Hyperliquid (HYPE) Price Prediction: Reclaiming Key Support at $44 Could Ignite a Breakout Towards $65

Hyperliquid is shifting from correction to recovery. Following a sharp pullback that tested market conviction, the project now finds itself backed by stronger fundamentals, rising user activity, and steady liquidity inflows. This alignment of on-chain strength and improving sentiment is laying the groundwork for what could be the next major leg higher in HYPE’s cycle.

On-Chain and Fundamental Strength Behind HYPE

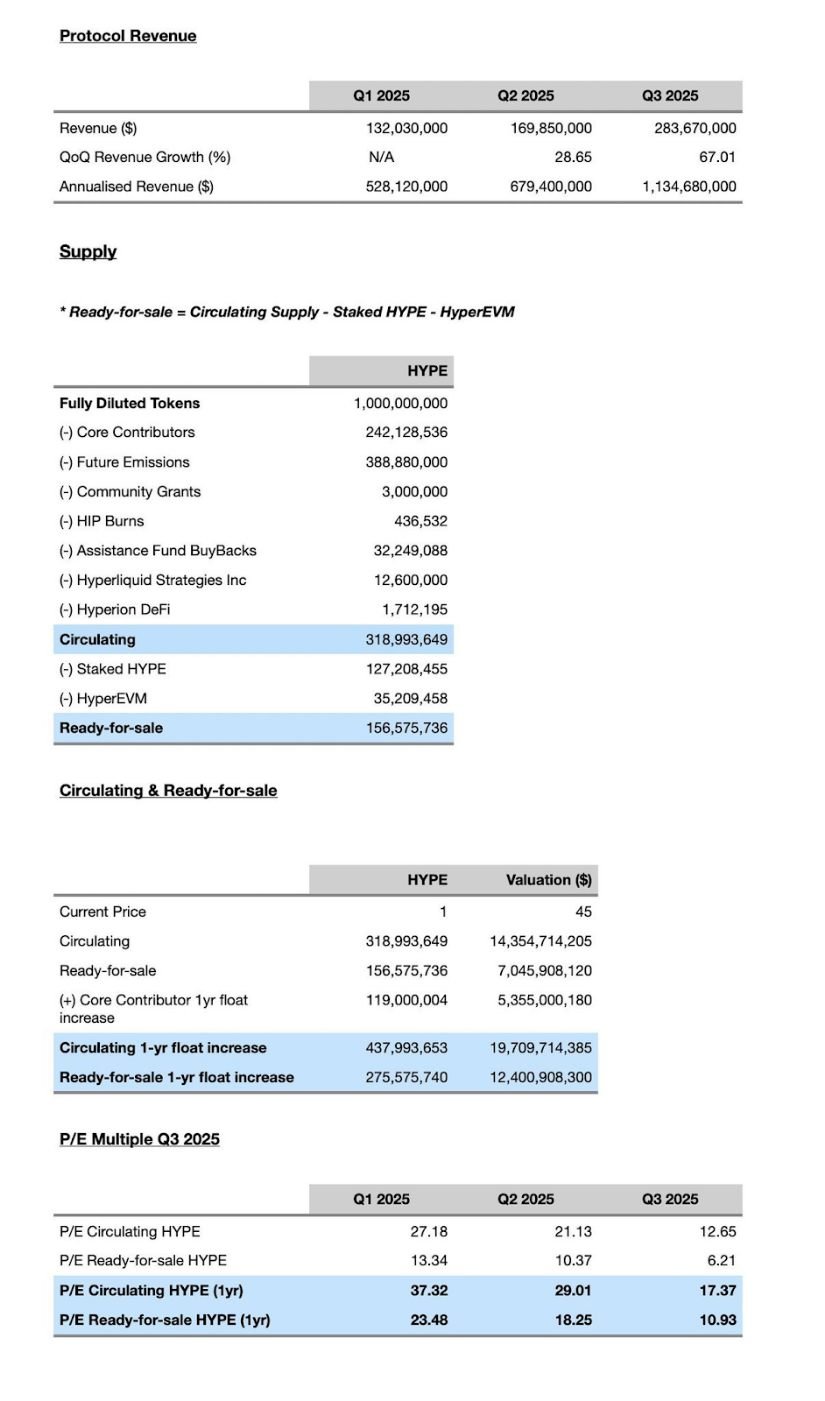

Arete Capital’s latest valuation report paints a strong picture for Hyperliquid going into 2026. The firm forecasts annualized revenue of $1.87B by the end of FY26, a 65% growth projection driven by Builder Codes, HyperCore, and the HIP-3 markets. Moreover, the HYPE team has allocated over $305M for strategic buybacks and ecosystem development, shrinking the ready-for-sale float to around 220M HYPE.

