Monero hit after 51% attack claims from Qubic Mining

- Monero price continues its slide on Tuesday, down 6% on the day.

- Qubic mining pool, which has been amassing hashrate for months, claims that it controls over 51% of the network.

- A major chain reorganization was detected on Tuesday, giving Qubic the ability to rewrite the blockchain, enable double-spending, and censor transactions.

Monero (XMR) price declines nearly 6% on Tuesday, trading below $250 at the time of writing, after plunging over 17% in the last seven days. The privacy-focused cryptocurrency is facing heightened scrutiny from traders after Qubic Mining allegedly claimed that it controls majority of the network's hashrate, triggering fears of potential blockchain manipulation and undermining confidence in the asset’s security.

Qubic successful in 51% attack on Monero

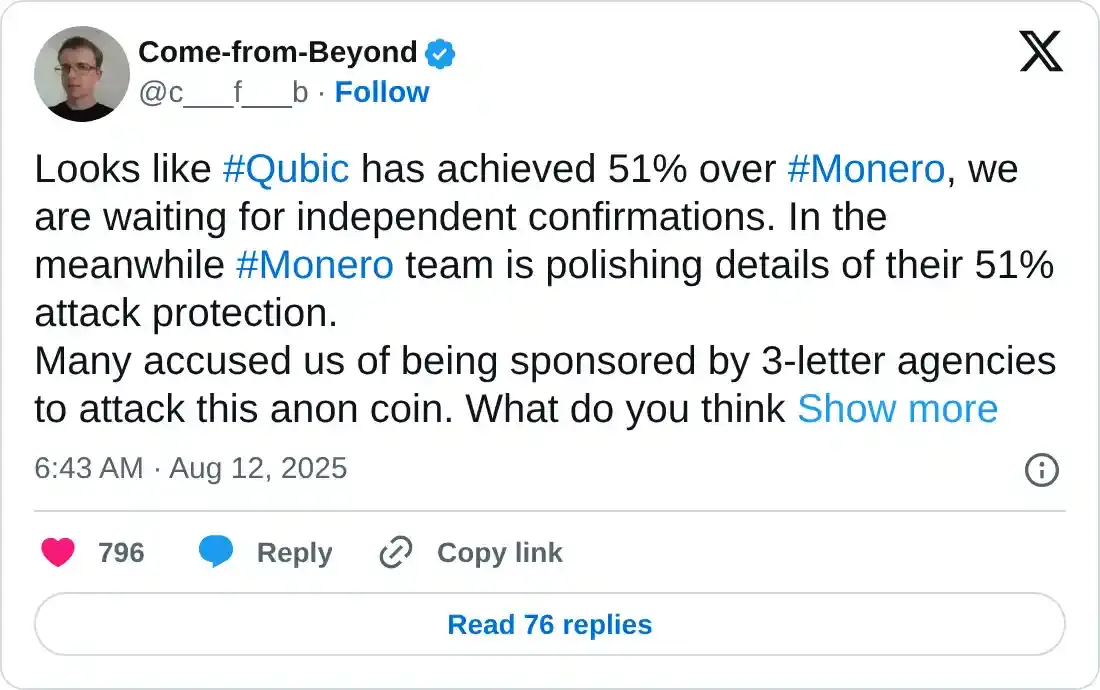

Qubic mining pool has reached a 51% pool share and now controls a majority of Monero’s network, Sergey Ivancheglo, Qubic’s lead developer, said on X. Ivancheglo added that an independent confirmation is pending, while Monero's official team didn't issue any statement regarding the matter.

This alleged control over the network gives Qubic access for a “51% attack,” which happens when one group controls over half of a blockchain’s mining power. This network control enables them to cheat the system, such as spending the same coins twice or blocking transactions. It’s considered a big threat because it breaks the trust in the network.

“Many accused us of being sponsored by 3-letter agencies to attack this anon coin. What do you think now, after we have helped Monero to prepare for its future fights against those agencies?,” Ivancheglo added.

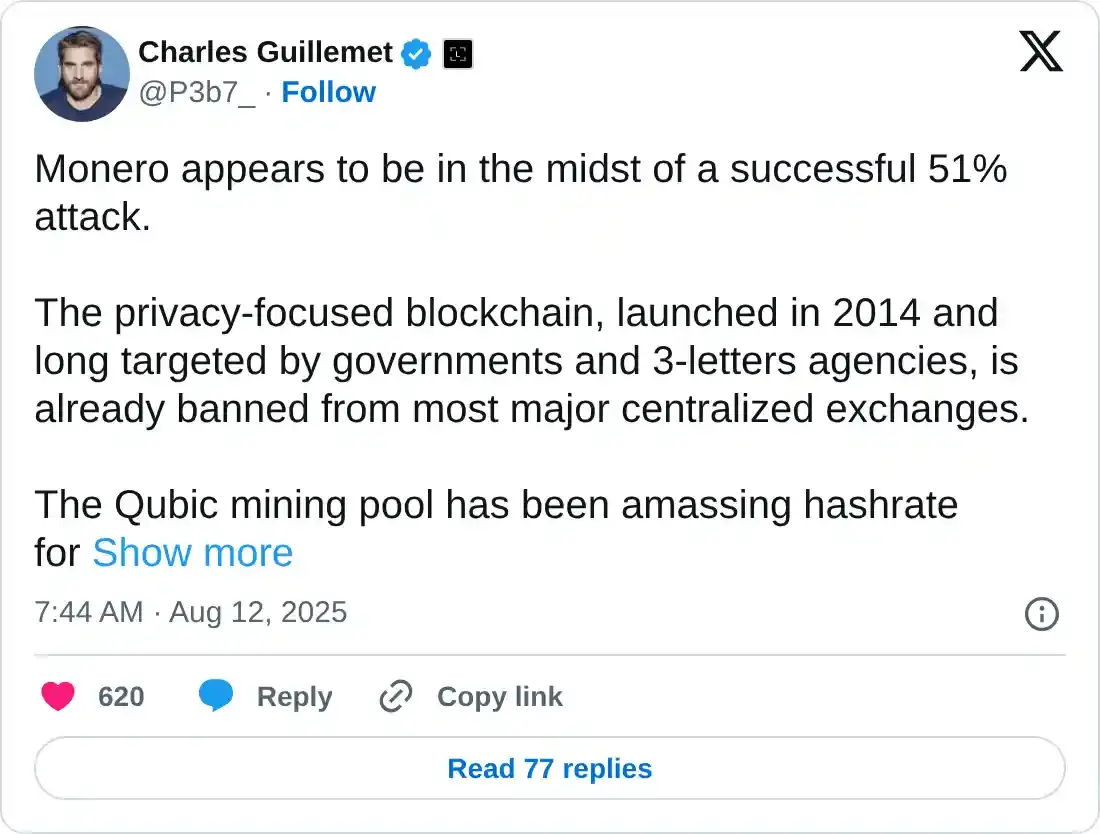

Charles Guillemet, CTO of Ledger wallets, posted on his X account on Tuesday that “Monero appears to be in the midst of a successful 51% attack.”

Guillemet explained in his post that a major chain reorganization was detected on Tuesday and that, with its current dominance, Qubic can rewrite the blockchain, enable double-spending, and censor any transaction.

“Sustaining this attack is estimated to cost $75 million per day. (….) Monero’s options for recovery are limited, and a full takeover is now possible and even likely,” said Guillemet.

However, before this network control on August 4, Qubic explained that they are not creeping up from the shadows to do a quick-hit-takeover and are publicly announcing every move and letting Monero prepare their defenses.

The Qubic community also ran a DAO vote, after which holders opted to continue their attempt to dominate 51% of Monero regardless of its price fluctuations.

You May Also Like

The Channel Factories We’ve Been Waiting For

USDC Treasury mints 250 million new USDC on Solana