Ripple and Thunes Partnership Expands: What This Means for XRP Holders

A Significant Step in Blockchain-Powered Finance.

The cooperation between Ripple and Thunes partnership has made great progress, altering how money transfers across borders. Ripple, a major blockchain payments company, and Thunes, a Singapore-based payment infrastructure provider, have announced an extension of their partnership to make international payments quicker, cheaper, and more accessible.

This revitalized collaboration is more than simply a financial agreement. It’s a strategic move that places Ripple as a significant player in connecting traditional banking with blockchain, while also allowing Thunes to expand its network into new areas.

Why This Expansion Matters

Individuals and corporations frequently experience delays, high costs, and frustration while making cross-border payments. The relationship between Ripple and Thunes partnership addresses these issues directly. By combining Ripple’s blockchain-powered infrastructure with Thunes’ SmartX Treasury System, the cooperation enables real-time payments in local currencies in over 130 countries.

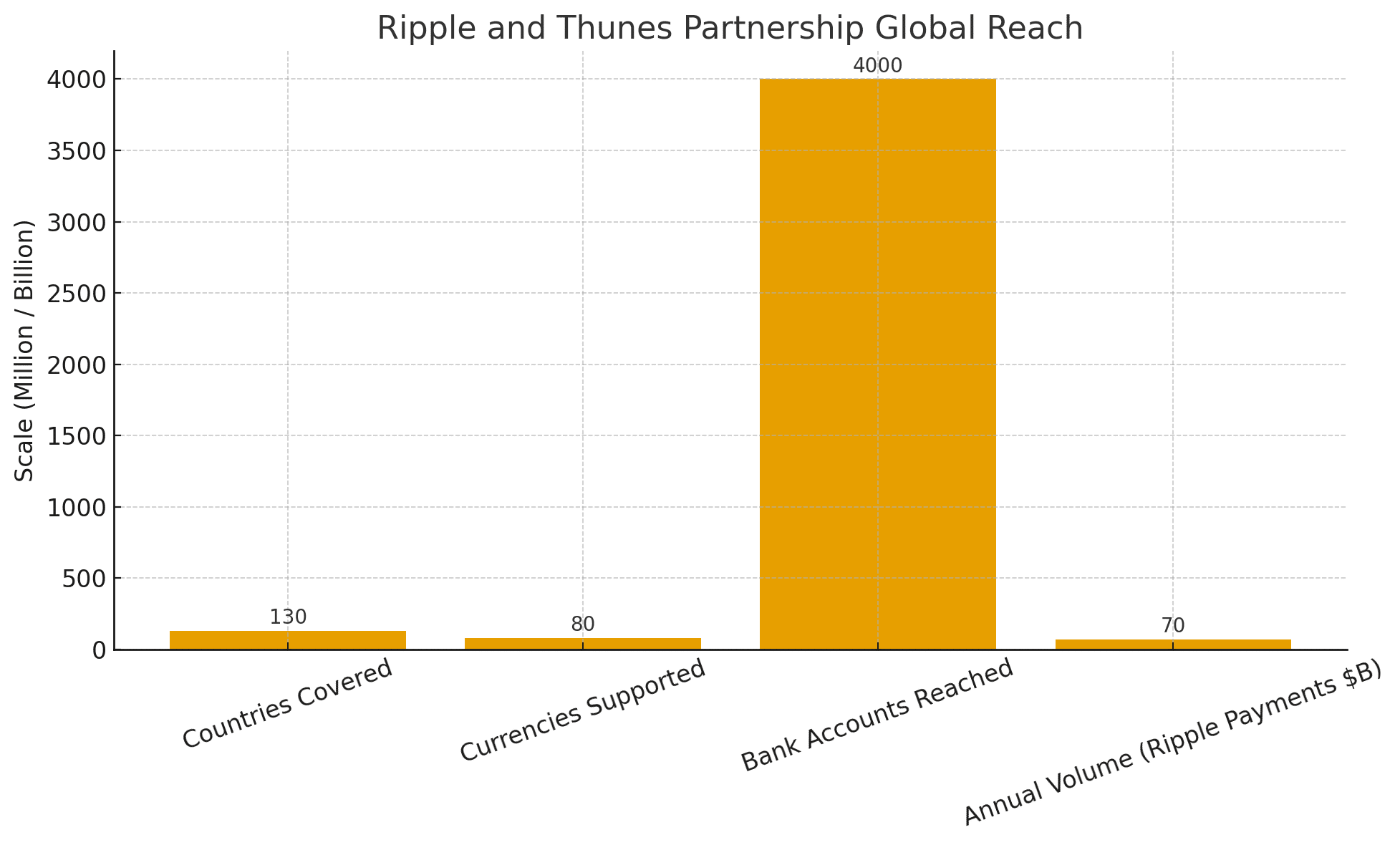

Ripple’s Payments network now processes over $70 billion yearly and serves over 90 payment markets. With Thunes’ access to 4 billion bank accounts and 80 currencies, the alliance establishes a new benchmark for worldwide financial transactions.

Analysts point out that this integration addresses long-standing concerns with botched transfers and compliance delays. Financial analyst Marcus Tan stated, “This partnership strengthens efficiency and trust in an area where customers demand both speed and transparency.”

Impact on XRP and Global Adoption

While Ripple stresses its technology, the increased relationship may indirectly help XRP adoption. As more banks, fintechs, and enterprises adopt Ripple Payments, the need for XRP liquidity may rise. Historically, agreements like these have resulted in increases in XRP market activity.

Experts believe that Ripple’s expanding presence in Asia, Africa, and Latin America will encourage more people to adopt digital assets. The Ripple and Thunes partnership promotes financial inclusion by addressing last-mile payout issues in underprivileged communities.

Looking ahead: Predictions

