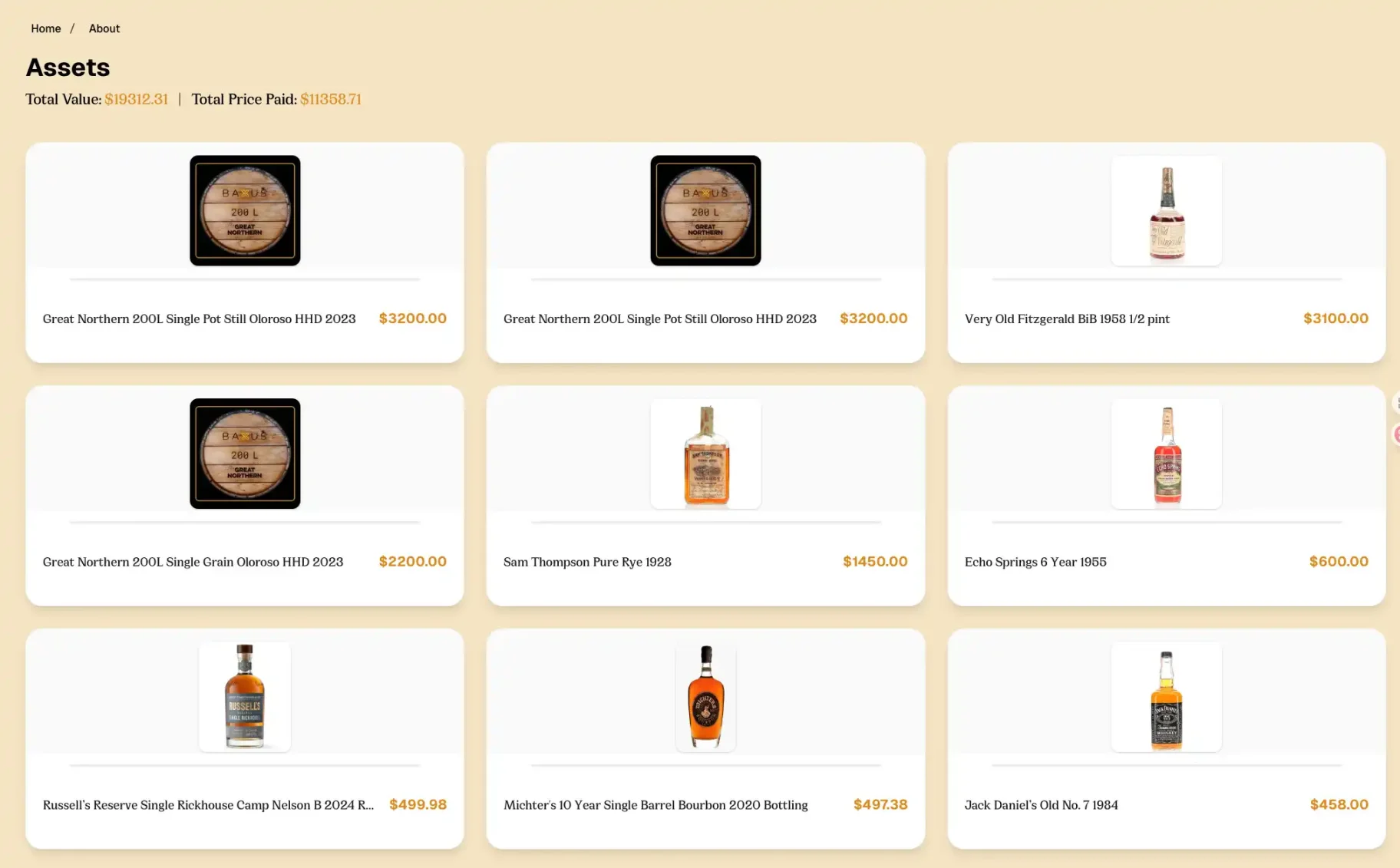

BAXUS is an RWA project featured on the DAOS.FUN platform, recommended by baoskee and renowned investor Mike Dudas. The project builds an on-chain marketplace for high-end whiskey and wine on the Solana network, aiming to address the inefficiency and illiquidity of the traditional high-end wine collector market. On the BAXUS platform, rare bottles receive trusted digital proof of ownership: collectors deliver the physical bottles to Baxus Vault, a professional, temperature-controlled warehouse. Each bottle is scanned with high precision and minted into a unique NFT, serving as on-chain proof of ownership. Buyers and sellers can access the platform globally at any time, accepting a variety of payment methods including credit cards, ACH, wire transfers, and cryptocurrencies/USDC. Users can view real-time price trends, trading volume, and historical data