Kanye West’s Yeezy Meme Coin Surged by 35,000% in 24 Hours, Hyping Projects Like Token6900

The token gained traction extremely fast, surging to over $3.1 per coin in the first few hours after launch, then crashing to abysmal levels shortly after.

The coin trades at $0.6733 at the time of writing, down over 40%, with a 24-hour trading volume 85.92% in the red. The community sentiment is 74% bearish, so things aren’t looking great.

Source: Coinmarketcap

However, this isn’t necessarily the final word on $YZY. This type of price swing is common with celebrity tokens, which feed on hype post-launch, cool down, then sometimes rebound to more realistic price points.

What Does $YZY’s Performance Tell Us About the Meme Market?

$YZY’s dramatic performance hasn’t really surprised anyone, except perhaps this FOMO-drunk whale who poured 1.55M $USDC into almost 1M $YZY just as the coin started to drop, resulting in a $500K loss in just 2 hours.

This is a typical pattern in the meme coin game, with Trump’s $TRUMP being the perfect example. The coin pushed to an ATH of over $45 shortly after launch before losing 50% of its value in just five days.

The crash continued, such that $TRUMP is trading at just $8.44 now.

Despite this, $TRUMP still shows regular signs of activity, with a 60% boost in the 24-hour trading volume and evidence of a prolonged consolidation phase in the $8-$9 range.

$TRUMP could still see exciting action in the context of Trump’s GENIUS Act. Which brings us to the power of meme coins: their latent potential and ability to bounce back on a whim.

Meme coins can lie dormant for months or years before a single event defibrillates them and pumps them up the charts.

Dogecoin is the perfect example, after being in purgatory for almost seven years before one day exploding for a massive 16,709% rally from $0.003388 to $0.5695 over the span of 30 days.

The coin is still trading at $0.2186 today, which represents a growth of 171,113% from its 2014’s $0.0001261.

$SPX is an even juicier example with a 49,042,580.17% all-time growth rate after sitting relatively still between 2023 and 2024. The coin now trades at $1.30, a 19,045% boost from its 2023 price of $0.006738.

The latest contender for outsized, irrational gains is Token6900.

How Token6900’s Void Ecosystem Sucks in Investors

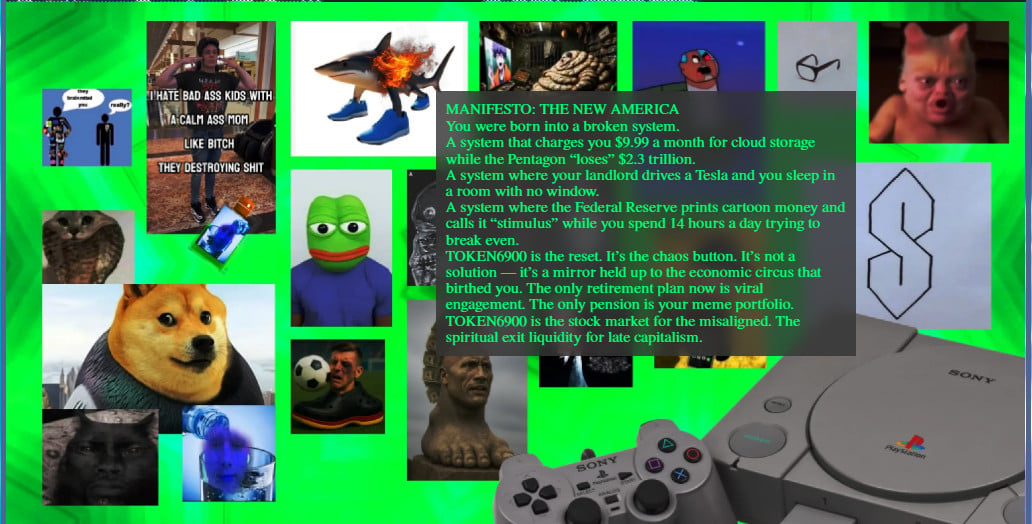

Token6900 ($T6900) follows in the footsteps of SPX6900, offering the same experience of degenerate trading and chart sniffing from mom’s basement.

As the project states in its litepaper that:

We one-upped SPX6900, added one extra token for the flex, and launched a fixed-supply ERC-20 through a hardcapped public presale that pays staking rewards in the Brain Rot Vault

—Token6900, Official Litepaper

As expected of a meme coin in the purest sense, it doesn’t have any real fundamentals, makes no promises, and offers little more than collective delusion and a hub of trading degeneracy.

The goal? To unite terminally online traders on a quest to bring about the disintegration of the traditional financial system. In the process it aims to match and even exceed SPX6900’s chart performance through unbridled brain-rot finance.

The signs are already there. The project’s presale has raised $2.36M, with $T6900 priced at $0.00705. This means the presale is almost 50% to its goal of $5M, after which $T6900 hits CEXs with the launch price of $0.007125.

Post launch, if all goes to plan, we could see $T6900 push up to $0.033696 by the end of 2025, for a 378% ROI. You can read our full price prediction for $T6900 right here for more hints.

If you’re brave enough to dive into Token6900’s brain-rotted ecosystem, learn how to buy $T6900 here, and get your tokens while they’re hot.

Will $YZY Recover?

The world of meme coins is characterized by uncertainty, and the Yeezy coin is no exception. It’s important to approach this space with caution, knowing that unpredictability is part of the deal.

That said, monitor the market and keep your eyes peeled for upstart projects like Token6900 (T6900), which could explode like YZY MONEY when it hits exchanges.

This isn’t financial advice. Do your own research (DYOR) and invest responsibly.

You May Also Like

Taiko Makes Chainlink Data Streams Its Official Oracle

Kalshi Prediction Markets Are Pulling In $1 Billion Monthly as State Regulators Loom

![[Pastilan] End the confidential fund madness](https://www.rappler.com/tachyon/2024/05/commission-on-audit-may-28-2024.jpg?resize=75%2C75&crop=301px%2C0px%2C720px%2C720px)