Hyperliquid’s fundamentals strengthen as revenue projections surge and strategic buybacks tighten token supply. Source: Arete Capital via X

Such data points suggest a tightening supply dynamic alongside growing revenue, a powerful combination that strengthens Hyperliquid’s long-term investment thesis. At $45, HYPE trades at less than 10x projected 2026 earnings, a valuation gap that could easily narrow once broader market conditions improve.

On-Chain Growth and User Expansion Accelerate

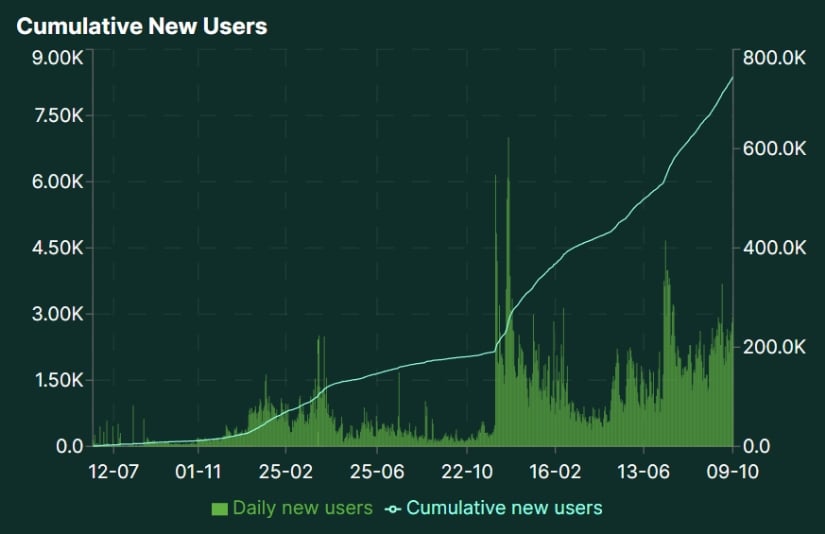

Hyperliquid’s user growth curve continues to steepen, with daily active users and new account creation hitting record highs. The cumulative user chart shows a sharp acceleration since mid-September, coinciding with rising trading volumes and consistent on-chain transaction throughput.

Hyperliquid’s user base and transaction activity reach record highs, signaling accelerating on-chain adoption. Source: Vlad Pivnev via X

This combination of growing user demand and strong ecosystem utility highlights that the project’s fundamentals are evolving faster than price action reflects. While upcoming unlocks in November may introduce some temporary volatility, long-term data continues to point towards sustainability.

