MARA Holdings Reaches 52,850 Bitcoin Worth Over $6 Billion

The Miami-based Bitcoin mining company revealed these numbers in its September 2025 production update, marking a significant milestone in corporate Bitcoin adoption.

The company trails only Strategy (formerly MicroStrategy), which holds 640,031 bitcoins. With Bitcoin trading above $114,000 in early October 2025, MARA’s holdings represent a major bet on cryptocurrency as a treasury asset.

Production Keeps Growing Despite Challenges

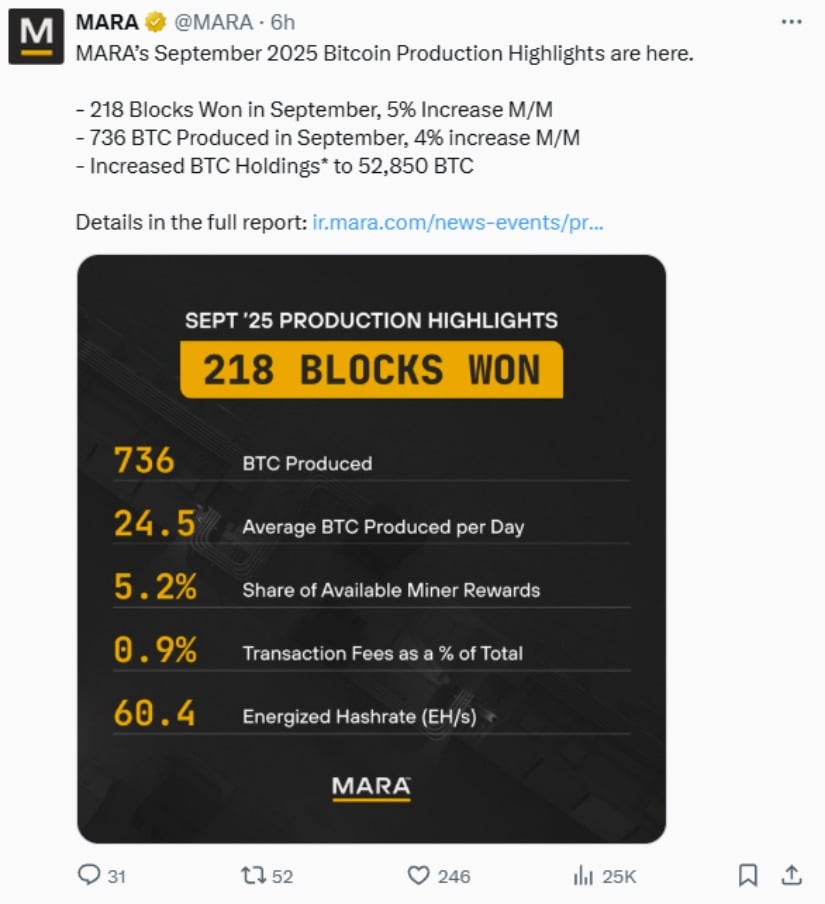

MARA mined 736 Bitcoin in September, a 4% increase from August. The company won 218 blocks on the Bitcoin network, showing a 5% monthly improvement. These gains came even as global mining competition intensified, with the worldwide hashrate jumping 9% to an average of 1,031 exahashes per second.

“This growth in production underscores our ability to execute consistently, even as mining becomes more difficult,” said Fred Thiel, MARA’s chairman and CEO, in the company’s official statement.

MARA’s energized hashrate reached 60.4 EH/s by month’s end, reflecting ongoing expansion of its mining infrastructure. The company maintained 99% fleet uptime during September, demonstrating operational reliability.

Rapid Treasury Expansion in 2025

MARA has accelerated its Bitcoin accumulation throughout 2025. The company held just 47,531 BTC in March, meaning it added over 5,300 bitcoins to its treasury in six months. This growth came through both mining operations and strategic purchases.

Source: @MARA

Here’s how MARA’s holdings grew:

- March 2025: 47,531 BTC

- May 2025: 49,179 BTC

- July 2025: 50,639 BTC

- September 2025: 52,850 BTC

The company did engage in some Bitcoin sales during September as part of its “digital asset management activities,” according to its disclosure. However, mining production more than offset these sales, resulting in net growth.

