Hut 8 (HUT) Stock: Bitcoin Miner Rallies 10% on Major U.S. Expansion Plans

TLDR

- Hut 8 stock rallied 10% after announcing four new U.S. mining sites in Texas, Louisiana and Illinois

- The expansion adds over 1.5 gigawatts of power capacity, more than doubling total capacity to 2.5 GW across 19 locations

- Company plans to raise up to $2.4 billion in liquidity using bitcoin holdings, credit lines and equity offerings

- Investment bank Roth Capital says the move could “materially re-rate the stock”

- New facilities will target energy-intensive uses including bitcoin mining and AI workloads

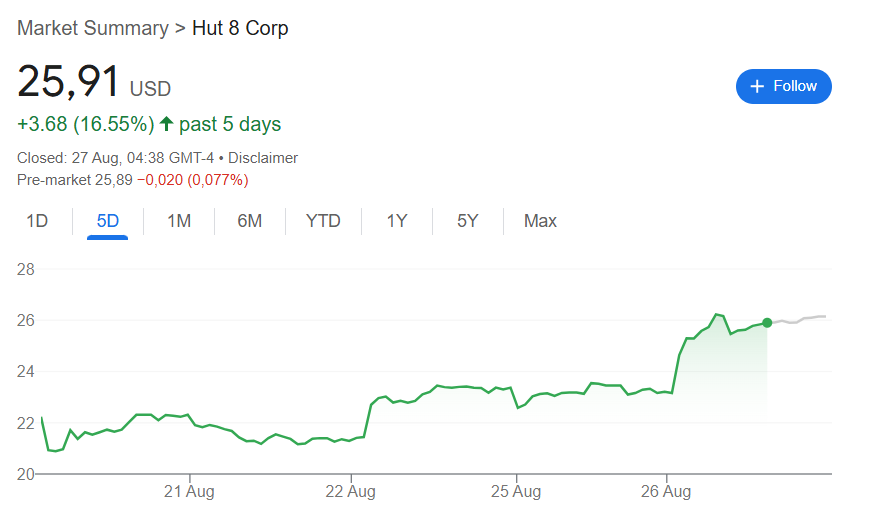

Hut 8 shares jumped 10% Tuesday after the bitcoin mining company announced plans for four new U.S. sites. The stock hit a seven-month high near $26 per share.

Source: Google Finance

Source: Google Finance

The expansion will add more than 1.5 gigawatts of power capacity across Texas, Louisiana and Illinois. This represents a major scale-up that will more than double the company’s total capacity.

The company moved these projects from “exclusivity” to “development” status. This means Hut 8 has secured land and power deals for the sites.

The firm is now working on design and commercialization phases. Current capacity of 1 gigawatt is already 90% utilized.

The new facilities target “energy-intensive use cases” including bitcoin mining and AI workloads. They could also support high-performance computing and industrial applications.

Financing Strategy

Hut 8 plans to raise up to $2.4 billion in liquidity to fund the projects. The financing will come from multiple sources across the company’s portfolio.

The company holds 10,000 bitcoin worth roughly $1.1 billion. It plans to borrow against this crypto stash as part of its funding strategy.

Hut 8 has access to a $200 million revolving credit line. An expanded $130 million facility from Coinbase provides additional capital.

The company recently launched a $1 billion at-the-market equity offering. This gives another avenue to raise funds as needed.

Market Response

Roth expects the stock to benefit as the new sites come online. The facilities will likely be contracted for AI and high-performance computing work.

Canaccord also raised its price target on the stock. The firm cited expected growth from increased capacity and geographic diversification.

U.S. miners control 75.4% of the global hashrate according to fintech platform OneSafe. In 2024, crypto mining created over 31,000 jobs in the United States.

The expansion comes as data center companies see renewed investor interest. Demand for computing power continues growing as AI applications expand.

Google recently took a minority stake in bitcoin miner TeraWulf. That deal was part of a $3.2 billion AI infrastructure agreement.

Hut 8 stock has gained 2.95% year-to-date despite recent volatility. The company maintains a current market cap of C$3.43 billion.

The post Hut 8 (HUT) Stock: Bitcoin Miner Rallies 10% on Major U.S. Expansion Plans appeared first on CoinCentral.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)