Technicals Reinforce Recovery Setup

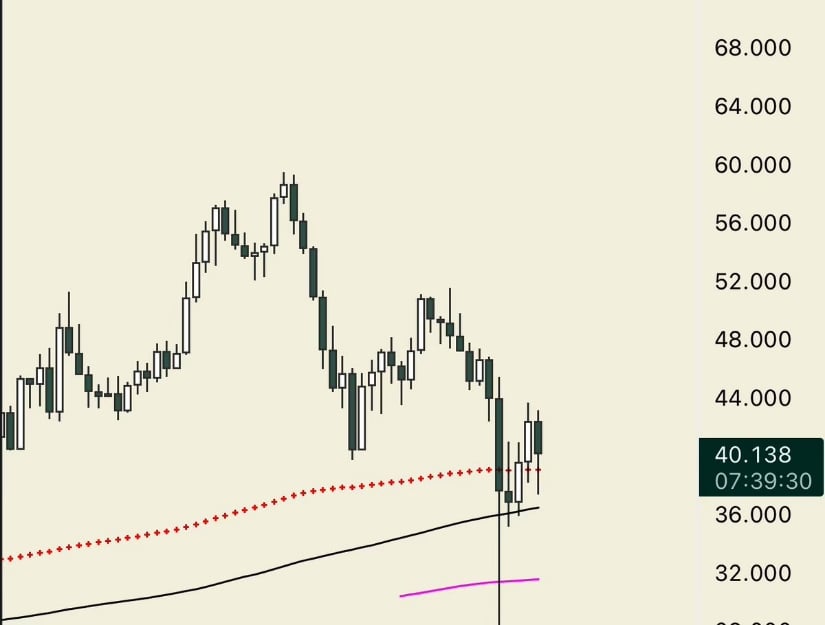

After a -46% drawdown from local highs, HYPE has reclaimed the $44 swing low, signaling early signs of technical recovery. McKenna noted that this level now acts as pivotal support, marking a potential base for continuation higher. The rebound follows a clear liquidity sweep below prior lows, a move that often precedes trend reversals when accompanied by rising spot demand.

Hyperliquid reclaims key support at $44, forming a potential base for continuation amid rising spot demand. Source: McKenna via X

The next confirmation zone sits between $48 and $52, where a close above would likely trigger further upside momentum. Structurally, this setup shows early strength returning after a breakdown, with price reestablishing higher-timeframe support.

Key Indicators Point to Strengthening Momentum

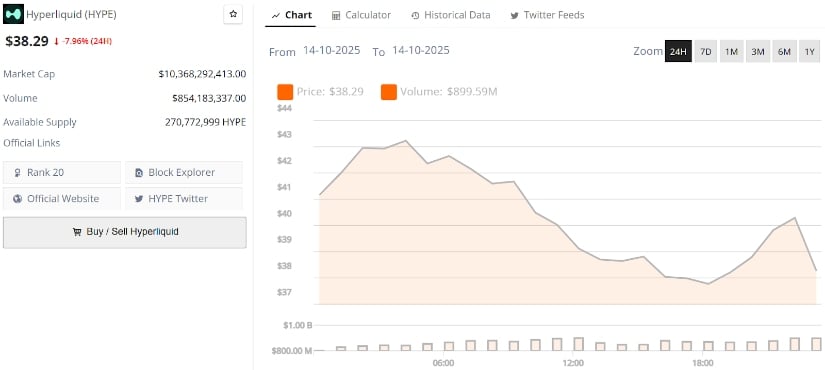

Momentum confirmation continues to build through moving averages. HYPE’s price has successfully retested both the 200-day MA and 200-day EMA, currently hovering near the $38 to $40 range, a zone that’s acting as dynamic support.

Hyperliquid holds above its 200-day MA and EMA. Source: mo_xbt via X

As long as HYPE sustains above these moving averages, the broader bias remains constructive. A clean close above $48 to $50 would reaffirm the recovery narrative and potentially open the door towards the $60 to $65 range.

Hyperliquid Price Prediction Outlook

Market sentiment around Hyperliquid continues to firm up, supported by improving liquidity flows and consistent spot accumulation. The community’s confidence has strengthened notably after Rushi’s projection that HYPE could reach $200 by the end of the year, a target that, while bold, aligns with the project’s tightening token supply and strong earnings trajectory.

Hyperliquid’s current price is $38.29, down -7.96% in the last 24 hours. Source: Brave New Coin

The combination of healthy fundamentals, long-term investor conviction, and technical recovery patterns gives this Hyperliquid Price Prediction a foundation beyond mere speculation. If momentum continues to build above key support zones and volume sustains through the next leg, HYPE could indeed emerge as one of Q4’s standout performers in the broader crypto landscape.

Final Thoughts

Hyperliquid’s recovery phase appears to be building real traction, with price defending the 200-day MA/EMA zone and showing renewed strength around $40. The structure now favors continuation as long as these levels hold, supported by clear fundamental tailwinds and growing on-chain participation.

While volatility may persist, the broader setup remains constructive. A decisive move above $50 could mark the start of a sustained uptrend towards higher valuation zones, keeping the $200 target from Rushi’s HYPE Price Prediction in sight for long-term participants.

You May Also Like

Xsolla Expands MTN Mobile Money Support to Congo-Brazzaville and Zambia, Enhancing Access in Fast-Growing Markets

iGMS Introduces AI-Driven Pro+ Plan, Cutting Host Workloads by Up to 85%