PayPal To Make Sending Bitcoin, Ethereum, PYUSD Easier Via One-Time Payment Links

PayPal is about to make crypto transfers in the US easier with one-time payment links for Bitcoin, Ethereum, PYUSD, and other tokens.

Users will be able to generate a single-use link in the app to send payments via text, email, or direct message, according to a press release. Links expire after ten days, and transfers between friends and family via PayPal and Venmo are exempt from 1099-K reporting, meaning users won’t have to file extra tax forms for these transactions.

The move signals a push to makes crypto payments more practical for everyday use. PayPal plans to expand the feature internationally and allow one-time crypto payments for a broader range of cryptos, signaling a push to take digital assets mainstream.

Before unclaimed links expire, users can also send reminders or cancel the payment request before the link is claimed, the announcement added. Once accepted, payments will be instant.

The program was initially launched for US users for dollar payments, but PayPal said in its release that crypto payments will be added “soon.”

“Crypto will soon be directly integrated into PayPal’s new P2P payment flow in the app,” it said. “This will make it more convenient for PayPal users in the U.S. to send Bitcoin, Ethereum, PYUSD, and more, to PayPal, Venmo, as well a rapidly growing number of digital wallets across the world that support crypto and stablecoins.”

In addition to adding more payment options in the near future, the program will also be expanded to the UK, Italy, and other markets “starting later this month,” the company said.

PayPal Says P2P Payments Poised For ‘Greater Momentum’

PayPal said its P2P and other consumer payment volume saw solid growth in the second quarter, with a 10% growth year-over-year.

It added that its P2P offering “is poised for even greater momentum in the future” following the launch of PayPal World, which is a platform that connects the world’s largest digital payments systems and wallets including PayPal and Venmo.

That platform will also make it possible for PayPal and Venmo users to easily swap select crypto tokens directly between user accounts, as well as send tokens to other digital wallets that support crypto and stablecoins.

PayPal Already Active In The Crypto Space

The upcoming crypto integration within the PayPal Links program is not the first move by the payments giant into the digital asset space.

Back in Oct. 20, PayPal launched a service for US customers to buy, hold, and sell selected cryptos, which included Bitcoin, Ethereum, Bitcoin Cash, and Litecoin directly via their PayPal accounts.

In August of 2023, the company also launched its own US dollar-denominated stablecoin called PayPal USD (PYUSD). It is an Ethereum token that follows the ERC-20 token standards, and is issued through Paxos Trust Company LLC, which is a fully chartered limited purpose trust company.

The token is also backed by US dollar deposits, short-term US Treasuries, and similar cash equivalents, allowing users to redeem PYUSD 1:1 for USD.

Since that launch, PYUSD has expanded to other blockchain networks such as Solana, and can also be used to fund remittances on Xoom with zero fees. To attract more users, PayPal has said that eligible accounts holding PYUSD will have no fees for buys, sells, or transfers. Transfers to friends on Venmo have no network fees as well.

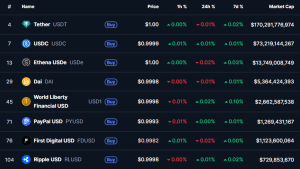

PYUSD currently has a market cap of more than $1.26 billion, ranking it as the sixth-largest stablecoin in the market, according to data from CoinMarketCap.

That was after the stablecoin experienced significant growth since the start of 2024, when its capitalization was around $234 million.

Top stablecoins by market cap (Source: CoinMarketCap)

PYUSD’s current market cap places it one position above First Digital USD (FDUSD) and one position below the Trump Family’s World Liberty Financial USD (USD1).

Tether (USDT) and Circle’s USD Coin (USDC) are still the top stablecoins by market cap, with USDT’s capitalization of over $170.29 billion and USDC’s capitalization standing at more than $73.12 billion.

Overall, the stablecoin market cap stands at over $302 billion. These tokens started gaining accelerated traction after US President Donald Trump signed the GENIUS Act into law.

You May Also Like

The Channel Factories We’ve Been Waiting For

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight