Ripple’s XRP Is Now a Top 100 Global Asset — Here’s What It Means

The three largest cryptocurrencies by market capitalization now have a spot among the top 100 global financial assets by that metric.

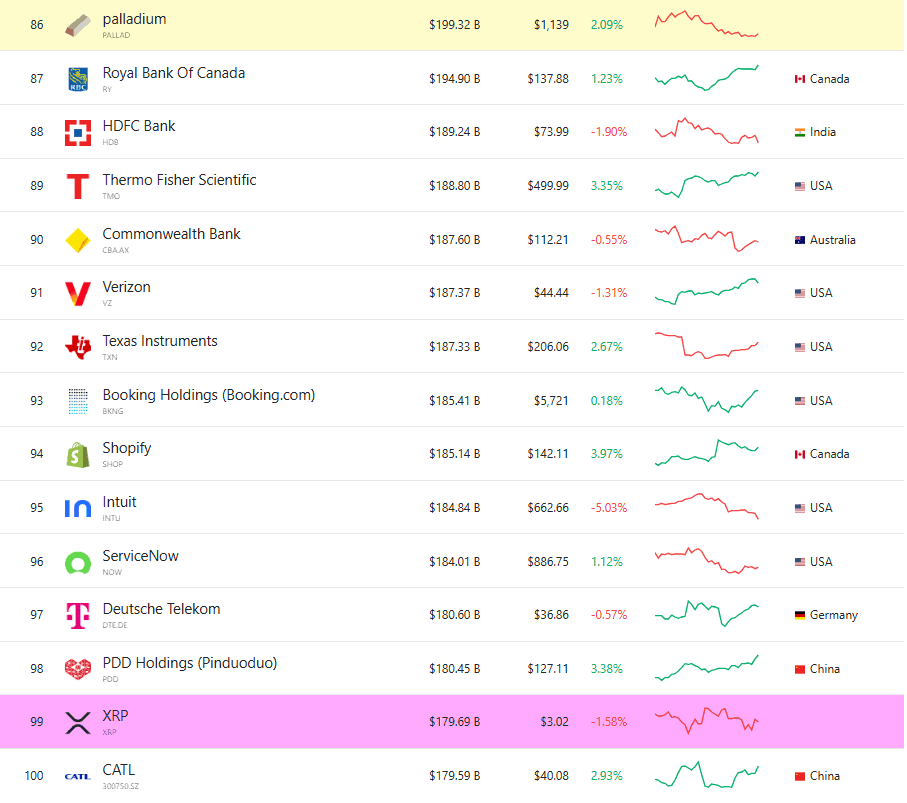

That became possible as Ripple’s native token jumped to a market cap of almost $180 billion, which helped it surpass several well-known names such as Allianz SE, Accenture, and Boston Scientific.

Ripple Enters Top 100

The overall growth of the cryptocurrency market cap has been more than evident for the past 10 months. Aside from bitcoin and ether, which are now positioned well within the top 10 and 30 global financial assets by market cap, the crypto market now has a third rep in the top 100 club.

Ripple’s native token has gone through remarkable growth within that same time frame since the US elections last November. At the time, the asset traded below $0.6 with a market cap of roughly $30-35 billion. In the following months, though, it managed to break through several resistance levels and skyrocketed to a new all-time high of $3.65 in mid-July.

Despite losing some traction since then, XRP still stands at just over $3, and its market cap, albeit being lower than its local peak of over $210 billion, is at $180 billion as of press time.

This, aligned with some corrections from other publicly-traded companies, has enabled Ripple’s token to enter the top 100 club of global financial assets by market capitalization.

Assets by Market Cap. Source: CompaniesMarketCap

Assets by Market Cap. Source: CompaniesMarketCap

On its way north, XRP also surpassed the likes of Adobe, Pfizer, Santander, Spotify, and many other big names.

Ripple’s Path

Aside from the price expansion registered in the past 10 months or so, Ripple and its overall ecosystem saw numerous positive developments on other fronts. Perhaps the most important one is the (almost) conclusion of the legal case against the US SEC, as the latest update on the matter reads that the Second Circuit has approved both parties’ joint stipulation of dismissal.

Ripple also made a few big acquisitions, including spending $1.25 billion to buy the prime brokerage giant Hidden Road. The company also expanded its portfolio of tokens with the introduction of an institutionally-focused stablecoin at the end of 2024 called RLUSD.

XRP has seen adoption as well, given the fact that there are now entities that are accumulating the token for their strategic reserves. What’s next for the adoption curve is perhaps the potential approval of spot XRP ETFs in the US, even though there are already several futures-based ones. The latest move on this matter came just yesterday when several applications were updated to align with the SEC’s guidelines.

The post Ripple’s XRP Is Now a Top 100 Global Asset — Here’s What It Means appeared first on CryptoPotato.

You May Also Like

BitGo expands its presence in Europe

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release