Here’s why Metaplanet stock price is stuck in a bear market

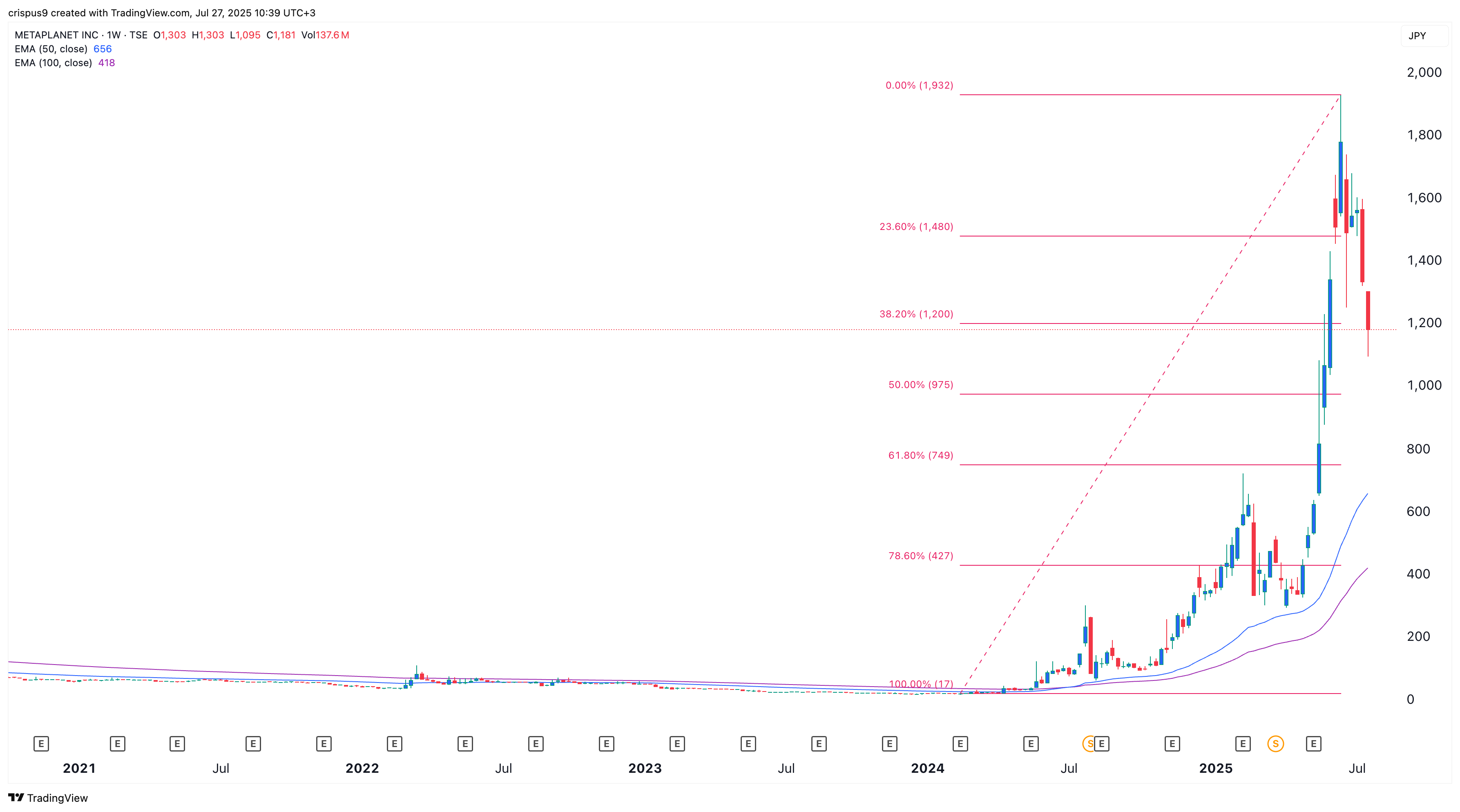

Metaplanet’s stock price has crashed into a bear market this month, falling by nearly 40% from its highest point this year.

- Metaplanet share price has moved into a bear market as Bitcoin hovers near its all-time high.

- A likely reason is that its NAV of 2.79 is higher than that of other companies.

- Technicals point to an eventual Metaplanet stock rebound.

Why Metaplanet stock as Bitcoin jumps

Metaplanet, one of the biggest Bitcoin (BTC) holders, has crashed to ¥1,180, down from the year-to-date high of ¥1,934. It has plunged to the lowest level since June 3rd this year.

Metaplanet stock price has plunged even as its Bitcoin holdings have become more valuable. Data shows that the company holds 16,352 Bitcoin, currently valued at $1.9 billion.

The average cost of its Bitcoin purchases was $99,502, meaning that its holdings have jumped by almost 20%.

There are three possible reasons why the stock has crashed in the past few weeks. First, there are concerns that its business has become highly overvalued this year. It has a net asset value or NAV multiple of 2.79, much higher than other similar companies.

For example, Strategy, the OG of the Bitcoin treasury companies, has a NAV multiple of 1.6. Other companies like Marathon Digital, Riot Platforms, and Semler Scientific have a NAV multiple of less than 2.

Second, Metaplanet stock price has crashed, possibly because of the ongoing stock dilution. Like Strategy, the company has issued stock to buy Bitcoin. While this strategy is sound and its investors are better off, there are concerns about continued dilution as it aims to have 100,000 coins.

Data show that the company’s outstanding shares are 459 million, significantly higher than the 57 million reported in 2022.

Third, Metaplanet stock underperformance has mirrored that of other Bitcoin treasury companies. For example, the MSTR stock price remains 25% below its all-time high, even as Bitcoin hovers near its all-time high.

Finally, Metaplanet’s stock price has dived, possibly as investors book profits after the recent surge. At its all-time high, the stock was up by over 12,900% from its lowest level in 2024. It is common for an asset to pull back after a major rally.

Metaplanet share price technical analysis

The weekly chart shows that the Metaplanet stock price has plummeted from ¥1,932 in June to ¥1,150 as of today. It has moved to the 38.2% Fibonacci Retracement level at ¥1,200.

On the positive side, the stock remains much higher than the 50-week and 100-week moving averages. It has also formed a hammer candlestick pattern, comprised of a small body and a long lower shadow.

Therefore, there is a likelihood that the Metaplanet share price will rebound, especially if Bitcoin price rebounds.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Coinbase Joins Ethereum Foundation to Back Open Intents Framework