SEI Price Faces Extreme Fear as Market Eyes $0.16 Range Amid Open Interest Collapse

Despite a short-lived rebound in the past 24 hours, with prices up 8.94% to $0.23, analysts warn that bearish sentiment remains dominant. The asset’s open interest, price structure, and technical signals all point to lingering uncertainty as traders brace for potential moves toward the $0.16 zone.

Open Interest Data Reveals Derivatives Market Reset

According to open interest data, SEI’s open interest dropped sharply this week, reflecting widespread liquidations and a mass exodus of leveraged traders. Aggregated open interest currently stands around $63 million, a steep decline from previous peaks above $160 million earlier in the month.

Source: Open Interest

This dramatic contraction suggests that speculative capital has largely been flushed from the market, leaving primarily spot buyers and short-term swing traders. The sudden drop coincided with a violent price wick below $0.15, a move that likely cleared many overleveraged positions before the coin stabilized around the $0.21–$0.23 band.

While open interest has slightly recovered, the low leverage environment points to hesitation among traders. Analysts note that a sustained rise in open interest without another sharp sell-off could indicate early bottom formation — but for now, momentum remains fragile.

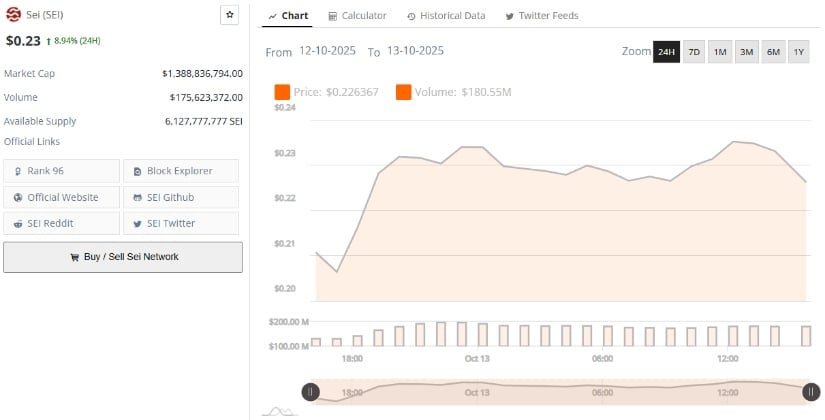

Market Data Confirms Short-Term Relief Rally

Market data from BraveNewCoin shows SEI’s market capitalization at $1.38 billion, supported by $175 million in 24-hour trading volume. The token has posted a modest 8.94% daily gain, yet remains down 38% over the past month and 31% over the last seven days.

Source: BraveNewCoin

This pattern underscores the mixed sentiment surrounding the crypto, while some traders are accumulating near current levels, broader market confidence remains subdued. The $0.22–$0.24 resistance zone is now a key battleground; a daily close above this range could trigger a short-term relief rally, but sustained upward momentum will depend heavily on volume returning to the DeFi sector.

If bears regain control, the next critical support lies near $0.19, with deeper downside targets extending to $0.14–$0.16, marking the lower bounds of the recent panic sell-off.

TradingView Technicals Highlight Fragile Recovery Attempt

Charts from TradingView show that SEI/USDT has yet to fully recover from its early-October crash. The token’s structure remains in a downtrend, with each rebound facing resistance at descending moving averages.

Source: TradingView

The Chaikin Money Flow (CMF) currently sits slightly above zero, signaling minor buying pressure, but the MACD remains deeply negative, confirming persistent bearish momentum. This divergence reflects a market still dominated by fear, as sentiment trackers label the coin’s outlook as “Extreme Fear.”

Technically, the coin’s short-term path depends on defending the $0.20–$0.21 zone. Failure to hold that range could open the door to retests of $0.16, while a break above $0.24 might shift focus toward $0.27–$0.29. However, analysts caution that such upside would likely be temporary unless stronger buying volume emerges.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun