PUMP Soars 22% in a Day as Bitcoin Holds Steady at $116K: Weekend Watch

Bitcoin’s gradual price recovery over the past week or so saw some resistance at $116,000, and the asset has failed to reclaim that level decisively.

Expectedly for a weekend trading, most altcoins are quite sluggish with little to no moves in either direction. However, there are a few exceptions.

BTC Keeps Calm at $116K

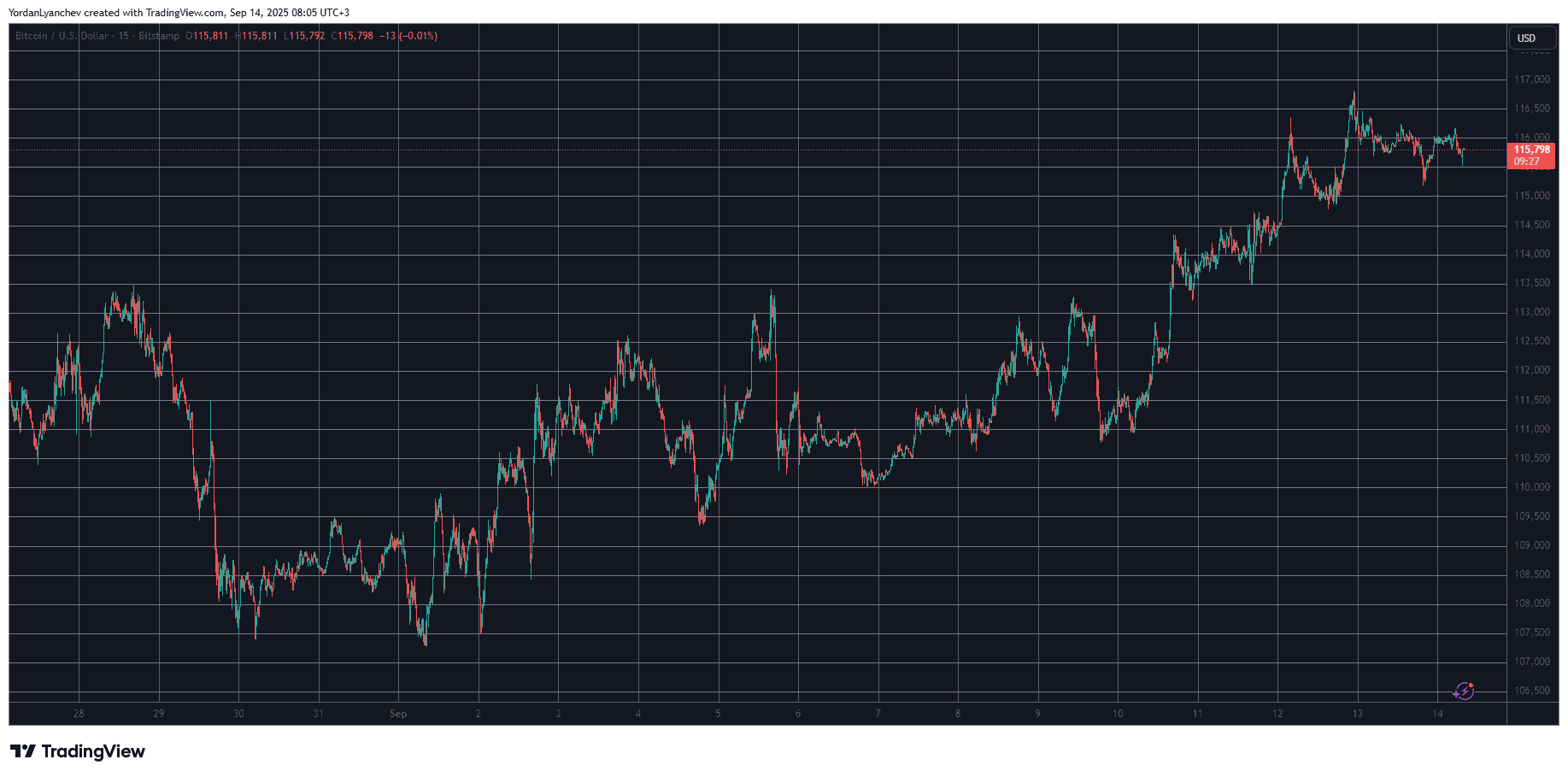

The aforementioned price recovery began at the start of the current month when bitcoin slumped to a multi-week low of just over $107,000. The asset tested that support on a couple of occasions in just a few days at the time.

However, the bulls ultimately managed to defend it and initiated leg-ups that drove BTC to over $110,000 within days. It kept climbing and challenged $113,000 on September 5 and 9, where it faced immediate rejections.

Nevertheless, that level finally gave in on September 1,0 and BTC hasn’t looked back since. Just the opposite, it kept rising and knocked on the $116,000 door on Friday. The bulls pushed it beyond that level on Saturday morning and up to a multi-week high of $116,700, but the cryptocurrency failed to move upwards.

It has been driven to just under $116,000 as of press time, which is still impressive given the latest macroeconomic developments and threats on the USA vs Russia/China front from yesterday.

For now, BTC’s market cap is still above the $2.3 trillion mark, while its dominance over the alts has recovered some ground and is up to 55.4% on CG.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

PUMP Pumps

As mentioned above, there’s little volatility from the larger-cap alts. Ethereum was stopped at over $4,700 yesterday and now sits below that level after a 1% daily decline. LINK, HYPE, XLM, TRX, and ADA are also slightly in the red.

In contrast, XRP, SOL, BNB, DOGE, and SUI are with insignificant gains. In contrast, M has resumed its massive rally and is up to over $2.5 after another 9% surge. WLFI is up by 8% and sits at $0.22.

PUMP has stolen the show with a massive 22% surge daily, which has pushed its price to $0.008.

The total crypto market cap, though, has lost around $30 billion since yesterday and is down to $4.160 trillion on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The post PUMP Soars 22% in a Day as Bitcoin Holds Steady at $116K: Weekend Watch appeared first on CryptoPotato.

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

SEC approves generic listing standards, paving way for rapid crypto ETF launches