CEO Fred Thiel has emphasized that MARA treats Bitcoin as a productive asset rather than letting it sit idle. “Unlike passive treasury companies, we treat our bitcoin as a productive, risk-managed asset,” Thiel explained in an August press release. The company uses its holdings to strengthen its balance sheet and fund operations.

Infrastructure Investments Pay Off

MARA’s production gains stem from major infrastructure improvements. At the company’s Texas wind farm, all mining containers and equipment are now fully deployed and connected. This facility is on track to reach full operational status in the fourth quarter of 2025.

The company’s Hannibal, Ohio site now operates at 100% capacity with 86 megawatts online. MARA plans to add another 14 megawatts by year-end. Since taking full control of this location, the company increased uptime to 99%.

These renewable energy projects serve dual purposes. They reduce MARA’s operating costs while supporting the company’s goal of sustainable Bitcoin mining. The Texas wind farm specifically helps MARA mine Bitcoin using clean energy sources.

Market Position and Competition

MARA’s 52,850 Bitcoin holdings place it far ahead of other public mining companies but well behind Strategy’s massive position. Strategy has pursued an aggressive Bitcoin acquisition strategy for years, using convertible debt and stock sales to fund purchases.

Michael Saylor predicted in December 2024 that MARA could become the next Bitcoin company to join the Nasdaq 100 index. This would follow Strategy’s historic inclusion in the prestigious index.

MARA’s market capitalization stood at approximately $6.74 billion as of early October 2025. The company’s stock has gained ground alongside Bitcoin’s price appreciation, with shares climbing 20% over the past month.

Other companies are starting to follow the Bitcoin treasury model. Adam Back’s Bitcoin Standard Treasury Co. is preparing to go public with plans to accumulate more than 50,000 BTC, which could challenge MARA’s second-place position.

The Bitcoin Treasury Trend Grows

MARA represents part of a broader movement of public companies adding Bitcoin to their balance sheets. This strategy gained traction after Strategy pioneered the approach in 2020. Companies view Bitcoin as a hedge against inflation and a superior store of value compared to traditional cash reserves.

Recent U.S. Treasury guidance has made this strategy more attractive by clarifying that certain unrealized gains on digital assets don’t count toward corporate minimum taxes. This provides tax benefits for companies like MARA that hold large Bitcoin positions.

The company emphasizes its role in national digital infrastructure. By mining Bitcoin and holding it as a treasury asset, MARA positions itself at the intersection of digital finance and energy management.

MARA differs from pure treasury companies by actively mining new Bitcoin rather than only buying it on the open market. This dual approach of mining production and strategic accumulation allows the company to grow holdings while controlling costs through operational efficiency.

Looking Forward

MARA continues expanding its mining operations across multiple locations. The company targets sustained production growth through infrastructure investments and energy optimization. With facilities in Texas, Ohio, and international locations, MARA maintains geographic diversification.

The company’s Bitcoin holdings now exceed the $6 billion mark, a milestone that reinforces its commitment to the cryptocurrency. As Bitcoin prices fluctuate, the value of these holdings will change, but MARA’s strategy focuses on accumulating more Bitcoin rather than maximizing short-term dollar value.

Whether other public companies follow MARA’s lead remains to be seen. For now, the company stands as the second-largest institutional Bitcoin holder, trailing only Strategy’s dominant position.

The Bottom Line on MARA’s Bitcoin Strategy

MARA Holdings has built a $6 billion Bitcoin treasury through consistent mining operations and strategic asset management. The company’s 52,850 BTC position demonstrates how public companies can use cryptocurrency as a core treasury asset. With operational efficiency improvements, renewable energy investments, and continued production growth, MARA has established itself as a leader in corporate Bitcoin adoption beyond just buying coins on the market.

You May Also Like

Pippin (PIPPIN) Price Prediction 2026–2030: Can PIPPIN Hit $0.70 Soon?

Will Cardano Reach $10 by 2030? Analysts Break Down ADA’s Growth Cycles