Pi Network Flags Scam Wallet Amid $346M Token Risks as 60M Users Await Unlock

Key Takeaways:

- Pi Network exposed a scam wallet allegedly siphoning unlocked tokens and dispersing them into hundreds of smaller wallets.

- The incident comes as Pi prepares for its second migration phase, with 60M users but only 16M wallets migrated.

- New security tools, including PassKeys and a Safety Center, are being rolled out to counter growing scam activity.

Pi Network has warned its community about a scammer-controlled wallet stealing tokens when accounts unlock, then scattering the assets into multiple wallets. The revelation underscores security challenges as the project edges closer to a major migration milestone.

Read More: Pi Network Shocks Crypto World with $100M Venture Fund to Power Real-World Utility

Scam Wallet Exposed on X

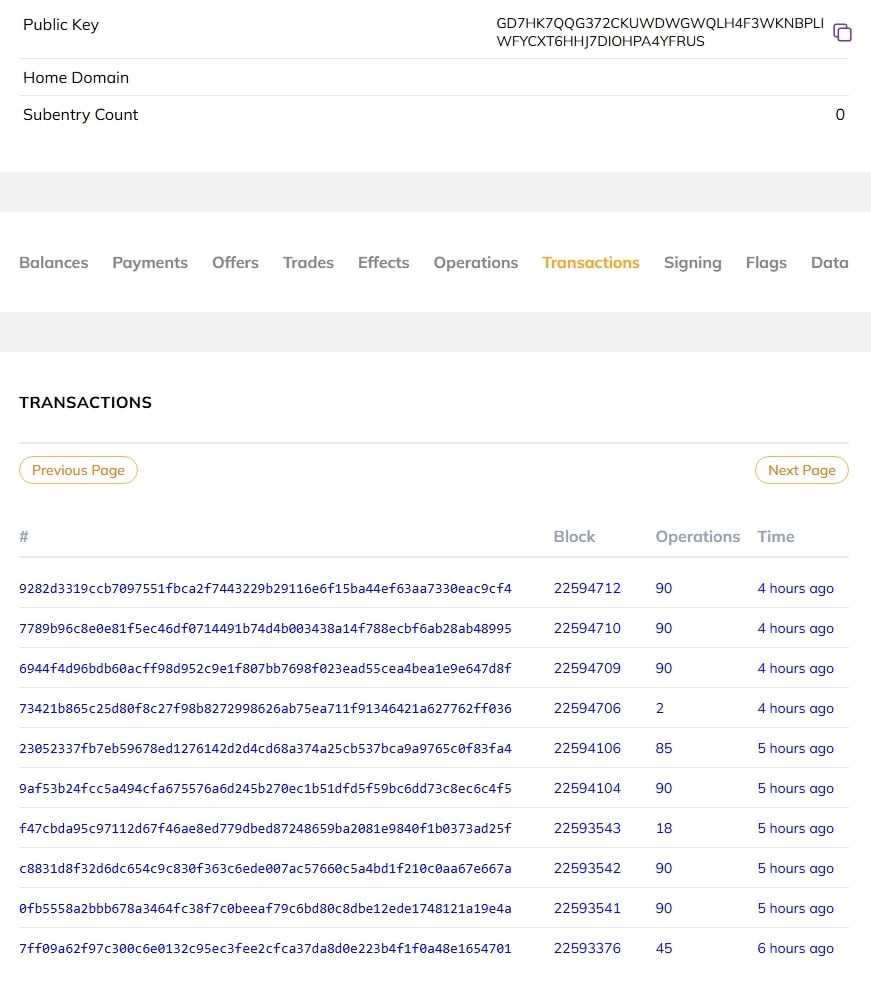

In a post shared on X, Pi Network flagged a wallet suspected of being behind repeated thefts of Pi tokens. The scammer allegedly waits for user balances to unlock, seizes the funds, and fragments them across hundreds of wallets to cover tracks.

The flagged wallet address: GD7HK7QQG372CKUWDWGWQLH4F3WKNBPLIWFYCXT6HHJ7DIOHPA4YFRUS has become the latest symbol of the risks users face in decentralized ecosystems. Unlike traditional banking systems, where fraud can be reversed, blockchain transactions are permanent, making stolen tokens virtually impossible to recover.

The exposure comes at a critical moment for Pi Network. With its ecosystem still in development and millions of tokens waiting for migration, scammers are exploiting weak spots, fake sites, and phishing attempts to prey on less experienced users.

Security Push: PassKeys and Safety Center

In response, the Pi Core Team has accelerated security upgrades inside its app. A key addition is PassKeys, a feature that enables device-level authentication through biometrics or PIN codes. By replacing passwords with stronger authentication methods, PassKeys aim to curb phishing attacks and password theft.

Pi has also grown the Safety Center promoted as the central place of verified updates, educational materials, and reporting about scams. This hub brings together community alerts, official warnings and practical advice that provides the user a front line defense against dynamic threats.

Read More: Pi Network Surges Past 21,000 Apps but Is the Token Still Struggling to Prove Itself?

Why It Matters

Cases with more advanced scammers require more than basic education campaigns. The capability such as PassKeys is a proactive step to securing wallets at scale, especially as Pi sees its user base grow beyond 60 million pioneers worldwide.

Token Migration: Phase Two in Sight

This security push came at the same time the preparations of the second stage of Pi migration were underway. The first migration cycle left unresolved issues such as referral rewards and unverified balances. Moderators now say a second round could clean up loose ends and bring more of the community into full participation.

Out of the 60M total users, only 16M wallets have successfully migrated. That leaves about 44M accounts stuck in a pending state, with tokens effectively unusable until migration completes.

For many pioneers, frustration is mounting. The network’s three-year lockup period for migrated tokens does not start until balances are moved, meaning delays directly impact when users can access and trade their Pi. At the current migration pace, community members fear it could take close to a decade before full token unlocks are achieved.

Market Reaction: Pi Token Price Stalls

The price of the token of Pi is not rising even though the security improvements and the migration have all the buzz. Pi was trading at about 0.3468 at the beginning of this week only increasing by 1 percent over the past 24 hours. After the altcoin landed on Onramp Money, analysts had anticipated greater momentum but, thus far, price action has remained within a narrow range.

To an investor, this stagnation points to a greater challenge, utility. Pi continues to be mostly speculative, as a lot of its value is based on the expectation of its use, and not its actual application, in the absence of a fully open mainnet and wider exchange infrastructure.

Trust, Security, and the Road Ahead

The scam wallet exposure is not a one-off event, it is an evaluation of the credibility of the project. In the case of Pi Network, which has traditionally positioned itself as a people-powered crypto that can become mass-adopted, securing pioneer assets is now a priority.

In case of an accelerated movement and the successfulness of the new security features, Pi might consolidate to be one of the largest grassroots crypto experiments. However, delays along with the presence of high-ranking activity in the scam department threaten to destroy user confidence at an opportune time.

The post Pi Network Flags Scam Wallet Amid $346M Token Risks as 60M Users Await Unlock appeared first on CryptoNinjas.

You May Also Like

CME Group to launch options on XRP and SOL futures

Bipartisan Bill Targets Crypto Tax Loopholes and Stablecoin Rules: Report