for each bottle. Furthermore, any bottle traded or stored on BAXUS can be withdrawn at any time or remain in the Vault for resale, resulting in transaction efficiency far exceeding that of traditional auctions.

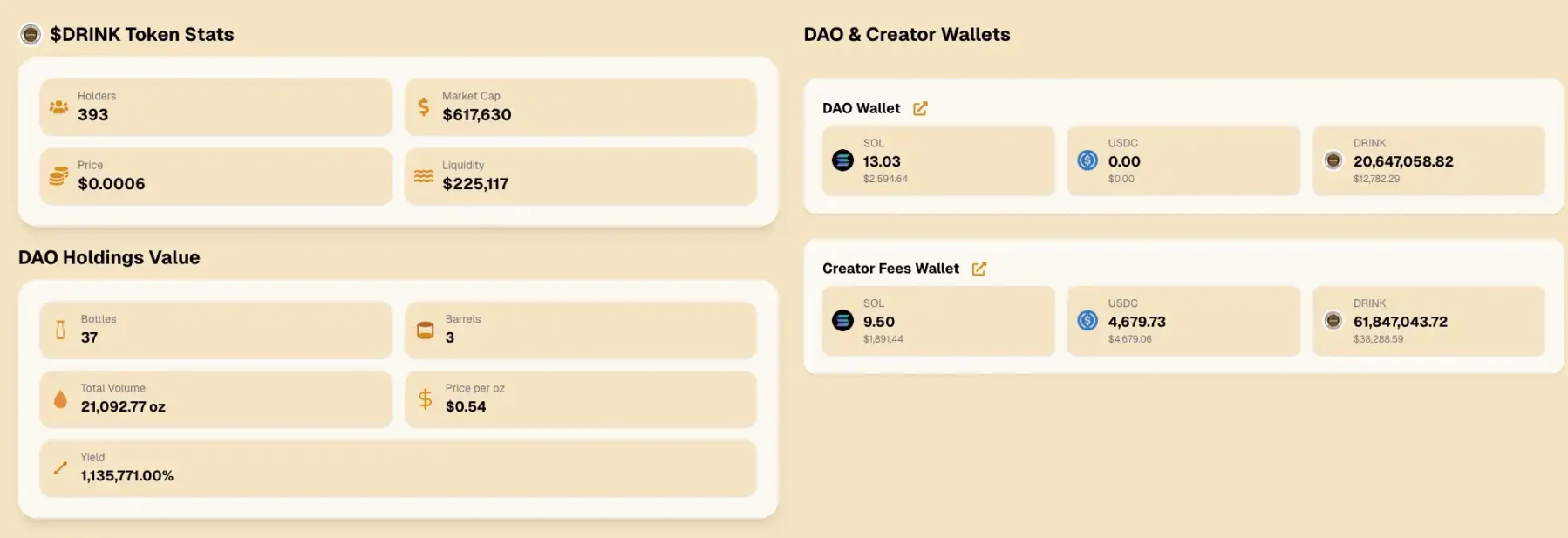

Drink is the token of the DAO organization promoted by the founder of Baxus, who launched an alcohol "micro-strategy" concept

Members of the DAO can choose to vote on the acquisition, management, and ultimate fate of specific bottles or barrels of wine. They can decide whether to sell, hold on to, or share (drink).

When LLM became popular yesterday, Baoskee also took the opportunity to recommend Drink, which caused its price to rise by 100% in a short period of time and is now valued at US$600,000.

You May Also Like

Token allocations on Binance are still a small share of total supply

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings