One-stop access to the Metaverse, how does Vcity create a cross-chain social dream factory?

Author: Nancy, PANews

The popularity of Web3+ Metaverse is accelerating the evolution of digital economy towards personalization, openness and high interactivity. This change is not only limited to the technical level, but also deeply penetrates into diversified scenarios such as social, finance, and games, promoting the integration and innovation of these fields. In particular, as "digital natives", Generation Z, with their natural proficiency in digital tools and keen insight, has no longer limited their expectations for the virtual world to simple functionality, but pursues a new experience of immersion, experience and strong interactivity.

In line with this trend, Vcity, the fifth city of the cross-chain social financial metaverse, uses the metaverse as a carrier to satisfy the freedom of individual identity expression and value proposition, while enriching the interactive experience and sense of participation in the digital economy through a multi-module ecological application scenario strategy.

Breakthrough in user growth, multi-scenario applications and incentive mechanisms in parallel

At present, with the increasing prominence of data abuse, privacy leakage and imbalanced distribution of benefits brought about by the traditional Internet centralized model, users' demand for autonomous, secure and transparent digital experience is increasing day by day. This trend provides a deep driving force for the rise of Web3 in the digital economy. With its core features such as decentralization, data privacy protection, incentive mechanism design and cross-chain interoperability, Web3 has started a comprehensive innovation from technical architecture to business model. As an ideal carrier of Web3, the Metaverse further maps the economic activities of the real world into the virtual space, bringing users a better sense of immersion and participation. Whether it is financial transactions, social interactions or entertainment activities, they are all given stronger scenario and visualization features in the Metaverse, which not only enriches the user experience, but also expands more possibilities for the business model of the digital economy.

Although Web3+Metaverse has a strong narrative power, it faces huge challenges in attracting traditional Internet users to migrate. For the majority of users who are accustomed to the convenience, low threshold and high user experience of centralized platforms, the decentralized characteristics are desirable in concept, but in actual operation they are often accompanied by a steep learning curve, complex technical barriers and unstable user experience. For example, problems such as wallet management, private key custody, and gas fees all discourage ordinary users. In addition, the Web3 ecosystem is still in its early stages, and the richness and maturity of application scenarios are still far behind those of the traditional Internet, which makes it difficult to quickly achieve large-scale user conversion. In the past, a large amount of capital influx once pushed up the valuation of Metaverse projects and the market enthusiasm was high, but as the enthusiasm faded sharply, many projects gradually cooled down due to the lack of sustainable business models and solid user bases, and even went bankrupt.

In order to meet these challenges and attract more users, Vcity has introduced diversified application scenarios and economic incentive mechanisms. In terms of application scenarios, Vcity integrates multiple fields such as metaverse, streaming media, social networking, education, and NFT. For example, V-Meta can provide virtual social, virtual business and cross-border integration scenarios to build an immersive experience for users; V-Between supports scenarios such as corporate live broadcasts, education and training, and entertainment interactions, and provides decentralized audio and video production and distribution services. It has the characteristics of no intermediaries and users’ independent control of content and income distribution. V-Coco realizes instant messaging and community interaction between users to ensure data privacy and security; V-Academy provides Web3 knowledge training and skills improvement to help users integrate into the digital economy; V-Dmart is a decentralized trading platform for digital goods and services, allowing users to participate in virtual exhibitions and collections, and will support multiple payment methods; V-NFT Marketplace supports NFT casting, trading and display, and promotes the popularization of digital art and cultural assets. It has issued more than 8.43 million NFT assets with a value of more than 100 million US dollars; Vcity instant messaging and VoIP social platform supports users to communicate through voicemail, video calls, text messages and multimedia.

In terms of economic incentives, V5 plans to launch an X To Earn model that supports multiple scenarios, where players can earn income or rewards by participating in products. For example, users can earn income by purchasing, building and renting NFT virtual plots, and even land holders can vote on platform policies and development; earn tokens by visiting museums (such as exhibitions or large-scale cultural scene activities), and get unique experiences and specific digital assets that are only open to token holders; users get token rewards by completing specific learning tasks or courses, etc. In addition, V-DeFi will provide services such as lending, staking, and liquidity mining. For example, players can use NFT assets for loans and enhance asset liquidity, bringing a decentralized financial experience; V-socialfi allows users to buy and sell social influence NFTs, unlock encrypted information and exclusive content, and earn rewards by posting content, commenting or interacting. Once these incentive models are officially launched, they will effectively build a traffic pool, thereby creating a loyal community and forming a flywheel effect. As of January 2025, V5 has more than 1.5 million registered users and more than 100,000 daily active users, covering 233 regions around the world.

Of course, to ensure the sustainable development of the ecosystem, the Fifth City has taken a series of measures. For example, its credit reporting system records data such as banned speech and violations to establish credit files for users and promote the healthy development of the ecosystem. The credit value system connects users to the platform, improves stickiness through a reward mechanism, and protects data privacy and security.

Build a solid infrastructure foundation and adopt twin economic flywheels

If the Metaverse is to achieve diversified application scenarios and attract a wider user base, the importance of its infrastructure is self-evident. This not only needs to meet multiple requirements such as high concurrent processing capabilities, low-cost operations, data security, and user autonomy, but also provide solid support for the expansion of the ecosystem. The Fifth City has laid the foundation for a sustainable Metaverse narrative through technological innovation, decentralized identity, and the construction of a wallet system.

Technically, the Vanguard Protocol is a modular blockchain framework designed by Fifth City specifically for developers. Its modular design, high throughput and decentralized features ensure the security and scalability of ecological operation. In the vision of the Metaverse, the primary task of infrastructure is to support the simultaneous online and real-time interaction of a large number of users. Imagine a virtual city where millions of users may be socializing, trading or participating in activities at the same time, which places extremely high demands on the performance of the underlying blockchain: both high concurrent interaction and low latency and high throughput are required. With its excellent scalability and low latency design, Vanguard Protocol can easily cope with such high-frequency and high-concurrency scenarios. It supports multiple consensus mechanisms (such as PoS and IBFT), effectively optimizes network efficiency, ensures fast transaction confirmation, and maintains decentralized security. Whether it is the instant transaction of virtual goods in the Metaverse or the real-time update of the user's status in the virtual space, Vanguard Protocol can provide stable and efficient technical support to clear obstacles for the implementation of large-scale applications.

At the same time, the infrastructure of the metaverse is not only about performance, but also needs to provide flexibility and autonomy for users and developers. Vanguard Protocol's modular architecture allows developers to customize blockchain functions according to specific scenarios. Its modules include consensus mechanism, network layer, data storage, etc., and developers can choose the most suitable consensus algorithm according to project requirements, making the construction of small virtual communities to large metaverse platforms more efficient. Vanguard Protocol is also fully compatible with the Ethereum Virtual Machine (EVM) and supports the deployment and execution of smart contracts. This compatibility enables developers to easily migrate existing Ethereum projects while taking advantage of the Vanguard Protocol ecosystem. Of course, in order to lower the development threshold, Vanguard Protocol provides easy-to-use tools and documents to help developers quickly start blockchain networks. Intuitive configuration options and a friendly development environment significantly shorten the development cycle. In addition, Vanguard Protocol's enterprise-level support further makes it a key link in the construction of digital infrastructure. Whether it is a private chain, a consortium chain or a public chain, Vanguard Protocol can provide customized solutions to meet diverse industry needs.

In addition to relying on the improvement of infrastructure, the prosperity of the Metaverse economic system also relies on decentralized identity and wallets as one of the core pillars. Decentralized identity V-DID is the Web3 virtual digital pass for users of the Fifth City, giving users full control over their digital identity and breaking the monopoly of traditional centralized platforms on user data. Whether it is cross-platform identity authentication or the binding of virtual characters in the Metaverse, V-DID can ensure the consistency and security of users' identities in different scenarios, avoiding the fragmented experience caused by data islands in the traditional Internet. For example, in the Fifth City's virtual live broadcast, academy or NFT transactions, users do not need to register repeatedly or disclose sensitive information, and can achieve rapid authentication through V-DID. This feature not only improves the user experience, but also clears the privacy barriers for the widespread adoption of the Metaverse. The multi-chain asset management and payment tool of the wallet Vallet allows users to easily interact with assets in the Metaverse - whether it is purchasing virtual land, paying service fees, or participating in social rewards, one-stop operation can be achieved.

