Huione crypto laundering network thrives despite supposed shutdown and regulatory sanctions: Chainanalysis

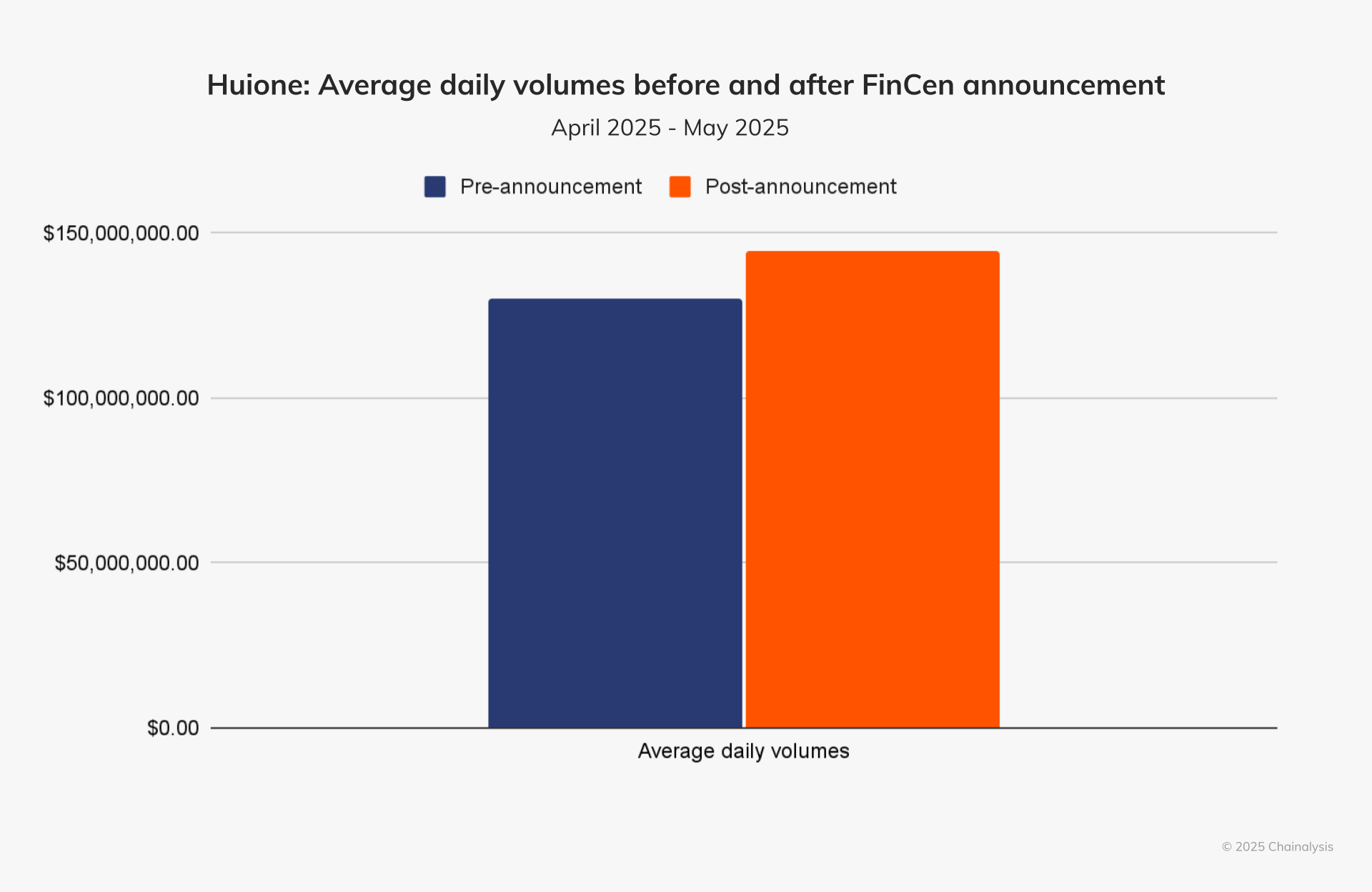

Crypto laundering network Huione continues to operate at scale, with its transaction volumes increasing even after FinCEN had designated it a primary money laundering concern.

Despite reports of its shutdown and removal of its website and Telegram channels, the Chinese-language crypto laundering platform Huione continues to operate at scale. According to Chaianalysis data, Huione’s transaction volumes have increased even after the May 1 announcement by FinCEN designating it as a primary money laundering concern under the USA PATRIOT Act.

This marks FinCEN’s second use of Sections 311 and 9714 against crypto-related illicit finance, after targeting the Bitzlato exchange. Section 311 allows regulators to isolate bad actors quickly without court approval. Although the rule is not yet final, U.S. banks typically cut ties immediately upon announcement to avoid regulatory risk. This likely cut Huione’s access to U.S. dollars from that day, but transaction data shows little to no disruption to its operations.

As reported by Chainalysis, Huione resurfaced under a new domain, Huione.me, retaining its old branding and active social media presence, including Telegram channels where user engagement remains strong. The platform continues to list its linked token XOC and stablecoin USDH for trading.

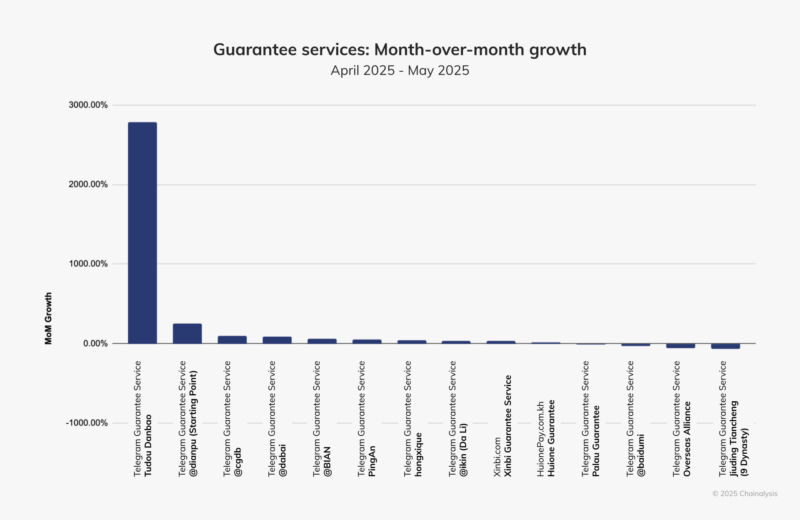

After Huione’s supposed shutdown, none of the other guarantee services could match its scale or transaction volume. While a few platforms, such as Tudou Danbao, saw temporary spikes in activity, these increases are marginal compared to Huione’s continued operations. This suggests that users have largely stayed within Huione’s laundering network rather than migrating elsewhere.

According to Chainalysis, Huione’s persistence highlights the limits of fragmented enforcement. Disrupting networks like this demands coordinated, cross-border action and real-time intelligence sharing. Blockchain analytics will be key to closing the gaps traditional methods can’t reach.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Why Is Crypto Up Today? – September 23, 2025