Market experts believe that increased collaboration will accelerate the institutional adoption of blockchain-powered payments. Ripple’s emphasis on regulatory compliance and transparency enhances its position as governments and central banks explore tokenized finance.

Analysts predict that if adoption develops at the predicted rate, the Ripple and Thunes partnership will process twice as much as it does now within the next three years. This would establish Ripple as a global leader in digital settlements.

Conclusio

The extended Ripple and Thunes partnership marks a watershed moment in global banking, combining blockchain innovation with established payment rails. By removing inefficiencies and increasing access, the alliance is poised to determine the future of international payments.

For cryptocurrency traders, investors, and institutions, this development indicates that blockchain will play an increasingly important role in regular financial systems.

Also read: Ripple’s RLUSD Push Into Japan Could Spark the Next Stablecoin War

Glossary

Ripple – A blockchain company focused on real-time cross-border payments.

Thunes – A global payment infrastructure provider headquartered in Singapore.

Cross-Border Payments – Transactions involving two parties in different countries.

XRP – The native cryptocurrency of the XRP Ledger, often used for liquidity in Ripple’s ecosystem.

Liquidity – The ease with which assets can be converted into cash or other currencies.

Financial Inclusion – Expanding access to financial services for underserved populations.

FAQs for Ripple and Thunes partnership

What is the Ripple and Thunes partnership about?

It is a collaboration between Ripple and Thunes to expand blockchain-powered cross-border payment services globally.

How many countries are included?

The partnership spans over 130 countries, with access to 4 billion bank accounts and 80 currencies.

Will this affect XRP price?

While not directly tied to XRP, greater use of Ripple’s payment infrastructure could boost liquidity demand, which may influence XRP prices.

Why is this important for global finance?

The partnership addresses high costs, slow processing, and failed transfers, making global payments faster, cheaper, and more reliable.

Read More: Ripple and Thunes Partnership Expands: What This Means for XRP Holders">Ripple and Thunes Partnership Expands: What This Means for XRP Holders

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Algorand (ALGO) Foundation Taps Ex-FinCEN, MoneyGram Execs for New US-Based Board