It is worth mentioning that the Fifth City adopts a dual-track economic model, realizing the spiral appreciation of tokens in governance and liquidity through internal and external circulation mechanisms. Among them, decibel (dB), as a practical token within the ecosystem, is the key medium for the circulation and use of various functional modules such as NFT and DeFi, ensuring the efficient operation of internal operations. The Vcity token is the core value carrier in the ecosystem. The total supply of tokens is 1 billion, of which 60% is allocated to the incentive pool, 30% is the foundation reserve and 10% is the market circulation. The application scenarios include NFT market, social finance, games, etc. In order to ensure the transparency and traceability of the use of funds, the Fifth City also introduced a smart contract time lock mechanism. Holders can participate in community rewards, content creation incentives and developer support through Vcity tokens, and can also participate in platform governance, product construction and ecological expansion, or obtain income distribution and liquidity mining rewards by staking Vcity tokens. In addition, Vcity tokens can also be used for NFT transactions and metaverse asset interactions. In order to optimize the token economy, the Fifth City has also designed to reduce the supply of tokens through halving events and elastic mechanisms to maintain the long-term healthy development of the ecosystem.

At present, the Fifth City has developed and launched Alpha versions of mobile and web applications, launched a test network, etc. This year, it will also promote the official launch of the public chain, launch a digital museum, enrich the use scenarios of tokens, realize multi-chain interaction, and expand the ecological partner network.

Overall, the one-stop Metaverse ecosystem of the Fifth City has brought users interactivity and rich digital experience beyond the traditional Internet through diversified application scenarios, innovative economic incentive mechanisms and strong infrastructure construction, giving users more control and sense of participation, and further enhancing the liquidity and value creation of digital assets.

You May Also Like

The Critical Analysis Behind ADA’s Potential $2 Surge

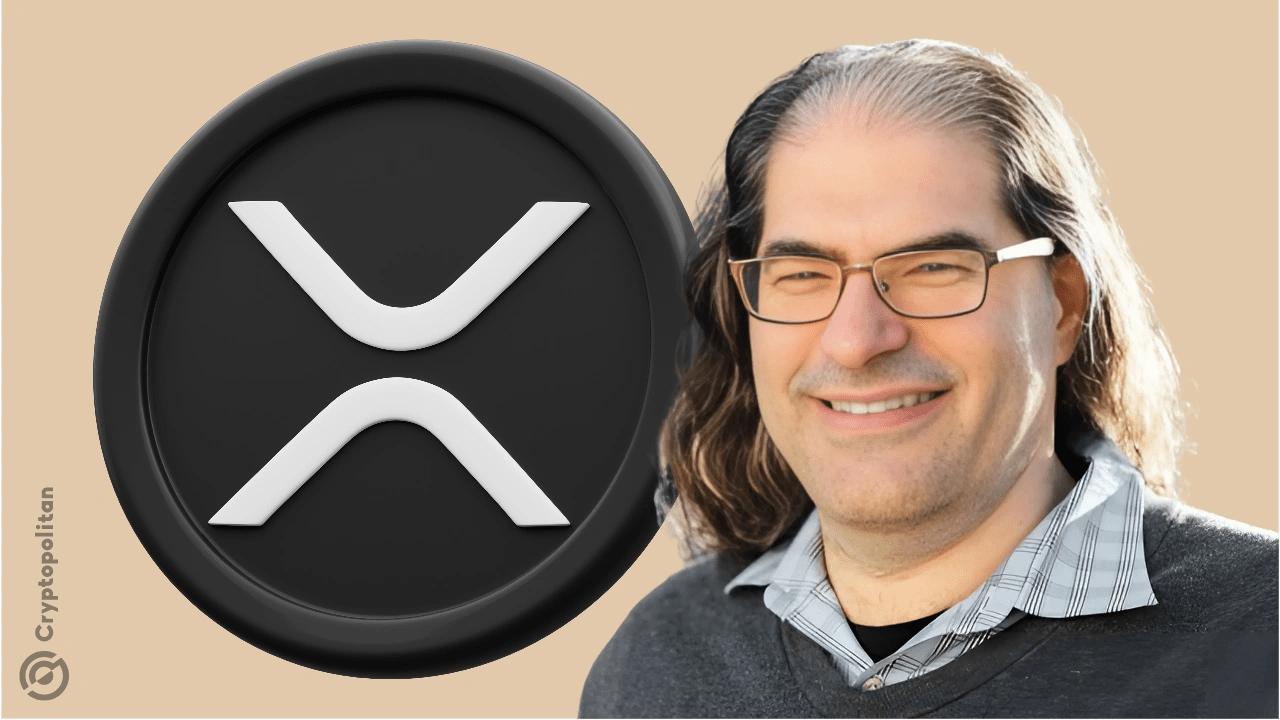

Novogratz doubts XRP and Cardano can maintain relevance as crypto market matures