How To Trade Bitcoin Into September FOMC, Top Analyst Reveals

With the Federal Reserve set to announce policy on Wednesday, September 17, a closely followed trader has laid out a precise, level-by-level playbook for navigating Bitcoin’s next move. In his weekly “Market Outlook #51,” published on September 15, Nik Patel (@cointradernik) for Ostium Research maps out both long and short triggers around a tight cluster of resistance at $117.5k–$120k and a “line in the sand” support at $112k—frameworks he argues should contain BTC’s path through the FOMC and into quarter-end.

How To Trade Bitcoin Into September FOMC

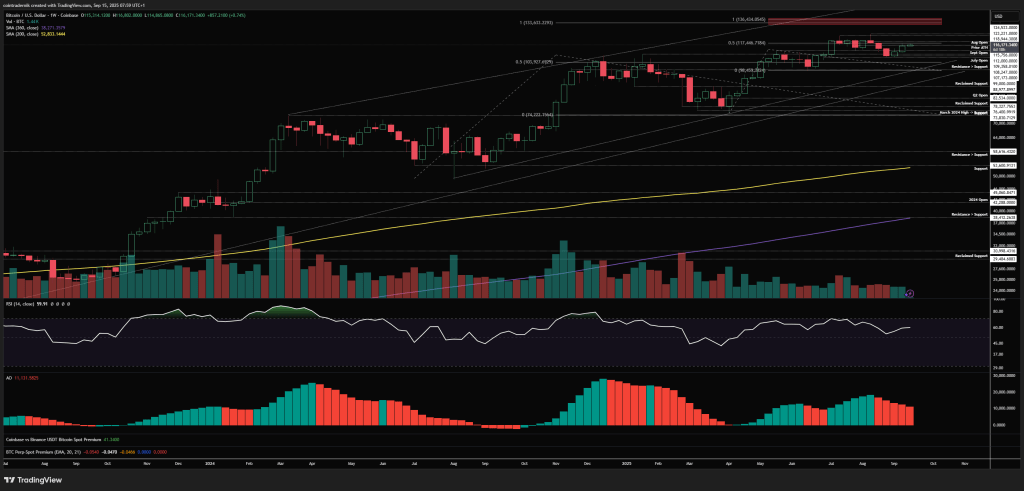

Nik’s higher-timeframe read starts with a strong weekly close that reclaimed the August open near $115.3k and, crucially, kept price above $112k. “This is now the line in the sand for short-term bullishness,” he writes, warning that a weekly close back below would reopen the route to July’s local lows around $107k and, in a deeper flush, the $99k swing low. To the upside, he highlights $117.5k as the next inflection; a clean acceptance over $120k would set up a swift run at all-time highs, where $123k is the first major cap on the daily timeframe.

Into the event, his directional bias remains conditional rather than dogmatic. On the long side, he favors a liquidity sweep early in the week: “On the long side you want to see a sharp flush lower… into $113.5k, where you could layer bids with invalidation on a daily close below $112k,” aiming for a reaction back to $117.5k (TP1) and $119k (TP2) into the FOMC.

Conversely, if BTC grinds higher without that flush, his short plan is to “short above $119k pre-FOMC,” then “add… on acceptance back below $117.5k post-FOMC,” with $112k as the first target and scope to trail for lower lows if structure weakens. The trader concedes the next couple of weeks are “a lot more unclear… with many variables,” but his base case still envisions “the second half of Q4 will be very strong.”

The setup lands as BTC churns around $115k ahead of the decision—a zone multiple analysts have framed as pivotal. Heading into the weekly close, market commentary stressed that a sustained reclaim of ~$114k is a prerequisite for renewed momentum, with one widely tracked technician arguing, “The goal isn’t for Bitcoin to break $117k… The goal is for Bitcoin to reclaim $114k into support first.” Over the weekend and into Tuesday, BTC’s price action remained pinned in that band, keeping both the upside break toward $119k–$123k and the downside sweep into $113.5k–$112k on the table.

Macro context heightens the stakes. Markets broadly expect the Fed to cut its policy rate by 25 bps on September 17, shifting the target range from 4.50% to 4.25%—a baseline Nik explicitly builds into his calendar.

Yet traders are equally focused on Chair Jerome Powell’s guidance and the updated “dot plot,” which will shape the path for additional cuts into year-end. While a cut is priced, the tone—whether the Fed signals a shallow or accelerated easing path—could be the catalyst that resolves BTC’s tight $114k–$119k coil.

Positioning provides further texture to Nik’s plan. He flags three-month annualized basis and the split between Bitcoin and altcoin open interest, along with concentrated one-week and one-month liquidation pockets just below spot and above the recent range highs—context for why he prefers either reactive longs on a downside flush or fades into strength near $119k–$120k if derivatives chase the move. The framework leans heavily on acceptance/rejection around well-defined levels rather than attempting to front-run the policy outcome itself.

Bottom line: in the Ostium playbook, bulls want a controlled dip that holds $112k on a daily closing basis and then forces a reclaim of $117.5k on the way to $119k–$123k; bears get their best shot if price runs late into $119k–$120k pre-FOMC and then loses $117.5k on the reaction. With BTC glued to the mid-$110ks and the market already bracing for a quarter-point cut, the catalyst may come down to Powell’s nuance.

At press time, BTC traded at $115,427.

You May Also Like

Swift and Standard Chartered Launch Blockchain Ledger for Global Tokenized Finance

Vitalik Buterin Expresses Total Support For Tornado Cash Co-Founder Roman Storm